“Monetizing” Clean Energy Tax Credits Creates a Sham Market for Bad Policy

Explore IRS clean energy tax credits, including Direct Pay, the IRA and CHIPS Act tax provisions, and Section 1603 grant program. See more.

7 min read

Explore IRS clean energy tax credits, including Direct Pay, the IRA and CHIPS Act tax provisions, and Section 1603 grant program. See more.

7 min read

It is hard to imagine the IRS Direct e-File Program operating seamlessly with the complexity of the current U.S. tax system. Instead, lawmakers should first address the more fundamental problem that causes taxpayer frustration: our highly complicated tax code.

4 min read

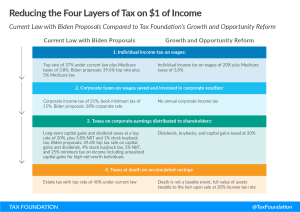

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read

To address the more challenging parts of the budget, especially the unsustainable growth in mandatory spending, lawmakers should follow up on this debt ceiling agreement with a focus on long-term fiscal sustainability.

6 min read

While research on optimal taxation often focuses on the pure economic implications, it rarely considers cultural and societal differences that can lead to very different outcomes when trying to implement an optimal tax system.

4 min read

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

While the IRS hopes to increase revenue collection and minimize additional burdens on taxpayers, uncertainty remains regarding its ability to deliver, particularly on the latter. Furthermore, some concerns about the original funding package are already surfacing, specifically around insufficient funding for taxpayer services.

6 min read

When designed well, excise taxes discourage the consumption of products that create external harm and generate revenue for funding services that ameliorate social costs. The effectiveness of excise tax policy depends on the appropriate selection of the tax base and tax rate, as well as the efficient use of revenues.

83 min read

If Alabama continues on its current path, its treatment of remote workers would be even more aggressive than that of New York—a shaky legal foundation.

6 min read

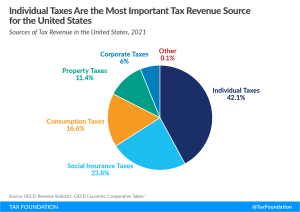

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Adopting a distributed profits tax would greatly simplify U.S. business taxes, reduce marginal tax rates on investment, and renew our country’s commitment to pro-growth tax policy.

6 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Most states avoid municipal income taxes for good reason. These taxes are more volatile and less economically competitive than other forms of taxation available to local governments, and add substantial complexity for governments and taxpayers alike.

23 min read