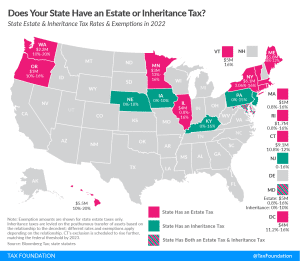

Estate and Inheritance Taxes by State, 2022

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

As part of President Biden’s proposed budget for fiscal year 2023, the White House has once again endorsed a major tax increase on accumulated wealth, adding up to a 61 percent tax on wealth of high-earning taxpayers.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

If Nebraska is to create a competitive environment and attract in-state investment, comprehensive tax modernization must be a priority.

9 min read

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

Twenty-one states and D.C. had significant tax changes take effect on January 1, including five states that cut individual income taxes and four states that saw corporate income tax rates decrease.

17 min read

Tax competition has proven to be key in keeping tax hikes under control in some regions of Spain as regional governments look to copy Madrid’s tax reforms.

6 min read

The Spanish Regional Tax Competitiveness Index allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare and serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

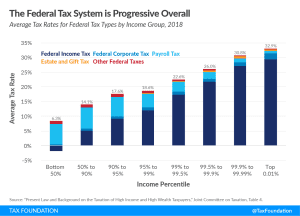

As Congress considers several tax proposals designed to raise taxes on high-income earners, it’s worth considering the distribution of the existing tax code.

3 min read

Temporary policy creates uncertainty for taxpayers and scheduling more expirations will add to the already-expiring provisions under the Tax Cuts and Jobs Act (TCJA) of 2017.

3 min read

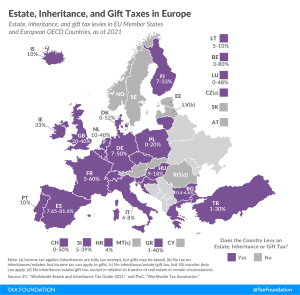

As tempting as inheritance, estate, and gift taxes might look especially when the OECD notes them as a way to reduce wealth inequality, their limited capacity to collect revenue and their negative impact on entrepreneurial activity, savings, and work should make policymakers consider their repeal instead of boosting them.

5 min read

New Joint Committee on Taxation (JCT) data indicates that the federal tax system is progressive, consistent with similar analysis by the Congressional Budget Office (CBO), and the OECD.

2 min read

As part of the tax proposals in President Biden’s American Families Plan, unrealized capital gains over $1 million would be taxed at death. However, this policy would likely raise less revenue than advocates expect after considering the proposal’s impact on taxpayer behavior, including capital gains realizations, and historical capital gains and estate tax revenue collections.

5 min read