Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

10 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

10 min read

Our preliminary analysis finds the tax provisions included in the May 12 text would increase long-run GDP by 0.6 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

7 min read

As Congress debates expensing and other policies impacting business investment, lawmakers should consider the importance of business investment in research and development (R&D) as a driver for economic growth. Recent studies suggest that the economic benefits of R&D spending are even greater than previously understood.

7 min read

A tax preference originally designed to level the playing field now has the opposite effect, creating preferences for one class of financial institutions even though the distinctions between credit unions and banks are increasingly blurred.

6 min read

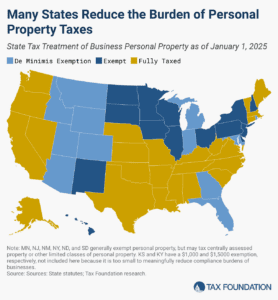

Does your state have a small business exemption for machinery and equipment?

4 min read

President Trump has repeatedly floated the idea of entirely replacing the federal income tax with new tariffs. Recently, he has said that when tariff revenues come in, he will use them to replace or substantially cut income taxes for people making under $200,000.

8 min read

Daniel Bunn had the opportunity to interview the Vice-Minister for Economy and Finance of Italy, Maurizio Leo, about the tax policy priorities of the Italian government. The conversation shows a commitment to reforming rules that create legal uncertainty and support competitiveness.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

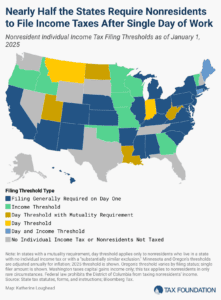

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

The flat tax trend is gaining momentum nationwide, and Missouri lawmakers are right to identify income tax rate reductions as particularly pro-growth.

4 min read

The better we understand taxes, the better we can manage our finances, but it starts with familiarizing ourselves with basic tax concepts like how tax brackets work.

3 min read

The proposed changes to federal tax code conformity in Oregon are a good example of a change that could significantly reshape the state’s tax code in the future, despite being framed as temporary technical adjustments.

4 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

Maryland’s proposed budget has garnered headlines for many reasons, but another momentous change is flying under the radar: backdoor adoption of potentially mandatory worldwide combined reporting.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The Inflation Reduction Act (IRA) introduced a series of new targeted tax breaks, many of which seem to be much more expensive than originally forecasted. Understandably, repealing these subsidies is a key option for policymakers looking to pay to extend the expiring broader tax cuts passed in the Tax Cuts and Jobs Act (TCJA).

7 min read

An update to the EU’s Excise Tax Directive that embraces harm reduction principles would save lives and provide a steady stream of revenue to support public health expenditures.

22 min read