Key Findings

- When corporate income is apportioned among states for taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. purposes, it is possible for some income to be earned in states which lack jurisdiction to tax the corporation, generating what is known as “nowhere income” that is not taxed by any state.

- Throwback and throwout rules are designed to allow states from which sales originate to tax the income from those sales in cases when the destination state, which would normally do so, lacks jurisdiction to levy tax on a given company (most commonly due to threshold requirements imposed by federal law), producing this “nowhere income.”

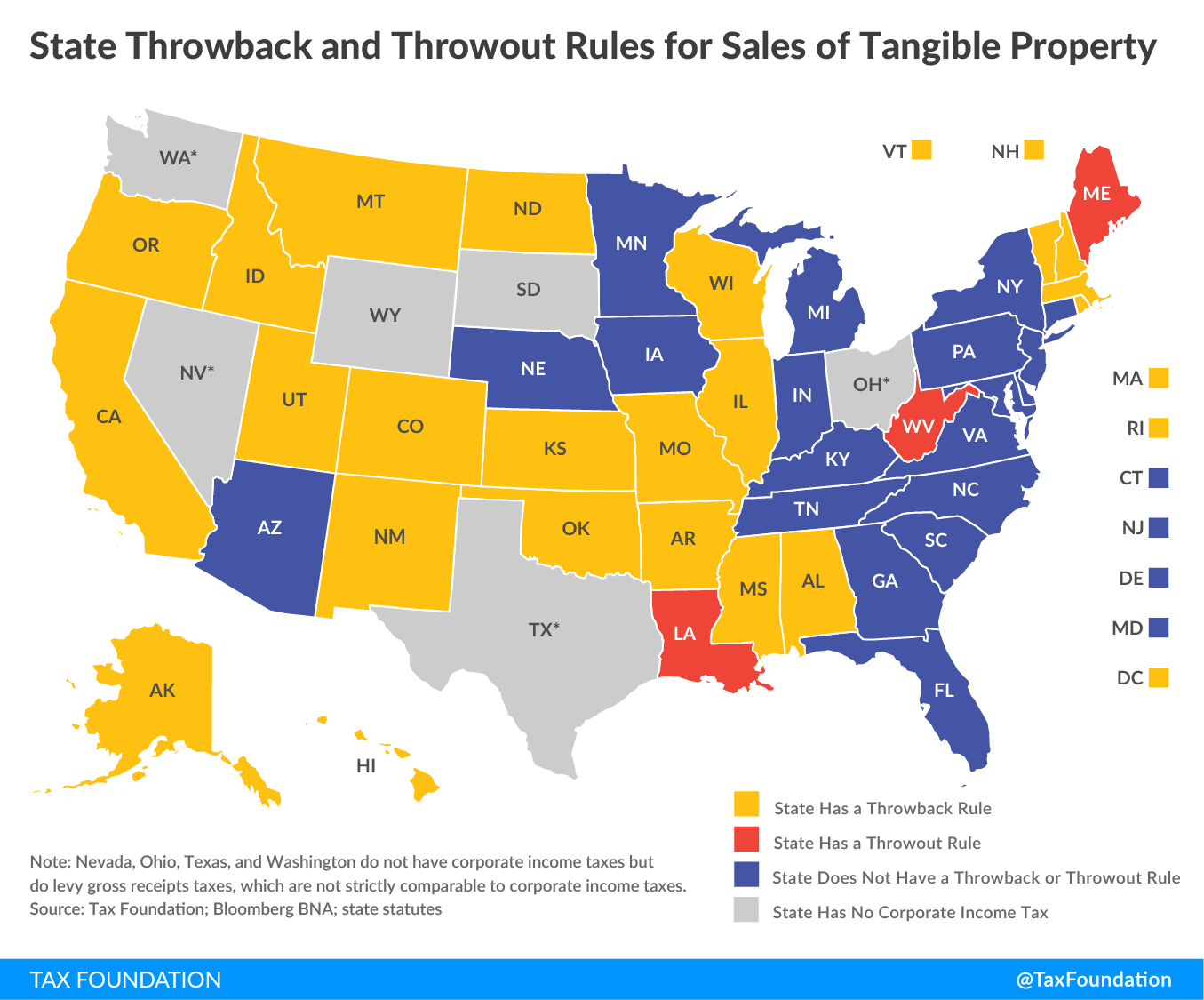

- Twenty-two states and the District of Columbia impose throwback rules, under which sales of tangible property which are untaxable in the destination state are “thrown back” into the numerator of the origin state’s sales factor.

- Three states impose throwout rules for sales of tangible property, under which “nowhere income” is subtracted from the denominator, while 22 states have adopted throwout rules for sales of intangible property.

- Unitary combined reporting, where a state treats all affiliated companies as part of a single group for tax purposes, adds complexity in throwback, and combined reporting states must adopt rules which determine whether they can capture “nowhere income” associated with a particular company if another member of its unitary group is taxable in the destination state.

- In some combinations, these combined reporting rules—known as Joyce and Finnigan rules—can yield double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. , while in others they can leave some income still untaxed.

- Throwback rules can yield exceedingly high and often uncompetitive levels of taxation for some businesses, to the point that the outmigration they generate can more than offset any revenue gains from taxing “nowhere income.”

- The origin-sourcing of “nowhere income” cuts against the competitive advantage states seek to provide for in-state businesses with single sales factor apportionmentApportionment is the determination of the percentage of a business’s profits subject to a given jurisdiction’s corporate income tax or other business tax. US states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. .

- Throwback and throwout rules do not represent neutral tax policy, since any income thrown back is taxed at the originating state’s rate, and companies without the ability to design their corporate structure around the tax code can face uncommonly high burdens, while other businesses may locate their sales activities in non-throwback states.

- Whatever their aims, throwback and throwout rules are nonneutral, often inequitable, uncompetitive, and ultimately counterproductive.

Introduction

Throwback is popular in sports jerseys, soft drinks, and angling. It is also an underappreciated contributor to corporate tax burdens, an obscure provision which can be more important than the tax rates themselves for many businesses.

Businesses sometimes make sales into states with which they lack sufficient connection (called “nexus”) to be subject to corporate taxation, with the potential that the income earned in that state will not be subject to any state’s corporate income tax. Twenty-five states and the District of Columbia have adopted throwback or throwout rules intended to expose income from outbound sales to their own corporate income taxes if, for whatever reason, it is not taxable in the destination state.

The goal of throwback and throwout rules is 100 percent taxability of corporate income, but the result is a complex, uncompetitive system that can drive businesses out of some states by yielding high—sometimes astronomically high—in-state tax burdens. Indeed, throwback rules have such an effect on business activity that multiple studies find that their adoption drives out enough business to offset the revenue gains that would otherwise be anticipated from taxing additional business income, to the detriment of those states’ economies.

Although throwback and throwout rules are significant for many businesses and feature strongly in their tax planning, they are often overlooked or misunderstood by policymakers. This paper seeks to provide clarity by explaining the purpose, structure, and function of throwback and throwout rules, and to offer guidance to lawmakers by outlining their economic ramifications and limitations.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeA Very Short Introduction to Corporate Apportionment

To understand the function of throwback and throwout rules, it is first necessary to comprehend the basic workings of formulary apportionment. When companies conduct business in multiple states, it is usually necessary for states to apportion that income for tax purposes, meaning that they must make a determination as to what share of that income is taxable in each state.[1] In the modern era, three factors are available to states in apportioning income: the share of property, payroll, and sales in a given state. Historically, most states equally weighted these factors, but there is a pronounced trend toward giving greater—or even exclusive—weight to the sales factor, in an attempt to benefit in-state companies while exporting more taxes to companies with sales, but less of a footprint, in a given state.[2]

Courts have granted states substantial leeway in adopting competing approaches to apportionment, provided that chosen approaches (1) have some rational relationship to the company’s activity in the state (a very permissive standard) and (2) are internally consistent, meaning that, if every state chose a given apportionment formula, no more than 100 percent of a corporation’s income would be taxed—even if, in practice, the interaction of competing standards can yield double taxation.[3]

The problem of taxing more than 100 percent of income has vexed taxpayers and practitioners, but states have often focused on a different perceived problem: the possibility of taxing less than 100 percent of a corporation’s business income.

An incongruity of apportionment formulas can be enough on its own to yield the taxation of less than 100 percent of a corporation’s business income. Consider an extreme case of a company that operates in two states, one using single sales factor (SSF) apportionment and another using evenly weighted three-factor (sales, payroll, and property at 33.3 percent each) apportionment. Imagine in the first scenario that the company is highly strategic, primarily operating in the single sales factor state and mostly selling into the three-factor state, and in the second, that its operations are the mirror image, with most sales being made from the three-factor state into the single sales factor state.

|

Source: Tax Foundation analysis. |

||||

| Scenario 1 | Scenario 2 | |||

|---|---|---|---|---|

| State A | State B | State A | State B | |

| Apportionment Formula | Three-Factor | SSF | Three-Factor | SSF |

| % of Sales | 90% | 10% | 10% | 90% |

| % of Payroll | 10% | 90% | 90% | 10% |

| % of Property | 10% | 90% | 90% | 10% |

| Apportioned Sales | 30% | 10% | 3.3% | 90% |

| Apportioned Payroll | 3.3% | 0% | 30% | 0% |

| Apportioned Property | 3.3% | 0% | 30% | 0% |

| Apportioned Share | 36.7% | 10% | 63.3% | 90% |

| Total Apportionment | 46.7% | 153.3% | ||

In the first scenario example, 90 percent of the sales are in State A, but the sales factor has a one-third weight, meaning that this pulls 30 percent of the company’s income (one-third of 90 percent) into State A for tax purposes. Similarly, 10 percent each of the company’s property and payroll are in the state, and one-third of each of those figures is pulled into the state—meaning that a total of 36.7 percent of the company’s income is taxable in State A.

The company’s footprint in State B is the inverse, with most production taking place there (90 percent each of property and payroll, neither of which are part of the state’s apportionment formula), but only a modest 10 percent share of sales, all of which is pulled in under single sales factor apportionment. Thus, State B taxes 10 percent of the company’s income. Across the two states, only 46.7 percent of the company’s business income is subject to state corporate taxation. Because most multistate businesses operate in more than two states, and cannot engage in this level of tax planning, this example is unusually stark, though not impossible.

Conversely, under Scenario 2, far more than 100 percent of the company’s income—in this case, 153.3 percent—is subject to tax. States are, unsurprisingly, more concerned about the first scenario than the second.

There is little that states can do about this situation, which tends to be the result of single sales factor apportionment, a conscious choice states make which can limit their ability to tax in-state businesses. But there is another way that corporate income goes untaxed as well: when, due to their own nexus standards, federal law, or constitutional constraints, states are unable to tax corporate income otherwise attributable to that state. This income is commonly termed “nowhere income,” and it is this income that states with throwback and throwout rules attempt to recapture. Functionally, these rules represent the effort of a state with jurisdiction over a corporate taxpayer to impose its own taxes on income attributable to another state which lacks its own jurisdiction, even though that income was not earned in the “throwback” state.

For proponents of throwback and throwout rules, they are a way to ensure that businesses cannot avoid taxation on some share of their business income, either by the incidental effect of the tax system as applied to their business formation, or through the intentional consequence of tax avoidance strategies, with proponents arguing that there should be a goal of 100 percent taxability. Opponents observe that throwback rules involve taxation by states with little claim to the income and argue that they can make states with such rules economically uncompetitive for certain kinds of companies, to the point that they can lead to significant corporate outmigration and economically inefficient tax avoidance strategies.

How Federal Law Creates “Nowhere Income”

For states to levy taxes on a company, there must be a sufficient connection—termed “nexus”—between the state and the company’s economic activities. Although this primer is not chiefly concerned with the complex subject of when and how a company has nexus for tax purposes, it is important to understand that nexus is defined and limited in three ways: by state statute, federal statute, and the U.S. Constitution. States have significant leeway to determine what sort of contacts are sufficient for a company to establish nexus there—factors like a commercial domicile, employees located in the state, deriving income from the state, or marketing into the state. If policymakers wish, states can take a narrower view of nexus than federal law—but where they take a broader one, federal law and the constitution prevail.

The chief limitation on state nexus is a federal law, Public Law 86-272, which prohibits states from taxing income arising from the sale of tangible property into the state by a company whose only activity in that state is the (remote) solicitation of sales. In other words, if a company maintains a warehouse in the state or even just a kiosk; if it has a sales office, or even just a traveling salesman; if it so much as delivers one of its products into the state with its own employees or in its own vehicle—if any of these factors are present, the company has nexus with the state and is taxable according to the state’s apportionment formula. If, however, any marketing is produced in another state, the sales office records the transactions in another state, and products are shipped to customers via a common carrier, then it does not matter whether the sales into that state are 1 percent or 100 percent of the company’s revenues: by law, that sales income is not taxable in the destination state, because those contacts with the state are insufficient, under federal law, to establish nexus.[4]

Here, the untaxed income does not just arise from the interplay of state apportionment formulas or state policymakers’ decisions not to tax certain activity, but from a prohibition in federal law that can result in “nowhere income” which does not get placed into the sales factor of any state’s apportionment formula. The same situation arises if, separate from P.L. 86-272, a company has sales into a state in which its activities are constitutionally insufficient to allow a state to establish tax jurisdiction or where the state’s own nexus standards are not met, though Due Process and Commerce Clause challenges to state tax authority[5] tend to be rare, and most so-called nowhere income is generated by P.L. 86-272.

Companies stand to benefit if they can avoid any economic activity other than the remote solicitation of sales into a state. This is a decision made at the margin; many other factors enter into the decision of where to locate facilities and employees, with many larger businesses resigned to the fact that they will have nexus almost everywhere and many business models structurally unsuited to avoiding the establishment of nexus in states where they have sales.

Some companies, however, have flexibility in where they produce and where they sell, and can benefit from locating their production in a single sales factor or low corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. state, while selling into states which lack the jurisdiction to tax them. Throwback and throwout rules are designed to capture that “nowhere income,” effectively reclaiming it from the state without legal authority to tax it and “throwing” it back into a state with jurisdiction over the taxpayer.

The Origin and Intent of Throwback Rules

The modern apportionment apparatus has its origin in the Uniform Division of Income for Tax Purposes Act (UDITPA). This model legislation emerged from the Uniform Law Commission in 1957 and was intended to promote uniformity in corporate apportionment, crafted in response to federal laws and the threat of further federal legislation if states did not begin to address their patchwork approach to the taxation of income. Initially, taxation of “nowhere income” was not a significant concern. The three-factor apportionment approach embodied in UDITPA generally yielded full taxability, the chief exception being when some of a company’s activity was carried out in a state without a corporate income or franchise tax.

The voluntary choice of a state not to tax corporate income was one that the drafters of UDITPA respected, with drafters’ notes reading, “If [a state] does not wish to tax income, that is no reason for a state that does wish to tax income to attempt to obtain more than its share of taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. .”[6] By the time UDITPA was enshrined as Article IV of the Multistate Tax Compact in 1966, however, Congress had enacted P.L. 86-272, and the absence of 100 percent taxability was no longer simply a matter of state policy choices, but—substantially—a constraint imposed by federal law. In response, the throwback rule was born.[7]

Initially adopted as the Interstate Income Act of 1959 (P.L. 86-272), the federal statute which provides the impetus for throwback rules reads, in part:

No State, or political subdivision thereof, shall have power to impose, for any taxable year ending after September 14, 1959, a net income tax on the income derived within such State by any person from interstate commerce if the only business activities within such State by or on behalf of such person during such taxable year are either, or both, of the following:

(1) the solicitation of orders by such person, or his representative, in such State for sales of tangible personal property, which orders are sent outside the State for approval or rejection, and, if approved, are filled by shipment or delivery from a point outside the State; and

(2) the solicitation of orders by such person, or his representative, in such State in the name of or for the benefit of a prospective customer of such person, if orders by such customer to such person to enable such customer to fill orders resulting from such solicitation are orders described in paragraph (1).[8]

In response to the potential for “nowhere income” and the planning opportunities to which it might give rise, the throwback rule was created and inserted into the Multistate Tax Compact, which has been adopted—frequently with few modifications—in many states.[9] The policy goal, in the words of Prof. Walter Hellerstein, a leading expert on state taxation, was to deny corporations the “opportunity of relying on the normal sales attribution rules to produce a tax-free haven for a portion of their income.”[10]

How Throwback and Throwout Rules Work

Although some states have adopted their own language, the standard throwback rule arises from two provisions of UDITPA as incorporated into Article IV of the Multistate Tax Compact. The throwback provision itself is § 16(b), and holds that receipts from the sale of tangible property are considered to be in a state (and thus in the numerator of its sales factor) if “the property is shipped from an office, store, warehouse, factory, or other place of storage in this State and (1) the purchaser is the United States Government or (2) the taxpayer is not taxable in the State of the purchaser.”[11]

Throwback, then, has two requirements:

- The taxing state must be the location from which the tangible property is shipped; and

- The income is not taxable in the state of the purchaser, either because that purchaser is the federal government or because the destination state lacks jurisdiction to levy a tax.

It is important to note that the throwback rule, as traditionally formulated, does not give states the ability to incorporate into their sales factor any income another state elected not to tax on policy grounds, like opting not to impose corporate taxes or offering incentives which eliminate a company’s tax liability. The throwback rule asks whether the corporation is taxable in the destination state, not whether it is taxed. (Sometimes, policymakers in states without a corporate income tax, or which provide incentives which zero out some corporations’ tax liability, express concern that the revenue they forgo is being swept up by another state’s throwback rules. They need not worry.) The second relevant UDITPA provision clarifies this point by providing a definition of taxability for apportionment purposes:

For purposes of allocation and apportionment of income under this Article, a taxpayer is taxable in another State if (1) in that State he is subject to a net income tax, a franchise tax measured by net income, a franchise tax for the privilege of doing business, or a corporate stock tax, or (2) that State has jurisdiction to subject the taxpayer to a net income tax regardless of whether, in fact, the State does or does not do so.[12]

Throwback rules function, therefore, by incorporating any sales that are not taxable in a destination state into the sales factor numerator of the origination state. A company’s income from one state cannot be thrown back to another if it can demonstrate that it is subject to a net income, franchise, or capital stock tax in the destination state, or if that state possesses jurisdiction to levy a tax on the company but opts not to impose corporate taxes.

The list of destination state taxes is not exhaustive, and that is by design. A company immunized against destination state taxation under P.L. 86-272 cannot avoid throwback by exposing itself to some minimal business fee or tax in the destination state or making a voluntary payment; the tax must be a corporate income tax or a state’s alternative to one.[13]

If, by way of example, a company had its sales divided evenly among five states (including the origin state), but lacked taxable nexus in two of those states under P.L. 86-272, then instead of three states each claiming 20 percent of the company’s sales in their numerators and two claiming none, the origin state would claim 60 percent—picking up the shares of the two states unable to impose their own taxes. Twenty-two states and the District of Columbia impose throwback rules.

Under a throwout rule, instead of out-of-state sales being added to the numerator (sales attributable to the taxing state), those sales are excluded from the denominator (all sales).[14] In the above throwback example, the origin state threw 40 percent of sales back into the numerator in addition to its own 20 percent, yielding a sales factor of 60/100, or 60 percent. If instead the destination state threw the untaxable sales out of its denominator, its sales factor would be 20/60, or 33.3 percent. In the past, New Jersey imposed a much more expansive (and constitutionally suspect) throwout rule, which will be discussed separately, but the approach illustrated here is representative of throwout rules as they currently exist in three states for sales of tangible property.

Throwout rules also exist for sales of services and other intangible property, whereas throwback rules apply exclusively to sales of tangible property. For apportionment purposes, tangible property is always sourced to the destination state in the absence of throwback, whereas sourcing rules for intangible property vary.[15] Twenty-two states remove sales of intangible property that, under their own sourcing rules, would be attributed to the destination state, from the denominator of the sales factor when the intangible sale is not taxable at its destination. Many of these states have throwback or throwout rules for tangible property as well, but six states have a throwout rule for intangible property without adopting a corresponding throwback or throwout rule for tangible property.

|

(a) Kentucky has a throwback rule that only applies to sales to the federal government and is not typically counted as a throwback state. (b) Maine replaced its throwback rule with a throwout rule in 2010 but continues to use throwback for sales to the federal government. (c) New Mexico’s throwback rule only applies to businesses opting to be taxed under single sales factor apportionment. Source: state statutes and administrative codes. |

|||

| State | Throwback (Tangible) | Throwout (Tangible) | Throwout (Intangible) |

|---|---|---|---|

| Alabama | ✓ | ✓ | |

| Alaska | ✓ | ✓ | |

| Arkansas | ✓ | ||

| California | ✓ | ✓ | |

| Colorado | ✓ | ||

| Florida | ✓ | ||

| Hawaii | ✓ | ✓ | |

| Idaho | ✓ | ✓ | |

| Illinois | ✓ | ✓ | |

| Kansas | ✓ | ✓ | |

| Kentucky | (a) | ✓ | |

| Louisiana | ✓ | ✓ | |

| Maine (b) | ✓ | ✓ | |

| Massachusetts | ✓ | ||

| Michigan | ✓ | ||

| Minnesota | ✓ | ||

| Mississippi | ✓ | ||

| Missouri | ✓ | ✓ | |

| Montana | ✓ | ✓ | |

| Nebraska | ✓ | ||

| New Hampshire | ✓ | ||

| New Mexico | ✓ (c) | ✓ | |

| North Dakota | ✓ | ✓ | |

| Oklahoma | ✓ | ||

| Oregon | ✓ | ✓ | |

| Rhode Island | ✓ | ||

| Tennessee | ✓ | ||

| Utah | ✓ | ✓ | |

| Vermont | ✓ | ||

| West Virginia | ✓ | ✓ | |

| Wisconsin | ✓ | ||

| District of Columbia | ✓ | ||

| Totals | 23 | 3 | 22 |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIn the real world, businesses have a variety of operations across multiple states, and it is entirely possible that the same state can be the origin of some multistate sales and the destination for others. With each transaction, however, there should be a single state of origin, and this is generally the only state that can throw back the nontaxable sales income. Other states in which a company does business cannot apply their throwback rules to capture “nowhere income” on sales that did not originate in their states.

Nothing in interstate taxation is simple, however. Many states have “double throwback” rules—sometimes, but not always, spelled out in statute—to address so-called drop shipment scenarios where goods are not shipped directly from a state in which a company has nexus, but are instead shipped from a vendor in a state in which the taxpayer is not subject to tax, and into a state in which the taxpayer is similarly immune from taxation.[16] In this case, “double throwback” states will resort to one further expediency, throwing the sales back to the state in which the transaction was processed even though it is not the origin of the shipment. If the state in which the third party ships the good has jurisdiction to tax the company which originated the sale, the sales income is not thrown back.

Consider a retailer based in State A which sells a replacement part to a customer in State B, but which contracts with a third-party vendor to ship the product out of State C. Although the third-party vendor (which may, in fact, be a subsidiary or other affiliated corporation) indisputably has nexus in State C, the retailer based out of State A may not, so if it similarly lacks nexus in the destination state (State B), its return on the transaction may constitute “nowhere income.” Effectively, double throwback or drop shipment rules allow the state in which the third-party sale was processed to include the sale in its numerator in cases where the processing company is not taxable in the states of the shipment’s origin or destination. A typical double throwback provision provides:

If a taxpayer, whose salesman operates from an office located in this state, makes a sale to a purchaser in another state in which the taxpayer is not taxable, and the property shipped directly by a third party to the purchaser, the following rules apply:

- If the taxpayer is taxable in the state from which the third party ships the property, then the sale is in such state.

- If the taxpayer is not taxable in the state from which the property is shipped, then the sale is in this state.[17]

For purposes of throwback rules, foreign countries are generally considered “states” and are subject to throwback as well, though two throwback states—Massachusetts and Wisconsin—do not apply the rule to foreign sales.[18] Massachusetts also has a unique provision, often called the Massachusetts Rule, under which throwback only applies to goods sold by a sales agent based in the state,[19] while Kentucky only applies its throwback rule to sales to the federal government, not to “nowhere income” earned in other states.[20] And there is one more wrinkle that complicates application of the throwback rule: combined reporting.

Applying Joyce and Finnigan Rules

Science split the atom, and Joyce and Finnigan split the world of tax apportionment. Specifically the Joyce and Finnigan rules, which, though complex, have nothing to do with a certain inaccessible Irish author.[21] Rather, the two sets of rules, on which states are divided, determine how combined reporting affects taxability of businesses for apportionment purposes—and by extension, under throwback rules.

Some states tax related corporations (parent companies, subsidiaries, and affiliates) as a unitary group, while in others, each company files a separate return. When a state adopts unitary combined reporting, it must decide whether a company is subject to tax if another member of the unitary group has nexus—a decision that affects not only the state’s taxation of sales activities within its borders, but also what “nowhere income” it can throw back from other states.

Two rules, both named after court cases in California, have come to govern this question.[22] Under the Joyce rule, the relevant taxpayer is a particular corporate entity making a sale, whereas in a Finnigan rule state, the taxpayer is the combined group.[23] This means that under Joyce, a corporation is determined to be taxable in a state only if the corporation itself possesses taxable nexus, whereas under Finnigan, a corporation is taxable if any member of its unitary group is taxable.

By way of example, imagine three companies, each with a million dollars in sales into a given state—and nowhere else. The three companies are all members of the same unitary group, but only Company A has taxable nexus in the state, whereas the others only sell into the state, with operations located elsewhere. Under Finnigan rules, all $3 million of the company’s sales are apportioned to the state, since the nexus established by Company A gives the state the authority to tax Companies B and C as well. Under Joyce rules, however, only the $1 million from Company A is included in a sales factor in the state.

States possess the freedom to adopt either approach, and at present, 16 of the combined reporting states utilize Finnigan rules, while 14 and the District of Columbia follow Joyce.[24] Of the combined reporting states with throwback or throwout rules for sales of tangible property, 12 adopt Joyce rules and 8 employ Finnigan rules.

|

* Missouri’s throwback rule is scheduled for repeal in 2020. Sources: State statutes and administrative codes; Multistate Tax Commission. |

||

| Finnigan Rule | Joyce Rule | Separate Returns |

|---|---|---|

| California | Alaska | Alabama |

| Kansas | Colorado | Arkansas |

| Massachusetts | Hawaii | Florida |

| Maine | Idaho | Louisiana |

| Montana | Illinois | Missouri* |

| Rhode Island | Mississippi | Oklahoma |

| Utah | North Dakota | |

| Wisconsin | New Hampshire | |

| New Mexico | ||

| Oregon | ||

| Vermont | ||

| West Virginia | ||

| District of Columbia | ||

Whatever choice a state makes, it cuts both ways on tax authority. If a company has sales into a Finnigan state but, as an individual company, lacks nexus due to P.L. 86-272, those sales can be taxed if one of its related companies falls under the state’s tax jurisdiction, since the tax falls on the unitary group. However, if a company based in that Finnigan state sells into another state where it lacks nexus, generating “nowhere income” that could be subject to the originating state’s throwback rule, the originating Finnigan state cannot throw back that income if another member of the company’s unitary group has nexus in the destination state—even if the destination state does not itself tax that income because it is a separate return state or has adopted Joyce rather than Finnigan rules.

One consequence of this is that a company selling from a Joyce state into a Finnigan state can experience double taxation, whereas one selling from a Finnigan state into a Joyce state may not have all its income taxed even though the originating (Finnigan) state imposes a throwback rule. When a unitary group member in a Joyce state sells into a Finnigan state in which one of its related companies has nexus, the Joyce state throws back that outbound income, on the (Joyce-based) theory that the destination state lacks taxable nexus, while the Finnigan state taxes that inbound income on the (Finnigan-based) assertion that it does, in fact, have nexus through its connections with the unitary group.[25]

Economic Consequences of Throwback and Throwout Rules

Although throwback and throwout rules are designed to avoid the perceived under-taxation of corporate income, they can lead to double taxation in some circumstances and frequently impose high tax burdens in specific states—high enough to make the state unattractive for businesses.

Imagine a hypothetical firm with $100 million in sales into its home state and nine other states. For simplicity’s sake, let us suppose that these are evenly distributed at $10 million in sales per state, and that the company has a taxable presence in three states (including the state in which the firm is located), is immune from taxation in six others due to the workings of P.L. 86-272, and has no liability in the tenth because that state does not impose a corporate income or similar business tax. Imagine, moreover, that 70 percent of the company’s sales—again evenly distributed—are tangible personal property, while 30 percent are services or other intangible property.

| Tax Status | # of States | Tangible | Intangible |

|---|---|---|---|

| Home State | 1 | $7 million | $3 million |

| Subject to Corporate Tax | 2 | $14 million | $6 million |

| No Jurisdiction | 6 | $42 million | $18 million |

| No Corporate Tax | 1 | $7 million | $3 million |

| All States | 10 | $70 million | $30 million |

In calculating the sales factor for corporate income tax purposes in the domiciliary state, the denominator is initially set at the total of all sales made anywhere, in this case $100 million. The home state begins by including all sales (tangible and intangible) made in the state, in this case $10 million, in the numerator. These sales, and all others, are already in the denominator.

It then adds to the numerator the $42 million in sales of tangible personal property made into states where sales were not taxable but does not include the $24 million in intangible sales made into those states. Sales from states in which the company is jurisdictionally able to be taxed—both the two states in which it is actually subject to a corporate tax and the one state which elects not to impose such a tax—are not added to the numerator, so the numerator is set at $52 million (the $10 million in home-state sales plus $42 million in sales of tangible personal property to states where the company was not taxable).

Next, sales of intangible property which are not subject to tax in a destination state ($18 million) are subtracted from the denominator, yielding a numerator of $52 million and a denominator of $82 million. Although only 10 percent of the hypothetical company’s sales are made into the home state, that state is able to claim a sales factor of 63.4 percent (52/82) due to the throwback of tangible personal property and the throwout of intangible property.

Consider the consequences of such a policy. Whatever the taxation of the company in aggregate across states, the cost of operating specifically in this one domiciliary state with a throwback rule is extraordinarily high. If the state happens to use single sales factor apportionment, the implementation of a throwback rule is responsible for a tax burden more than six times what it would be in the absence of throwback. If that state imposes a corporate income tax of 6 percent, the effective rate on the actual income earned in the state is an astonishing 38 percent—more than enough to convince many companies to locate their operations elsewhere.

It is unsurprising, therefore, that businesses are uniquely sensitive to throwback and throwout rules. In one prominent study (Papke 1995), the sensitivity of rates of profit to throwback rules was found to be about double the response to property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. abatements and investment subsidies, meaning that having a throwback rule tends to reverse any benefit provided by tax incentives packages—and then some.[26]

In fact, the economic literature suggests that throwback rules do not actually expand corporate tax bases or increase state revenue, even though they certainly increase collections—sometimes punitively—from certain taxpayers. Both Lightner (1999)[27] and Bruce, Deskins, and Fox (2007)[28] find no relationship between throwback rules and state revenues, with subsequent research finding that the imposition of a throwback rule can actually reduce revenues in high-tax states.[29] In other words, throwback rules sufficiently incentivize businesses to restructure their production activity that states adopting a throwback rule generate no more revenue than before—and in some cases, states may actually lose revenue. So long as some states continue to forgo throwback rules, the loss of competitiveness by imposing one will be substantial.[30]

Other research has shown that average effective corporate income tax rates in throwback states are significantly lower than in non-throwback states, which might suggest that corporate rates become uncompetitive faster in states with throwback rules, and that maintaining competitiveness under throwback requires suppressing rates compared to those imposed by peer states. Manufacturing shipments from throwback states have been shown to decline so significantly that the losses from manufacturing alone can be enough to reduce a throwback state’s total sales factor, even though the ostensive purpose of throwback rules is to increase the sales factor.[31] Finally, Gupta and Hofmann (2003) conclude that states with throwback rules experience substantially fewer capital expenditures than states without them.[32]

Studies on the effect of throwback on business entity formation are less clear, though there is some indication that throwback rules may serve to discourage businesses from organizing as C corporations.[33] The overarching conclusion from the economic literature on throwback rules is that they result in heavier taxation of shrinking business activity, with collections remaining flat—or even declining, particularly when throwback rules are combined with high corporate tax rates—while economic activity shifts out of state, to the detriment of the state’s economy. In short, these nonneutral apportionment rules cost the state in terms of tax base erosion and diminished economic activity, while providing little to no state benefit because tax collections often remain flat and may even decline as a result.

Equity and the Throwback Rule

Proponents hold up throwback rules as a means of righting the perceived wrong of anything less than 100 percent taxability of business income, while opponents tend to see them as a case of “levying the wrong tax at the wrong rate in the wrong state.”[34] That a business has untaxed activity in one state is not, of itself, a clear reason why another state should tax that activity. The logic of the throwback rule is that an origination state has the right to tax income properly associated with another state simply because that other state does not choose, or is unable, to tax the income itself.[35]

Taxing “nowhere income” also cuts against the strong trend toward the adoption of single sales factor apportionment formulas, which are intended to reduce tax burdens on in-state operations while shifting them onto sellers who have most of their production activity out-of-state. The throwback rule converts a portion of their sales factor from destination- to origin-based, thus importing rather than exporting tax burdens.[36]

Single sales factor states are disadvantaged to the degree that they cannot tax some of the sales into their state, but compensating for that by imposing large additional burdens on in-state firms with outbound sales runs counter to the presumptive purpose of apportioning on the basis of sales.[37] The result is uncommonly high taxes on multistate businesses domiciled in the throwback state, with the effect, in many cases, of either driving them elsewhere or inducing them to adopt expedients to avoid the tax, like shipping products out of another state which lacks a throwback rule.[38]

The degree to which many businesses can avoid the consequences of throwback rules undermines the equity argument, as these rules ultimately become a tax on a relatively small number of businesses that lack avoidance opportunities. States’ equity concerns, moreover, tend to be one-sided, concerned only with perceived under-collection, not over-collection, since the courts have permitted—and states have embraced—a pastiche of mismatched apportionment formulas and rules which can lead to double taxation, an outcome that has led to considerably less handwringing from states. In the words of one scholar, “Why should ‘nowhere income’ be any more unpalatable than the over-taxation or ‘imaginary income’ that results for some taxpayers?”[39]

The result of throwback rules is not neutral taxation, since any income “thrown back” is taxed at the origination state’s rate, not the rate of the destination state which is unable to tax it. Companies with little ability or inclination to design their corporate structure around the tax code will face uncommonly high tax burdens, while other businesses may locate their sales activities in non-throwback states.[40]

Finally, throwback rules undermine the theoretical justification for making sales a factor in formulary apportionment in the first place. State authority to tax is premised on some connection between the activities of the taxpayer and either the costs they impose on the state or the benefits they receive from the state, though this requirement is construed broadly. There can be little doubt that companies benefit from the governance of states in which they have payroll or property, but the justification for apportioning partly or wholly on the basis of sales has historically been that companies benefit from access to a marketplace for which the state is in some ways responsible. For a throwback state to tax income from outbound sales is in some respects a repudiation of that theory, operating as if the other state conferred no benefits and thereby left the tax revenue for the originating state to claim.[41]

Constitutional Constraints

Although throwback and throwout rules are poor tax policy, courts have concluded that they do not have a constitutional impediment, at least in their typical configuration. States have the right to apportion on the basis of some combination of sales, property, and payroll, and to adopt origin or destination sourcing for the sales factor, so the chief constitutional question is whether they can adopt a hybrid approach, switching between origin and destination sourcing based on the taxability of that sales income elsewhere. The legal authority for states to do so has been broadly accepted, with Hellerstein (1978) observing that, since the alternative origin sourcing only applies to businesses untaxed elsewhere, the additional burden is unlikely to be of a magnitude to sustain a constitutional objection.[42]

A more aggressive, and constitutionally suspect, variant on throwback and throwout rules need not come from the realm of imagination, however: from 2002 to 2010, New Jersey imposed a throwout rule which excluded from the denominator all sales income untaxed elsewhere, regardless of whether New Jersey was the originating state. The provisions were extremely broad, applying both to income that was invulnerable to state taxation (typically due to P.L. 86-272) and which states simply chose not to tax, as in the case of states which forgo a corporate income tax or similar corporate tax.[43]

Whirlpool Properties, a company which owns brands licensed to its parent company Whirlpool Corporation (a home appliance manufacturer), did not do business in New Jersey, but its parent company did, which gave New Jersey the means to tax it as part of the unitary group. Under a typical throwback or throwout rule, this would have conferred scant benefit on New Jersey, since Whirlpool Properties had no property or employees in New Jersey and sold to licensee plants that were all based outside of New Jersey.[44] By any conventional analysis, there were no New Jersey contacts to tax.

Under its law, however, the state did not limit itself to “nowhere income” derived from sales made from New Jersey, but instead reduced the denominator by all nowhere income generated by Whirlpool Properties, whatever its origin. Between 1996 and 2001, the amount of income from the Whirlpool unitary group apportioned to New Jersey ranged between 0.95 and 1.33 percent of the company’s total income. By 2003, with the new throwout rule fully in effect, New Jersey was claiming the right to tax 41.86 percent of Whirlpool’s income—an increase of more than 3,000 percent.[45]

New Jersey was alone in this uncommonly aggressive approach, but had other states followed suit, they would be laying claim to the same income. Under traditional throwback and throwout rules, while one state levies tax on income arguably not truly belonging to it, the income is still only supposed to be taxed one time, by one state. In practice, the operation of different apportionment formulas and combined reporting rules can and often does lead to double taxation, but each state’s system, if universalized to all states, would tax no more than 100 percent of income (the internal consistency test).[46]

New Jersey’s law ignored internal consistency requirements. In fact, it completely disregarded several prongs of the Complete Auto test for whether a state tax regime violates the Commerce Clause: it lacked fair apportionment, it was not fairly related to any services provided to the taxpayer by the taxing state, and it arguably discriminated against out-of-state sales.[47] Courts have generally interpreted these requirements charitably in favor of states, but New Jersey’s law far exceeded any reasonable interpretation. If other states were to adopt the same system, they too could be taxing more than 40 percent of Whirlpool’s income, and large swaths of the income of other corporations as well, with the result of taxing a corporation on many multiples of its income nationwide.

To the dismay of many legal observers, New Jersey courts sustained the tax multiple times during the Whirlpool litigation, but the state ultimately repealed the tax in 2010, so the question never had a chance to be litigated in federal court. Under existing federal case law, it is highly doubtful whether New Jersey or any other state may levy a tax imposed solely based on economic activity taking place in other states, with no connection to New Jersey. During the period in which it was levied, the tax led to absurd and punitive outcomes; other states should avoid similar taxes not only because of their innate inequity, but also because, the New Jersey courts notwithstanding, such a tax is arguably extraterritorial taxation, and as such, unconstitutional.[48]

Conclusion

Whether the existence of “nowhere income” is a problem is, in some ways, a philosophical question. Even if it is undesirable, however, the cure is worse than the disease. State efforts to tax “nowhere income” are nonneutral, imposed by a state with which the income would not normally be associated, at the rate of that origin state rather than the sales destination state where the income goes untaxed.

These efforts are themselves often inequitable, sometimes contributing to double taxation of income. And they are uncompetitive, because the effort to throw back all income not taxable elsewhere can yield incredibly high tax liability in the origin state—liability high enough to induce businesses to locate some or all of their facilities in a non-throwback state, avoiding throwback rules either by shipping property from a warehouse in a non-throwback state or by moving the whole operation, thus depriving the originating state of any economic benefit.

And consequently, these rules are counterproductive, because the economic activity they drive out of the state undercuts, or even reverses, the additional revenue the state aspires to collect using throwback rules—to say nothing of the jobs and income that follow these companies out of state. The case for throwback and throwout rules crumbles under scrutiny, and states would be well-advised to rid themselves of these provisions which undermine economic competitiveness while failing to generate the anticipated revenue.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Only business income is apportioned. Nonbusiness income, e.g., income arising from investments or property ownership, is typically allocated in its entirety to a specific state where the company is domiciled or the property is located. See Charles McLure Jr., “Understanding Uniformity and Diversity in State Corporate Income Taxes,” National Tax Journal 61:1 (March 2008), 147.

[2] For a brief synopsis of developments in formulary apportionment, see generally, Joann M. Weiner, “Using the Experience in the U.S. States to Evaluate Issues in Implementing Formula Apportionment at the International Level,” U.S. Department of the Treasury, OTA Paper 83, April 1999, https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/WP-83.pdf.

[3] This summation omits significant nuance and is intended as an abbreviated summary to facilitate the understanding of throwback rules. For a more comprehensive overview of apportionment, see Charles McLure Jr., “Understanding Uniformity and Diversity in State Corporate Income Taxes,” and Bradley W. Joondeph, “The Meaning of Fair Apportionment and the Prohibition on Extraterritorial State Taxation,” Fordham Law Review 71:1 (2002).

[4] 15 U.S. Code § 381-383.

[5] Ilya A. Lipin, “Corporate Taxpayers’ Sore Arm: Throw-Out Rule Litigation in State and Local Taxation,” Tax Law 66:4 (2013), 906.

[6] 74 U.L.A. 91 (1957), “The Uniform Division of Income for Tax Purposes Act” [hereinafter UDITPA] §3, Note 1.

[7] Roxanne Bland, “The Throwback Rule: Part I,” State Tax Notes, Mar. 20, 2017.

[8] 15 U.S. Code § 381(a).

[9] Vernon B. Savoie and Michael L. Burr, “The Throwback Rule: Concepts, Components and Planning Opportunities,” Journal of State Taxation 2:19 (1983-1984), 20.

[10] Walter Hellerstein, “Construing the Uniform Division of Income for Tax Purposes Act: Reflections on the Illinois Supreme Court’s Reading of the ‘Throwback’ Rule,” U. Chi. L. Rev. 45:4 (Summer 1978) 770.

[11] M.T.C. Reg. § IV.16.(b).

[12] M.T.C. Reg. § IV.3.

[13] Bruce Fort, “Report on Application of the ‘Taxable in Another State’ Provisions in Multistate Tax Compact Article IV.3 and Model Allocation and Apportionment Regulations IV.3.(a), (b) and (c). 3,” Multistate Tax Commission, July 14, 2011.

[14] Ilya A. Lipin, “Corporate Taxpayers’ Sore Arm: Throw-Out Rule Litigation in State and Local Taxation,” 904.

[15] For UDITPA states, sales of services are attributed to the state in which income-producing activity is performed, or where the greater proportion of it is performed. Some states, however, use what is commonly known as market sourcing, which sources the sale of services and other intangibles to the destination state. See Walter Hellerstein, “Construing the Uniform Division of Income for Tax Purposes Act: Reflections on the Illinois Supreme Court’s Reading of the ‘Throwback’ Rule,” 772-773.

[16] Vernon B. Savoie and Michael Burr, “The Throwback Rule: Concepts, Components, and Planning Opportunities,” 29.

[17] 35 Miss. Admin. Code Pt. 3, Subpt. 08, Ch. 06, R. 402.09(3)(b)(viii).

[18] Vernon B. Savoie and Michael L. Burr, “The Throwback Rule: Concepts, Components, and Planning Opportunities,” 31.

[19] Mass. Gen. L. ch. 63, § 38(f)(2).

[20] Ky. Rev. Stat. Ann. § 141.120(10).

[21] In their complexity, the Joyce and Finnigan rules have nothing on James Joyce’s Finnegans Wake, the book which “split the world” like “science split the atom,” which opens not only in media res, but literally mid-sentence: “riverrun, past Eve and Adam’s, from swerve of shore to bend of bay, brings us by a commodius vicus of recirculation back to Howth Castle and Environs.” James Joyce, Finnigans Wake, ed. Robbert-Jan Henkes, Erik Bindervoet, and Finn Fordham (Oxford: Oxford University Press, 2012), 3.

[22] Lisandra Ortiz, “Joyce v. Finnigan: Adoption of the ‘Best’ Approach in Hopes of Some Uniformity,” The Tax Lawyer 67:4 (Summer 2014), 979-980.

[23] Margaret C. Wilson, “Apportionment Apoplexy: Throwback, Throwout, or Just Throw Up Your Hands,” Tax Executive 57:4 (July 1, 2005), 363.

[24] Multistate Tax Commission, “Multistate Business Income Tax: Joyce v. Finnigan,” Aug. 13, 2018, http://www.mtc.gov/getattachment/Uniformity/Project-Teams/Model-Option-for-Combined-Filing/Multistate-Business-Income-Tax_Results-(2).pdf.aspx?lang=en-US.

[25] Lisandra Ortiz, “Joyce v. Finnigan: Adoption of the ‘Best’ Approach in Hopes of Some Uniformity,” 1003-1004.

[26] James A. Papke, “The Convergence of State-Local Business Tax Costs: Evidence of De Facto Collaboration,” Proceedings from the Annual Conference on Taxation Held under the Auspices of the National Tax Association-Tax Institute of America 88 (1995), 203.

[27] Teresa A. Lightner, “The Effect of the Formulary Apportionment System on State-Level Economic Development and Multijurisdictional Tax Planning,” Journal of the American Taxation Association 21 (January 1999).

[28] Donald Bruce, John Deskins, and William F. Fox, “On the Extent, Growth, and Efficiency Consequences of State Business Tax Planning,” in Alan J. Auerbach, James R. Hines Jr., and Joel Slemrod, eds., Taxing Corporate Income in the 21st Century (Cambridge: Cambridge University Press, 2007).

[29] Harley Duncan and William F. Fox, “State Strategies for Dealing with Tax Sheltering and Planning,” The State and Local Tax Lawyer 11:2 (2006), 90-91.

[30] William F. Fox, Matthew N. Murray, and LeAnn Luna, “How Should a Subnational Corporate Income Tax on Multistate Businesses Be Structured?” National Tax Journal 58:1 (March 2005), 150.

[31] Kenneth J. Klassen and Douglas A. Shackelford, “State and provincial corporate tax planning: income shifting and sales apportionment factor management,” Journal of Accounting and Economics 25:3 (June 1998), 402-404.

[32] Sanjay Gupta and Mary Ann Hofmann, “The Effect of State Income Tax Apportionment and Tax Incentives on New Capital Expenditures,” Journal of the American Taxation Association 25, Supplement (2003), 19-20.

[33] Donald Bruce and John Deskins, “Can State Tax Policies be Used to Promote Entrepreneurial Activity?” Small Business Economics 38 (May 2012), 383. One study finds a positive correlation with corporate formations, though the study does not assess trends, and the authors suggest as a plausible interpretation that states with high concentrations of C corporations have yielded to the temptation to impose throwback rules, not that throwback rules incentivize the formation of C corporations. See generally, LeAnn Luna and Matthew N. Murray, “The Effects of State Tax Structure on Business Organizational Form,” National Tax Journal 63:1 (December 2010), 995-1022.

[34] David Sawyer, “Re: COST’s Opposition to House Bill 1051, ‘Throwback’ of Sales for Corporate Income Tax,” Council on State Taxation Testimony to the Maryland House Ways and Means Committee, Feb. 28, 2018.

[35] Brian Strahle, “The Bridge to ‘Nowhere Income,’” State Tax Notes, Feb. 17, 2014.

[36] William F. Fox, Matthew N. Murray, and LeAnn Luna, “How Should a Subnational Corporate Income Tax on Multistate Businesses Be Structured?” 150-151.

[37] Roxanne Bland, “The Throwback Rule—Part II,” State Tax Notes, Mar. 27, 2017.

[38] Vernon B. Savoie and Michael L. Burr, “The Throwback Rule: Concepts, Components, and Planning Opportunities,” 33.

[39] Margaret C. Wilson, “Apportionment Apoplexy: Throwback, Throwout, or Just Throw Up Your Hands,” 364.

[40] William F. Fox, Matthew N. Murray, and LeAnn Luna, “How Should a Subnational Corporate Income Tax on Multistate Businesses Be Structured?” 150-151.

[41] Walter Hellerstein, “Construing the Uniform Division of Income for Tax Purposes Act: Reflections on the Illinois Supreme Court’s Reading of the ‘Throwback’ Rule,” 779.

[42] Id., 780.

[43] Ilya A. Lipin, “Corporate Taxpayers’ Sore Arm: Throw-Out Rule Litigation in State and Local Taxation,” 917.

[44] Id., 919-920.

[45] Id.

[46] Complete Auto Transit, Inc. v. Brady, 430 U.S. 274 (1977).

[47] Id.

[48] Michael A. Guariglia, David J. Shipley, and Open Weaver Banks, “Whirlpool: New Jersey Courts Put Taxpayers Through the Wringer,” State Tax Notes, July 26, 2010, 212-214.

Share this article