Key Findings:

- Under current law, businesses are not allowed to deduct inventory costs until the inventory is sold.

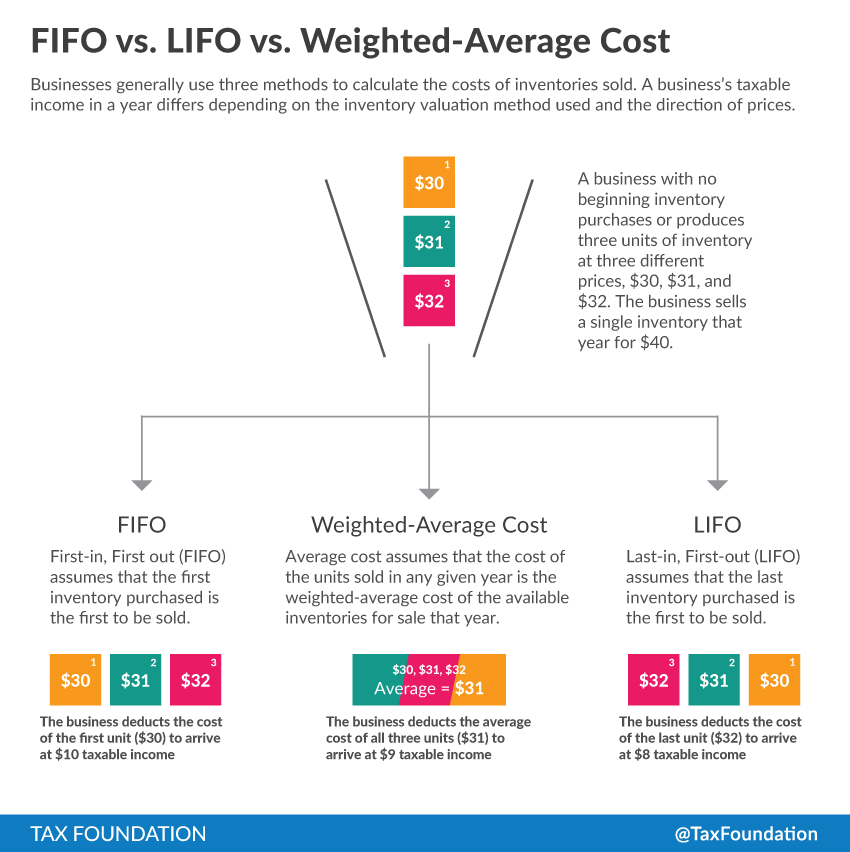

- There are three general methods by which companies may choose to calculate their inventory costs: First-in, First-out (FIFO); Last-in, First-out (LIFO); and Weighted-Average Cost.

- Requiring businesses to delay deductions of business expenses, such as inventories, understates the true costs of the expenses, overstates businesses’ income, and leads to a higher taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burden. When prices are rising, LIFO moderates this over-taxation by providing faster write-offs than the other methods, closer to true costs.

- Lawmakers have recently targeted LIFO for repeal, either as a means to raise revenue or as a part of broader tax reform.

- According to the Tax Foundation’s Taxes and Growth Model, the elimination of Last-in, First-out accounting for write-offs of future inventory would reduce GDP by $11.6 billion per year and end up reducing federal revenue by $518 million each year.

- Unless a special provision were made, LIFO repeal would also retroactively tax a company’s “LIFO reserve.” This additional tax could hit cash-strapped companies particularly hard and could result in 50,300 additional job losses in the short run.

Introduction

Under current law, businesses generally cannot deduct the cost of capital investments, including inventories, when they purchase them. Instead, businesses are required to deduct the cost of inventories when they are sold and are generally allowed to choose between three different methods when calculating their cost in a given year: First-in, First-out (FIFO); Last-in, First-out (LIFO); and Weighted-Average Cost. In the past few years, lawmakers have targeted LIFO for repeal either to raise revenue or as part of broader tax reform. According to the Tax Foundation’s Taxes and Growth Model, repealing LIFO would raise the cost of capital and result in a smaller GDP in the long run. In addition, LIFO repeal enacts a one-time retroactive tax on a company’s LIFO reserve. This temporary tax could hit cash-strapped companies hard and result in short-run job losses.

Businesses Currently Account for Inventories in One of Three Ways: LIFO, FIFO, and Weighted-Average Cost

Under current law, when a business calculates its taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. for the IRS, it generally takes its revenues and subtracts its total costs from that year (such as wages, raw materials, interest, and certain state and local taxes).

However, businesses that purchase capital investments (machines, buildings, or intangible assets) are not allowed to fully deduct them against taxable income when purchased. Instead, businesses are required to deduct, or depreciate, investments for several years or decades, according to schedules provided by the IRS.

As with capital investments, businesses cannot immediately deduct the purchases of inventories against taxable income. Instead, the cost of inventories is deducted against taxable income when sold, whether the inventory is sold the same year it is purchased or several years later.

Businesses generally use three major cost flow assumptions to figure out how much inventory costs should be deducted when inventories are sold: First-in, First-out (FIFO); Last-in, First-out (LIFO); and Weighted-Average Cost. Businesses use these cost flow assumptions because keeping track of specific inventories is not practical. Complex flows of inventory each year and inventory that by its nature isn’t clearly distinguishable may make it difficult to determine the precise inventory that was sold in a given year.[1] It is also worth noting that the use of a cost flow assumption means that the inventory accounting does not necessarily match up with the actual flow of goods.

The Choice of Inventory Method Impacts a Business’s Taxable Income

The choice of cost flow assumption has an impact on a company’s taxable income. To illustrate this, suppose a business purchases three units of inventory throughout the year at three different prices ($30, $31, and $32). The company sells one unit of inventory at $40.

First-in, First-out (FIFO)

Under FIFO, the business assumes that the first inventory unit purchased is the first to be sold. In this case, the cost was $30. The $30 cost of the first inventory unit is deducted against the revenue produced ($40) to net a taxable income of $10. When the business sells a second unit, the business would then deduct a cost of $31; upon selling a third unit, it would deduct a cost of $32.

When prices rise over time, FIFO may result in what are called “phantom profits.” Phantom profits occur when a business’s deduction under FIFO is less than the cost of replacing those inventories. Suppose the above company replaced the unit of inventory it sold for $40, and that replacement unit cost $33. Although the company’s taxable income was $10, ($40 minus the $30 FIFO cost of goods sold) the company’s actual profit that year was $7 ($40 minus the $33 cost of the replacement inventory).

Last-in, First-out (LIFO)

Under LIFO, a business assumes that the last inventory purchased is the first to be sold. In this case, the business is assumed to have sold the last unit purchased for $32. Thus the amount the business can deduct against taxable income is $32. The business’s taxable income is $8. When the business sells the next unit of inventory, it would then deduct the cost of the second unit for $31; and on the third sale, it would deduct the first unit purchased for $30.

A business normally maintains or increases its level of inventory, continuously replacing inventory as it is sold. If it uses LIFO, it continues to deduct the cost of the last inventory purchased, and it appears never to be selling the earliest inventory purchased (at least on paper). If prices and deductions are rising, this creates what is called a “LIFO reserve.” A LIFO reserve is an accounting entry that reflects the sum of all taxable income that would have resulted if the company had been using FIFO accounting. The business above that used LIFO had a taxable income of $8. If that business had used FIFO, their taxable income would have been $10. Thus, its LIFO reserve from this inventory is $2.

In general, prices in the economy rise over time. This means that a company that uses LIFO for many years or decades can build a substantial LIFO reserve. However, if prices begin to fall (as with the case recently for oil and natural gas) a company’s LIFO reserve will start to diminish. This is because taxable income under LIFO is higher than it is under FIFO when prices fall. The LIFO reserve also diminishes when the level of inventory drops, and would disappear if inventories were reduced to zero.

Weighted-Average Cost

Weighted-average cost is the middle ground between LIFO and FIFO inventory accounting. Under this method, a company makes the assumption that the cost of the units sold in any given year is the weighted-average historical cost of all the available inventories for sale that year. If the business purchases the three units for $30, $31, and $32, the average cost is $31. If the business sells a unit for $40, the business’s taxable income would be $9.

The above examples show that a business’s taxable income in a year differs depending on the inventory valuation method used and the direction of prices. The use of LIFO when prices rise results in a lower taxable income because the last inventory purchased had a higher price and results in a larger deduction. Conversely, the use of FIFO when prices increase results in a higher taxable income because the first inventory purchased will have the lowest price. Weighted-Average Cost falls somewhere in the middle of the two. All three methods could yield the same result if prices remained steady overtime. If prices were falling, LIFO would result in the highest taxable income, FIFO the lowest.

Delaying Deductions Raises the Cost of Capital, but LIFO Partially Mitigates this Issue

The fact that businesses have to delay the deduction for certain business costs is one of the biggest deficiencies in our current tax code, one that discourages capital formation and reduces GDP.

Delaying cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. deductions in the tax code results in the overstatement of business costs, due to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and the time value of money. A $10 deduction this year is worth several percent more, in present-value and inflation-adjusted terms, than a $10 deduction next year, and is much more valuable than a $10 deduction a decade from now.

Under current law, companies that purchase capital investments lose the value of the deductions due to their delay. Suppose a business purchases a $1000 machine and is required to deduct it over five years (Table 1). The sum of the nominal deductions will be $1000, but the sum of each year’s present-value deductions will only equal $809 (at a 5 percent discount rate and 2.5 percent inflation). Although the business spent $1000 up front on the machine, it only ended up being able to deduct 80.9 percent of the value of its true cost.

|

Table 1. Straight-Line Depreciation Deductions for a Five-Year Asset that Costs $1000 |

|||||||

|

Year |

0 |

1 |

2 |

3 |

4 |

5 |

Total |

|

Capital outlay |

$1,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$1,000 |

|

Nominal value of deduction |

$0.00 |

$200.00 |

$200.00 |

$200.00 |

$200.00 |

$200.00 |

$1,000 |

|

Present value of deduction |

$0.00 |

$186.05 |

$173.07 |

$160.99 |

$149.76 |

$139.31 |

$809 |

|

Note: These calculations assume a 5 percent discount rate, 2.5 percent inflation, and straight-line depreciation. |

This same intuition holds for inventories. Suppose that instead of purchasing a $1000 machine, the business purchases five units of inventory at $200 apiece (Table 2). It then sells and replaces one unit of inventory a year and uses the FIFO method. Each year, the business is able to deduct the cost of each unit sold at its nominal purchase price of $200 even though its replacement cost is slightly more due to inflation. By the end of the five year period, the original $1000 of inventory has been sold and the business has been able to deduct $1000 in nominal terms. However, due to inflation and the time value of money, the present value of the deductions was only $809, which would mean the real value of the business’s taxable income would be $191 higher, and its tax burden about $67 higher (at a 35 percent tax rate). Another way to look at the problem is to note that the business had to pay $1,078 to replace the $1,000 of inventory.

LIFO partially offsets the delay in deductions because it allows for larger nominal deductions as businesses replace inventory, assuming that prices are rising. If the same company uses LIFO, it would deduct the cost of the replacement (last-in) inventory against its taxable income each year. In other words, the company’s nominal deductions would be adjusted for inflation. As a result, the company’s present-value deductions at the end of the five years is higher under LIFO ($869) than it is under FIFO ($809). This means that deductions under LIFO better reflect the real cost of inventories when prices are rising.

|

Table 2. LIFO Provides a Better Present-Value Cost Recovery than FIFO |

|||||||

|

Year |

0 |

1 |

2 |

3 |

4 |

5 |

Total |

|

First-in, First-out |

|||||||

|

Inventory outlay (5 @ $200) |

$1,000 |

$1,000 |

|||||

|

Replacement inventory |

$0.00 |

$205.00 |

$210.13 |

$215.38 |

$220.76 |

$226.28 |

$1,078 |

|

Nominal value of deduction |

$0.00 |

$200.00 |

$200.00 |

$200.00 |

$200.00 |

$200.00 |

$1,000 |

|

Present value of deduction |

$0.00 |

$186.05 |

$173.07 |

$160.99 |

$149.76 |

$139.31 |

$809 |

|

Last-in, First-out |

|||||||

|

Inventory outlay (5 @ $200) |

$1,000 |

$1,000 |

|||||

|

Replacement inventory |

$0.00 |

$205.00 |

$210.13 |

$215.38 |

$220.76 |

$226.28 |

$1,078 |

|

Nominal value of deduction |

$0.00 |

$205.00 |

$210.13 |

$215.38 |

$220.76 |

$226.28 |

$1,078 |

|

Present value of deduction |

$0.00 |

$190.70 |

$181.83 |

$173.37 |

$165.31 |

$157.62 |

$869 |

|

Note: These calculations assume a 5 percent discount rate, 2.5 percent inflation, and the replacement inventory’s price increases at the same rate as inflation each year. |

Some Lawmakers Have Proposed Eliminating Last-In, First-Out

The choice to use one of the three cost flow assumptions has been part of the U.S. tax code ever since LIFO was introduced in the Revenue Act of 1938.[2] However, lawmakers have recently targeted LIFO for repeal as a means to raise revenue or as a part of broader tax reform. This would restrict companies to either FIFO or Weighted-Average Cost. In 2013, Representative Dave Camp introduced a tax reform proposal, which would have eliminated Last-in, First-out for inventories.[3] The same year, former Senator Max Baucus proposed eliminating LIFO for companies.[4] In addition, every one of President Obama’s budgets has proposed the elimination of Last-in, First-out accounting for inventories.[5]

LIFO Repeal Would Increase the Cost of Capital and Reduce the Long-Run Size of the Economy

Since LIFO provides companies a larger present-value deduction for inventory expenses during times of rising prices, its repeal would increase the cost of capital. As a result, businesses would invest less, which would result in a smaller economy.

According to the Tax Foundation’s Taxes and Growth Model, the repeal of LIFO would reduce GDP by $11.66 billion after all economic adjustments. The smaller economy would result in 7,700 fewer full-time jobs and a $53.3 billion smaller capital stock in the long run. As a result of the smaller economy, the repeal of LIFO would end up reducing federal tax revenue by $518 million each year. That is, instead of bringing in more tax revenue, as proponents of repeal anticipate, ending LIFO would reduce tax revenue.

|

Table 3. Long-Term Effects of LIFO Repeal on Federal Revenue and GDP |

|

|

GDP |

-$11.66 Billion |

|

Annual Federal Revenue (Static) |

$1.82 Billion |

|

Federal Revenue (Dynamic) |

-$518 Million |

|

Capital Stock |

-$53.3 Billion |

|

Full-Time Jobs |

-7,700 |

|

Source: Tax Foundation Taxes and Growth Model, October 2015. |

LIFO Repeal Places a Retroactive Tax on Companies that Could Impact the Economy and Reduce Employment by an Additional 50,300 Jobs in the Short Run

In addition to the permanent, ongoing effects of the increase in the cost of capital due to the repeal of LIFO, modelled above, businesses would also be hit with a one-time, retroactive tax on their LIFO reserve that could have an additional immediate, short-term negative impact on economic output and employment.

The recapture of a company’s LIFO reserve is considered a retroactive tax because companies, for decades, have been making investments in inventory while using LIFO. As such, they made purchases of inventories under the assumption that they would be able to use LIFO going forward and accumulate a tax-deferred LIFO reserve until such time as the company or its inventory was liquidated.

The retroactive portion of LIFO repeal brings in a significant amount of revenue compared to the ongoing revenue impact of moving to FIFO. The transition to FIFO would bring in an additional $86 billion over a decade, compared to the $18 billion raised from requiring companies to use FIFO going forward over the same period.[6]

Tax analysts often assume that retroactive taxes are efficient revenue raisers in that they don’t impact a business’s long-run incentives to invest. This is because taxpayers are typically not able to adjust their behavior to avoid the tax. It really isn’t feasible to go back in time.

However, retroactive taxes, such the LIFO transition tax, come with two concerns. A general concern is that sudden changes in federal tax policy make businesses fearful that other arbitrary adjustments may happen in the future, and increase risk and uncertainty, which reduce the willingness to invest. Another is a concern about fairness. It is not equitable to tax businesses and individuals based on economic activities that they made in the past under a different set of rules.[7] In addition, the transition tax in LIFO applies to the “LIFO reserve,” which is simply an accounting entry. As such, businesses would be required to pay tax on something that really isn’t an asset. This may require some companies to borrow money to pay tax on their reserve.

The retroactive portion of LIFO repeal could have a short-run negative impact on economic activity to the extent that companies are cash-strapped and have difficulty redirecting cash to pay the one-time tax. For some companies and industries this tax could be large. According to PwC, the manufacturing industry, which has a large aggregate LIFO reserve among public companies, would see a one-time tax increase equal to 135 percent of its 2013 tax bill if LIFO were repealed. The wholesale trade (53 percent) and retail trade (38 percent) industries would also face large one-time tax increases.[8] Even these alarming industry averages hide worse effects for specific companies. This is why some proposals to eliminate LIFO have allowed companies to pay taxes on their LIFO reserve over a number of years.[9]

To the extent that companies have difficulty paying the additional tax on their LIFO reserve, investment by these companies would fall, which would lead to a reduction in employment. A tax increase of approximately $86 billion over a decade that impedes capital investment could result in an additional loss of employment equal to 50,300 full-time equivalent jobs in the short run. Another consequence might be forced restructurings, buy-outs, or churning of ownership of affected businesses.

Conclusion

The U.S. tax code currently allows businesses to choose the method by which they account for inventories. Repealing Last-in, First-out accounting moves the tax code further from neutrality and raises the cost of capital. As a result, it would reduce long-run GDP and jobs. LIFO repeal would fly in the face of one of the goals of tax reform, which is to allow businesses to fully and immediately expense any investments it makes, including inventories. Lawmakers who want to raise revenue in order to lower marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s should be careful not to distort and exaggerate taxable income in the process, and should focus on more efficient sources of revenue.

[1] “Tax Accounting for Inventories and the Pharmaceutical Distribution Industry.” PwC National Economic and Statistics. March 2015.

[2] Carpenter, Brian W., Douglas M. Boyle, and Yi Ren. “The Impending Demise of LIFO: History, Threats, Implications, and Potential Remedies.” The Journal of Applied Business Research (July/August 2012).

[3] “Estimated Revenue Effects of the ‘Tax Reform Act of 2014.’” Joint Committee on Taxation. https://www.jct.gov/publications.html?func=startdown&id=4562.

[4] Schuyler, Michael. “Retroactive Taxation and the Baucus Proposal.” Tax Foundation. December 9, 2013. https://taxfoundation.org/article/retroactive-taxation-and-baucus-proposal.

[5] “Description of Certain Revenue Provisions Contained in the President’s Fiscal Year 2016 Budget Proposal.” Joint Committee on Taxation. https://www.jct.gov/publications.html?func=startdown&id=4841.

[6] “Estimated Budget Effects of the Revenue Provisions Contained in the President’s Fiscal Year 2016 Budget Proposal.” Split based on most recent LIFO repeal revenue estimate. In total, JCT estimates the LIFO repeal would raise $104 billion over the next decade.

[7] Schuyler, Michael. “Retroactive Taxation and the Baucus Proposal.” Tax Foundation. December 9, 2013. https://taxfoundation.org/article/retroactive-taxation-and-baucus-proposal.

[8] “Tax Accounting for Inventories and the Pharmaceutical Distribution Industry.” PwC National Economic and Statistics. March 2015.

[9] For example, President Obama’s proposal would allow businesses pay tax on their LIFO reserve over 10 years. Camp’s proposal would allow businesses to pay over four, but delay payment for five years after repeal.