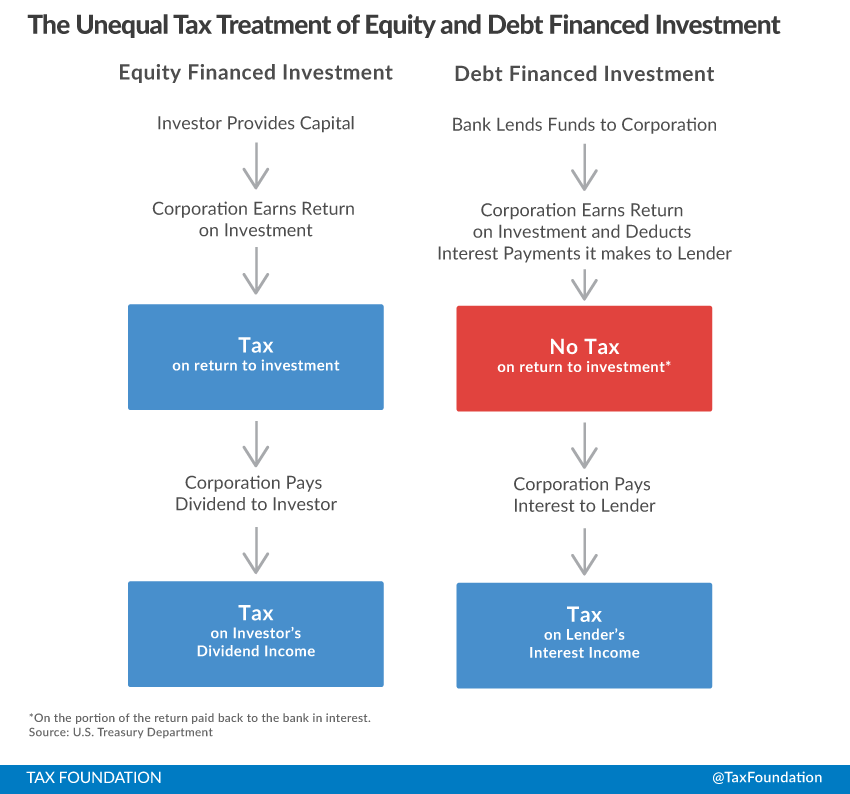

Double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. and the heavy taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burden on corporate profits has created a couple of distortions in the U.S. economy. One such distortion is that corporations often prefer to choose debt financing rather than equity financing. This is because the current tax code treats debt financing more favorably than equity financing. Specifically, equity financing faces two layers of taxation, where debt financing only faces one layer of taxation.

Suppose there are two C-corporations, A and B, seeking to expand their business. Company A borrows from a bank to finance an investment. The tax code allows the business to deduct any interest payments made to the lender against its taxable profits. In contrast, Company B uses inside or outside equity to make an investment equal in amount. If the investment earns a profit, Company B must first pay the entity level tax, then pay the required return to the investor, where it faces another tax. This puts Company A in a better position than Company B in terms of the after-tax return on investment when all else is equal.

Small businesses and startups often struggle to find available credit. Without a proven track record, it is difficult to receive loans from commercial banks. According to analysis by Cole and Sokolyk based on a national wide Survey of U.S. startups, one quarter of small businesses and startups are purely funded by equity for their initial asset. This means many startups aren’t able to debt finance and instead face the two layers of tax for equity financed investments.

Compared to common startups, R&D focused and innovation intensive startups have to rely even more on equity financing than debt financing. This is because R&D focused startups are often involved in specialized technology to some extent. Unlike generic assets, specialized technology is difficult to be accepted as collateral for a loan, because it can be hard to redeploy it in alternative ways. Thus, even if the lenders agree to fund a project by this type of startup, they will charge exceptionally high interest rates.

Due to the inequitable treatment of debt and equity in the current tax code, our most innovative contributors in the economy often face a tax disadvantage. A more neutral tax code would remove this distortion. One solution would be to integrate the corporate and individual tax codes to eliminate the double taxation of equity financed projects.

Share this article