A C corporation or C corp (named for being in subchapter “C” of the Internal Revenue Code) is an independent legal entity owned by its shareholders. A C corporation’s profit is taxed twice—as business income at the entity level and as individual income at the shareholder level when distributed as dividends or realized as capital gains.

Why Do C Corporations Exist?

The purpose of C corporations is to create a separate legal entity from its owners (shareholders) with the ability to own assets, enter into contracts, and otherwise conduct business, while limiting the liabilities of the individual owners and establishing a “perpetual existence” that is not tied to any individual owner or set of owners. Limited liability protection, under which the corporation assumes its own liabilities rather than having shareholders held responsible for corporate debts, is not unique to C corporations, but is fundamental to the concept of incorporation.

C corporations can be distinguished from other types of business organizations like S corporations, limited liability companies (LLCs), and partnerships, and all of these are distinguishable from sole proprietorships. While a corporation is legally separate from its owner(s), a sole proprietorship is a business composed of and legally synonymous with the single individual who owns it. In contrast with S corporations, a C corporation can have an unlimited number of shareholders (any or all of which can be foreign investors, which is restricted for S corporation owners) and can issue multiple classes of stock. C corporations also have greater access to capital than S corporations, and have the ability to “go public.” Against these benefits, however, C corporations face more regulatory obligations, higher costs, and double taxation.

How Are C Corporations Taxed?

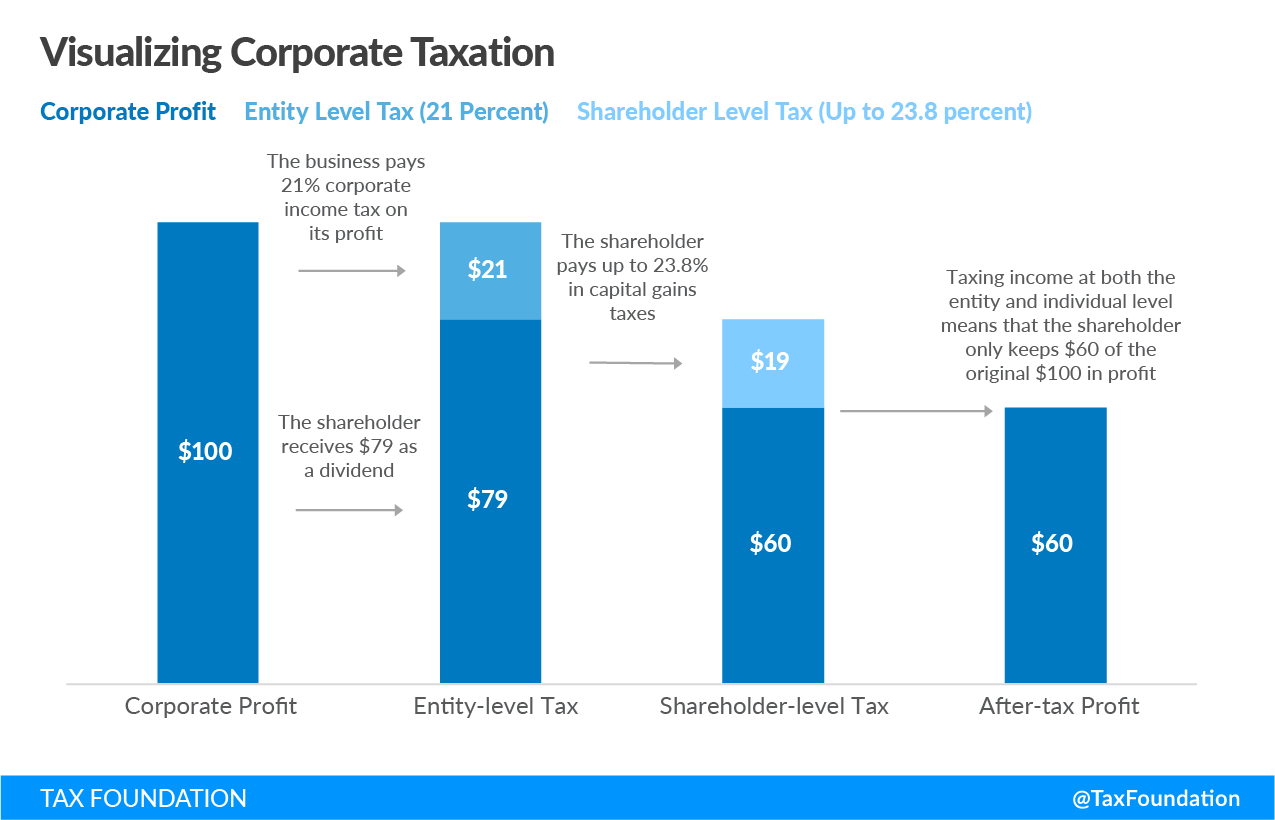

In the tax code, corporation profits are taxed at both the entity level by the corporate income tax and again at the shareholder level by the individual income tax when profits are distributed as dividends or realized as capital gains. With an S corporation, partnership, LLC, or sole proprietorship, all of which are known as “pass-through businesses,” the income flows through to owners/shareholders and is taxed only once, on their individual income tax returns; C corporations are taxed at the entity level under corporate income taxes, with the income subject to a second layer of taxation at the shareholder level, on both dividends and capital gains. Most dividends are classified as “qualifying dividends.” These dividends, along with long-term capital gains (for assets held at least one year), are currently taxed at a maximum rate of 23.8 percent. Short-term capital gains and non-qualifying dividends are taxed at ordinary income tax rates, which are higher.

To visualize this, suppose a C corporation makes a profit of $100 in a year. Under the corporate income tax (21 percent), the corporation would remit $21 at the entity level, reducing net income to $79. If all $79 was paid as a dividend to shareholders, the shareholders would be required to pay tax under the individual income tax at rates of 0 percent, 15 percent, or 20 percent, and potentially face the Net Investment Income Tax (NIIT) of 3.8 percent. Depending on the shareholders’ income level, the $79 dividend could be taxed at a rate of up to 23.8 percent ($18.80). Thus, of the original $100 profit, the after-tax income is $60.20. State and local taxes may apply at both the entity and individual level as well.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe