All Related Articles

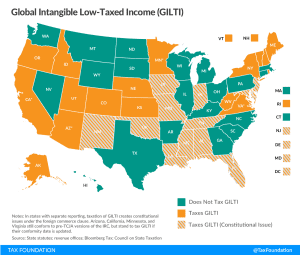

GILTI Minds: Why Some States Want to Tax International Income—And Why They Shouldn’t

The new federal tax on Global Intangible Low-Taxed Income (GILTI) is something of a misnomer: it’s certainly global and it’s definitely income, but the rest of it is, at best, an approximation. It’s not exclusively levied on low-taxed income, nor just on the economic returns from intangible property. So what is GILTI, why might states tax it, and what’s the problem with that?

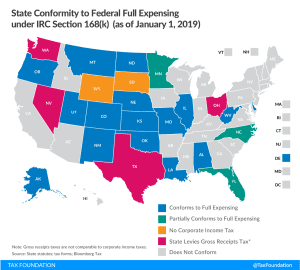

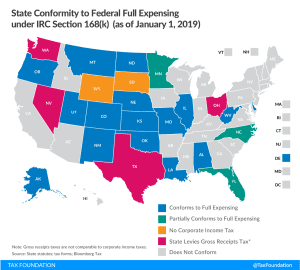

8 min readToward a State of Conformity: State Tax Codes a Year After Federal Tax Reform

States incorporate provisions of the federal tax code into their own codes in varying degrees, meaning that federal tax reform has implications for state revenue beyond any broader economic effects of tax reform.

73 min read

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

State Tax Implications of Federal Tax Reform in Virginia

Virginia has an opportunity to improve its tax competitiveness following the Tax Cuts and Jobs Act. Inaction will result in higher taxes.

14 min read

Five States Accomplish Meaningful Tax Reform in the Wake of the Tax Cuts and Jobs Act

Georgia, Idaho, Iowa, Missouri, and Utah capitalized upon the Tax Cuts and Jobs Act’s (TCJA) changes by conforming to increase their annual state revenues.

5 min read

Indiana Passes Conformity Bill in One-Day Special Session

Indiana recently passed tax conformity legislation linking the state’s individual and corporate tax code to the new federal law.

2 min read

States Can’t Just Hit Pause on Implications of Federal Tax Reform

The new federal tax law left states with some important decisions to make. If they delay, their residents could face confusion come filing time.

4 min read

What’s in the Iowa Tax Reform Package

Iowa Gov. Kim Reynolds is on the verge of signing tax reform legislation that would greatly improve the state’s needlessly complex tax code.

6 min read

Minnesota’s Tax Plans Make Modest Improvements

In response to the new federal tax law, the governor and lawmakers in both houses have proposed plans for updating Minnesota’s tax code.

2 min read

Governor Dayton’s Budget Proposal: Some Pro-Growth Provisions, but Misses the Mark on Others

The proposal includes some good reforms, including conforming to the federal full expensing provision, but also rolls back some recent positive changes.

2 min read

How an Unexpected Revenue Ruling Penalizes Capital Investment in Pennsylvania, and How Lawmakers Can Fix It

Failure to reverse this newly adverse treatment of capital investment makes it less likely that businesses will invest in Pennsylvania.

15 min read