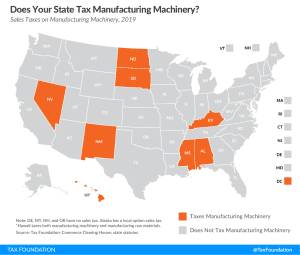

Taxes, Tariffs, and Industrial Policy: How the US Tax Code Fails Manufacturing

Policymakers actively marginalized the manufacturing sector by saddling them with cost recovery rules that prevent them from deducting the full cost of investment in physical plant and equipment. Going forward, policymakers should avoid haphazard fixes, targeted measures, and protectionism.

50 min read