Funding for Democrats’ $3.5 Trillion Spending Plan Is Unstable and Unsustainable

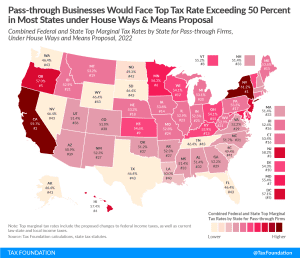

One has to wonder how stable or sustainable the Democrats’ spending program can be if it must rely so heavily on the taxes paid by such a small number of taxpayers as in the top 1 percent.

5 min read