Digital Services Taxes: Is There an End in Sight?

As it stands, Pillar One would usher in the end of many digital services taxes (though perhaps not all) at the cost of increased complexity (in an already complex and uncertain system).

4 min read

As it stands, Pillar One would usher in the end of many digital services taxes (though perhaps not all) at the cost of increased complexity (in an already complex and uncertain system).

4 min read

When it comes to international economic competition, people often frame the argument as the U.S. versus China. But across the Atlantic, nation-states in the European Union have been working hard to show the world that they deserve to be considered an economic force. Rising up to this challenge for the EU is easier said than done.

Later this week, the European Union is expected to release a new Tobacco Tax Directive, the first update in more than a decade. Early reports indicate that the EU will propose a significant increase to the existing minimum cigarette tax rates levied across the Union and expand the product categories that are taxed, including a block-wide vaping tax.

7 min read

French President Macron is coming to Washington, D.C., this week to ask President Biden the question on the minds of European leaders: “Why did you do this to us?”

6 min read

Europe is facing difficult times. Governments are balancing the need for more resources with the need to maintain peace and prosperity domestically. To properly strike this balance, EU policymakers must incorporate “Fiscal Fairness” into the debate.

2 min read

the Inflation Reduction Act gives us a glimpse into a future where the U.S. and EU opt for protectionist tax and trade policies rather than implementing principled tax policies and reducing trade barriers between allies.

5 min read

A more principled EU tax system will increase economic growth across the economy and provide the government with stable finances for spending priorities.

7 min read

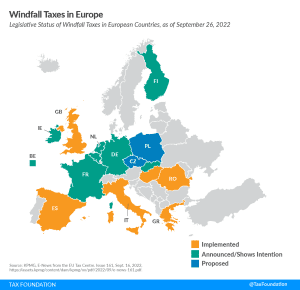

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

In the EU, Italy plays an important role in economic policy. If the EU wants to further develop own resources, it will need the backing of the Italian government—which seems unlikely at the moment.

4 min read

While the global minimum tax gets much attention in the media, there is another significant piece to the deal.

6 min read

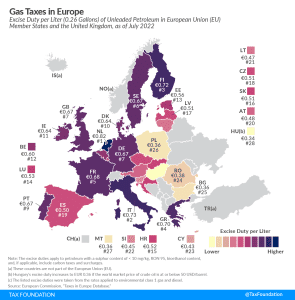

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

5 min read

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

25 min read

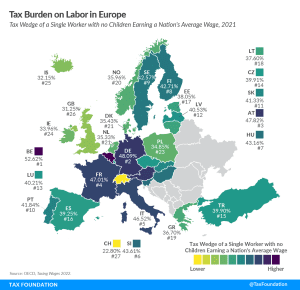

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

Treasury Secretary Janet Yellen offered estimates from the EU Tax Observatory as evidence that the Polish government would benefit from supporting the global tax deal. Unfortunately, evidence was, at best, out of date.

2 min read

With this new VAT directive, the EU has invited member states to adopt policies that create new complexities, are poorly targeted, and undermine an Own Resource.

5 min read

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read