All Related Articles

Reviewing Wyden’s Reconciliation Tax Policy Proposals

Congressional lawmakers are putting together a reconciliation bill to enact much of President Biden’s Build Back Better agenda. Many lawmakers including Senate Finance Committee Chair Ron Wyden (D-OR), however, want to make their own mark on the legislation.

5 min read

Tax Foundation Comments on the Wyden, Warner, Brown Discussion Draft

The proposed restructuring of the GILTI and FDII regimes makes several changes to the tax base that are largely offsetting, leaving virtually all the revenue potential to be determined by the tax rates on GILTI and FDII and the haircuts on foreign tax credits. Lawmakers should carefully weigh the trade-offs between higher tax revenues and competitiveness.

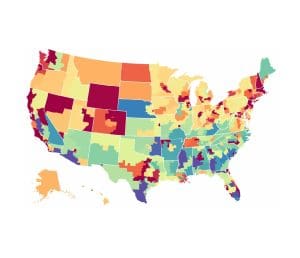

The Impact of the Biden Administration’s Tax Proposals by State and Congressional District

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

Details and Analysis of President Biden’s FY 2022 Budget Proposals

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Details and Analysis of President Biden’s American Jobs Plan

Details and analysis of the American Jobs Plan tax proposals. Learn more about the major tax changes in the proposed Biden infrastructure plan.

9 min read

Accounting for Deficits: When Should They Matter and How Should We Solve It?

Revenue shortfalls and deficits can be addressed best by considering when to consider the deficit as the primary priority and reevaluating how revenue can be raised most efficiently through sound tax policy principles.

5 min read

Tax Policy After Coronavirus: Clearing a Path to Economic Recovery

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read

Anti-Base Erosion Provisions and Territorial Tax Systems in OECD Countries

The U.S. decision to adopt a territorial tax system is certainly an improvement over having a worldwide system. However, in moving to a territorial system some of the new features created with the TCJA increased the complexity of the system.

38 min read

A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act moved the U.S. toward more of a territorial corporate tax system used by most other OECD countries. However, the U.S. law contains key differences in the treatment of foreign profits.

24 min read