State-level taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es may be the most visible source of state government revenues for most taxpayers, but it’s important to remember that’s not the only source of state revenue. State governments also receive a significant amount of assistance from the federal government in the form of federal grants-in-aid. Federal aid is given to states for Medicaid, transportation, education, and other means-tested entitlement programs administered by the states.

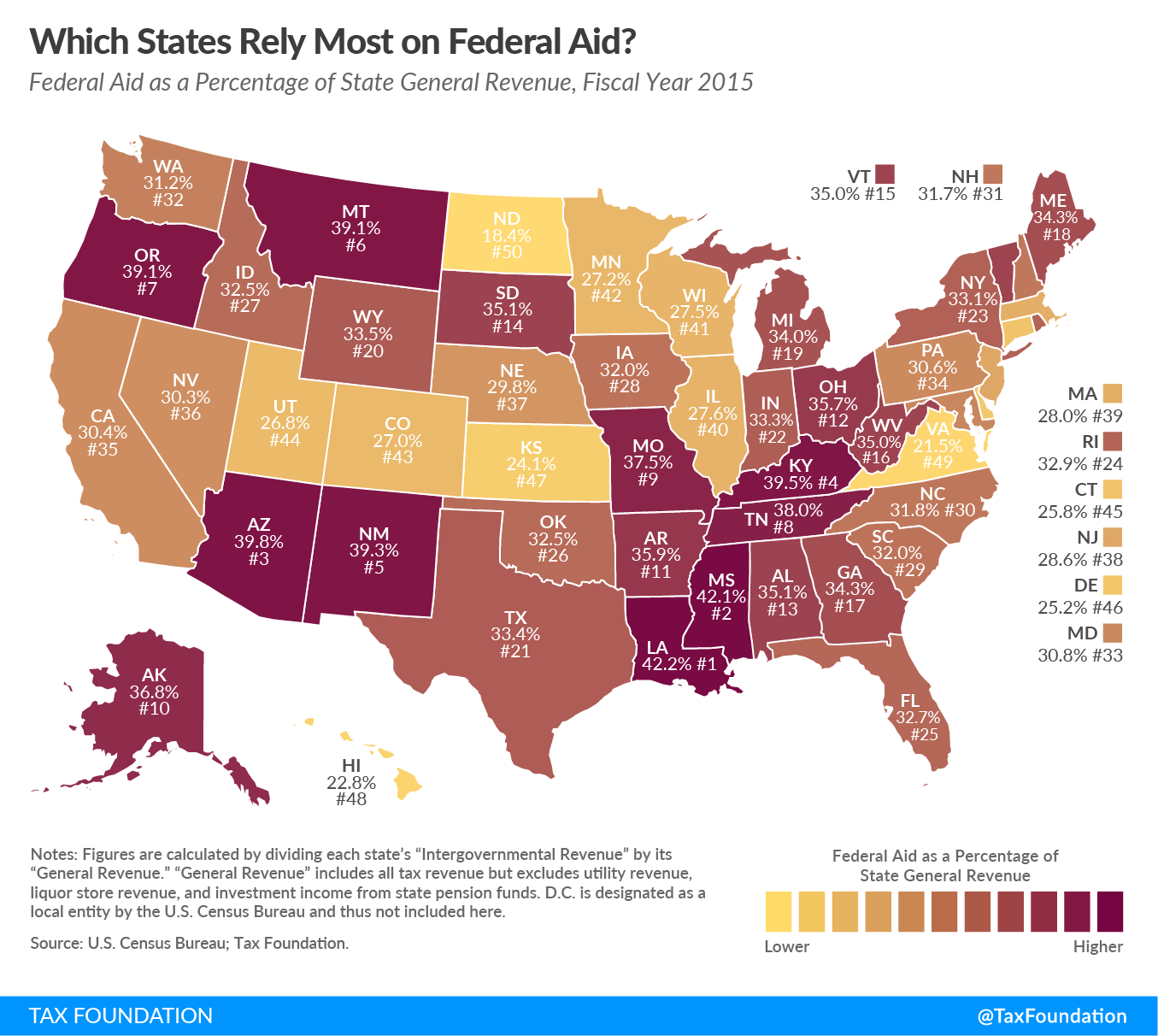

States differ in the amount of federal aid they receive. The top recipient of federal aid in FY 2015 was Louisiana, which relied on federal assistance for 42.2 percent of its revenue. Other states heavily reliant on federal assistance include Mississippi (42.1 percent), Arizona (39.8 percent), Kentucky (39.5 percent), and New Mexico (39.3 percent). As we have previously noted, these states, and others that rely heavily on federal assistance, tend to have modest tax collections and a relatively large low-income population.

Other states have comparatively low reliance on federal aid. North Dakota relies on federal assistance for only 18.4 percent of its general revenue. Other less-reliant states include Virginia (21.5 percent), Hawaii (22.8 percent), Kansas (24.1 percent), and Delaware (25.2 percent). Trends in these states are opposite those in federal aid-heavy states; they typically have higher tax revenues and a smaller low-income population. North Dakota is also able to export much of its tax burden, through severance taxes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe