Last week, we reviewed how states are conformed to the federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code for individual income. Many states use the federal tax code as the basis of their state individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. code, but even more states use the federal corporate tax code to form their state corporate income taxes.

For reasons of administrative simplicity, states frequently seek to conform many, though rarely all, elements of their state tax codes to the federal tax code. This harmonization of definitions and policies reduces compliance costs for individuals and businesses with liability in multiple states and limits the potential for double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of income. No state conforms to the federal code in all respects, and not all provisions of the federal code make for good tax policy, but greater conformity substantially reduces tax complexity and has significant value.

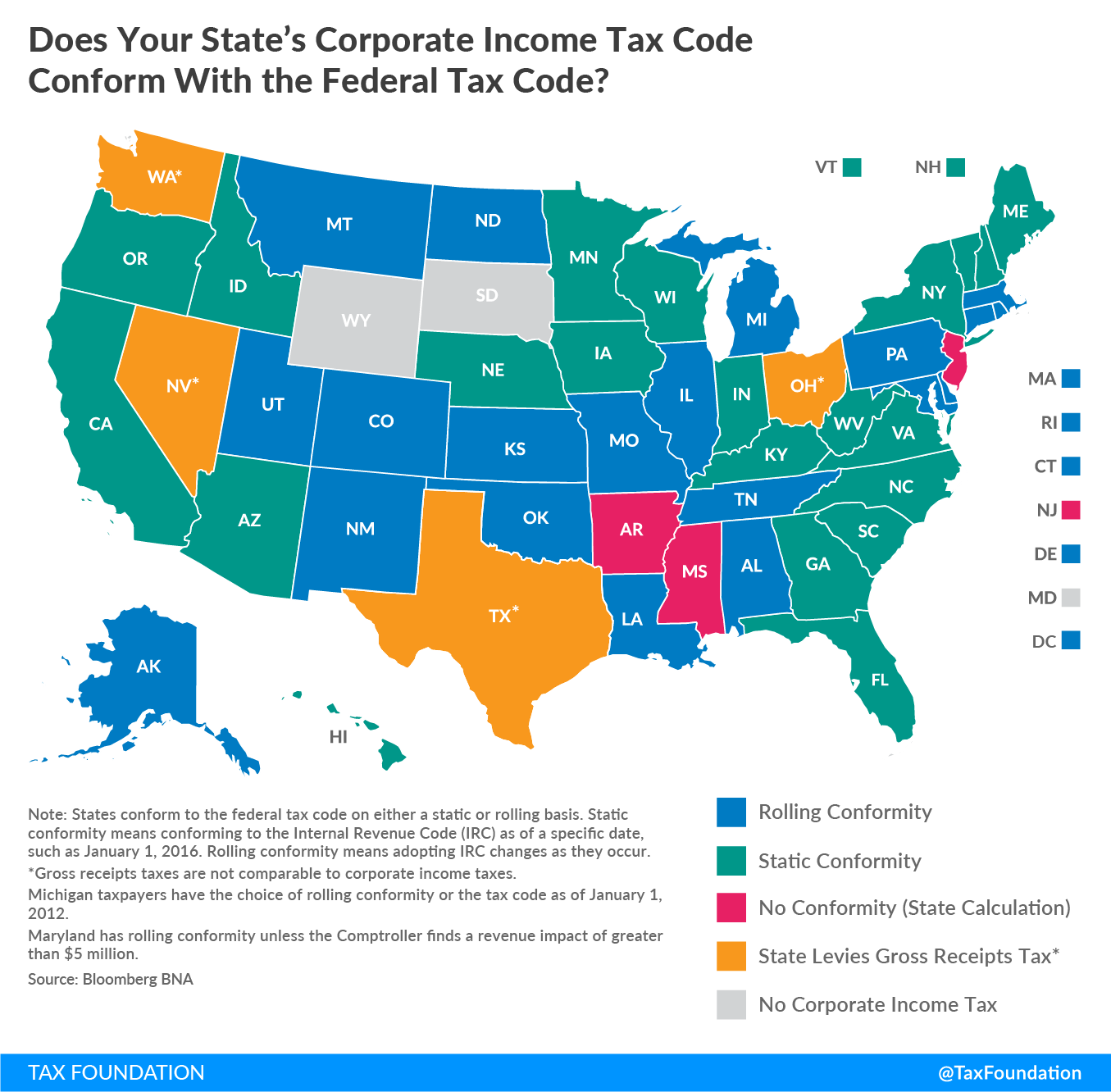

States conform to the Internal Revenue Code (IRC) for corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. calculations. (Last week’s map looked at individual income tax conformity.) States tend to conform to either taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. before net operating losses or taxable income after net operating losses. Forty-one states conform to one of these two definitions of income. Three states have their own calculations of income, and the remaining states either do not tax corporate income or impose a statewide gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding. (see map below).

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIn general, states are more conformed on corporate income than individual income, but even when conformed on the definition of level, many states decouple on other provisions. For instance, many states do not conform on the length of time that net operating losses can be carried forward or backward, but the majority of states do conform to federal Section 179 bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedules.

How states define their tax bases would matter a great deal for their revenue impacts under federal tax reform. For instance, the federal tax changes in the Tax Cuts and Jobs Act expand the base of taxable income in many different ways, such as limiting the deduction for net interest or the Section 199 domestic production deduction. The federal changes include rate cuts to offset the broader bases, but states set their tax rates independently. Absent state-level changes, states would have a much larger tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. without correspondingly lower rates, leading to higher state-level revenue.

A more detailed list on state conformity is available here.

Share