This month, New York Assemblywoman Linda Rosenthal (D) introduced A11123 which, if enacted, would increase the excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on ”other tobacco products” (including cigars) from 75 percent to 129 percent of wholesale value and the excise taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on vapor products from 20 percent to 48 percent of retail value.

Excise taxes on tobacco products are legitimate because these products cause negative externalities. For instance, some health-care costs of smoking are covered by government, i.e., secondhand smoke affects nonsmokers. Levying an excise tax allows a state to recover the costs related to these externalities—thereby internalizing them.

However, while these taxes can be legitimate, they should be carefully designed. Unfortunately, A11123 contains numerous design flaws.

The measure taxes vapor products and tobacco products based on price (ad valorem). This design results in inequitable treatment because products with similar qualities and in similar quantities should have equal tax liability regardless of design or price. Ad valorem taxes also incentivize downtrading, which is when consumers move from premium products to cheaper alternatives. Downtrading effects do not reduce harm and have no relation to any externalityAn externality, in economics terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either production or consumption of a good or service and can be positive or negative. the tax is seeking to capture.

A superior design would be a tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. d on volume, as volume is a better proxy for the harm associated with consumption (the negative externality). In addition to capturing the externality, it is the administratively simplest and most straightforward way for governments to tax a good as it does not require valuation and as such does not require expensive tax administration. Ad valorem taxes add unnecessary complexity to the system, which complicates enforcement. For instance, in vertically integrated companies (for example, those that are both manufacturers and wholesalers), taxable value must be computed to estimate tax liability. Making sure these companies’ internal prices (transfer pricing) are close to market value is an expensive and time-consuming effort for tax authorities.

Taxing based on quantity rather than value makes it easier for governments to forecast revenue as it is not affected by changes in consumer brand preference or retail prices. Simple taxes lower compliance costs and make it easier for tax authorities to enforce the tax.

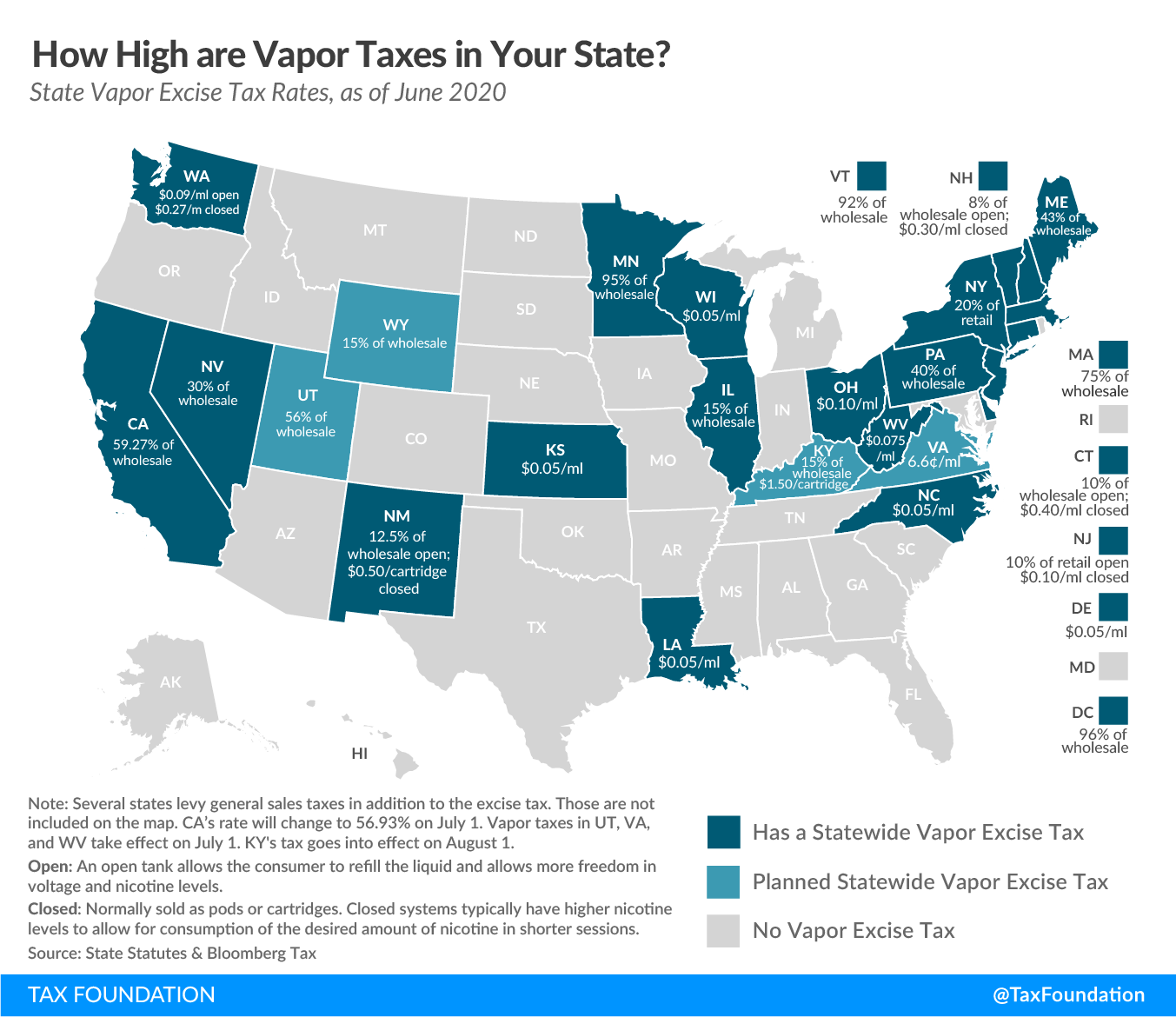

In addition to a non-neutral base, A11123 includes very high rates at 48 percent on vapor products and 129 percent on tobacco products other than cigarettes. While excise taxes on tobacco products are legitimate, it is hard to justify tobacco taxes at punitive rates above 100 percent. Although several states have higher statutory rates on vapor products, most levy these taxes at the wholesale level. New York would be levying a tax at the retail level, which means, even with a lower rate, it would be among the highest effective rates nationwide.

New York already suffers from significant smuggling of untaxed tobacco products—smuggled cigarettes accounted for 53 percent of cigarettes consumed in the state in 2018—and further increasing tobacco taxes is likely to make matters worse. This would offset some of the revenue gains from the increase. Further offsetting gains is New York’s flavor ban on vapor products.

The proposal does seem to respect the harm reduction principle, recognizing the benefit of consumers switching from more harmful cigarettes to less harmful vapor products. To encourage harm reduction, the products should be taxed relative to harm. Thus, excise taxes on vapor products should be relatively low compared to those on combustible tobacco products as cigarettes and vapor products are economic substitutes, meaning increased prices on either may encourage consumers to switch to the other.

As a final note, the legal market suffers when taxes are too high. Untaxed and unregulated products—which often carry unique dangers—get a significant competitive advantage over higher-priced legal products. This would impact the large number of small business owners operating thousands of vape and tobacco shops in New York as well as convenience stores and gas stations relying heavily on vapers as well as tobacco sales. Policymakers should not lose sight of the law of unintended consequences as they set rates and regulatory regimes for tobacco and vapor products alike.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe