Last week, I wrote about the latest corporate depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. statistics from the IRS and what they can tell us about the effects of bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. . Today, I’ll use the same dataset to discuss the effects of Section 179, another provision in the tax code that allows companies to deduct the costs of investment immediately.

At first glance, Section 179 looks like a much more powerful taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. provision than bonus depreciation. While bonus depreciation allows businesses to immediately deduct 50 percent of the cost of qualified investments, Section 179 lets businesses deduct 100 percent of the cost of qualified investments immediately. And, while bonus depreciation generally only applies to investments in equipment and software, Section 179 applies to some structures as well.

However, Section 179 is subject to two strict limitations. First, companies are only allowed to deduct $500,000 of Section 179 investments each year. Second, companies with more than $2,000,000 of qualified investments are required to reduce their Section 179 deduction for each additional dollar of qualified investments they make, meaning that a company with more than $2,500,000 in investments cannot receive any Section 179 deduction. These two limitations were designed to insure that Section 179 would only benefit small businesses.

As a result, bonus depreciation is a more widely available provision than Section 179, and costs the federal government more each year. According to the Joint Committee on Taxation, bonus depreciation would cost the federal government $90 billion in 2016, while Section 179 would cost around $22 billion.[1]

The most recent depreciation statistics from the IRS allow us to examine how Section 179 affects different sectors of the U.S. economy. As noted in last week’s post, these statistics only apply to American corporations; they leave out pass-through businesses, such as S corporations and partnerships. As a result, because most small businesses are not corporations, these statistics only capture a portion of the effects of Section 179.

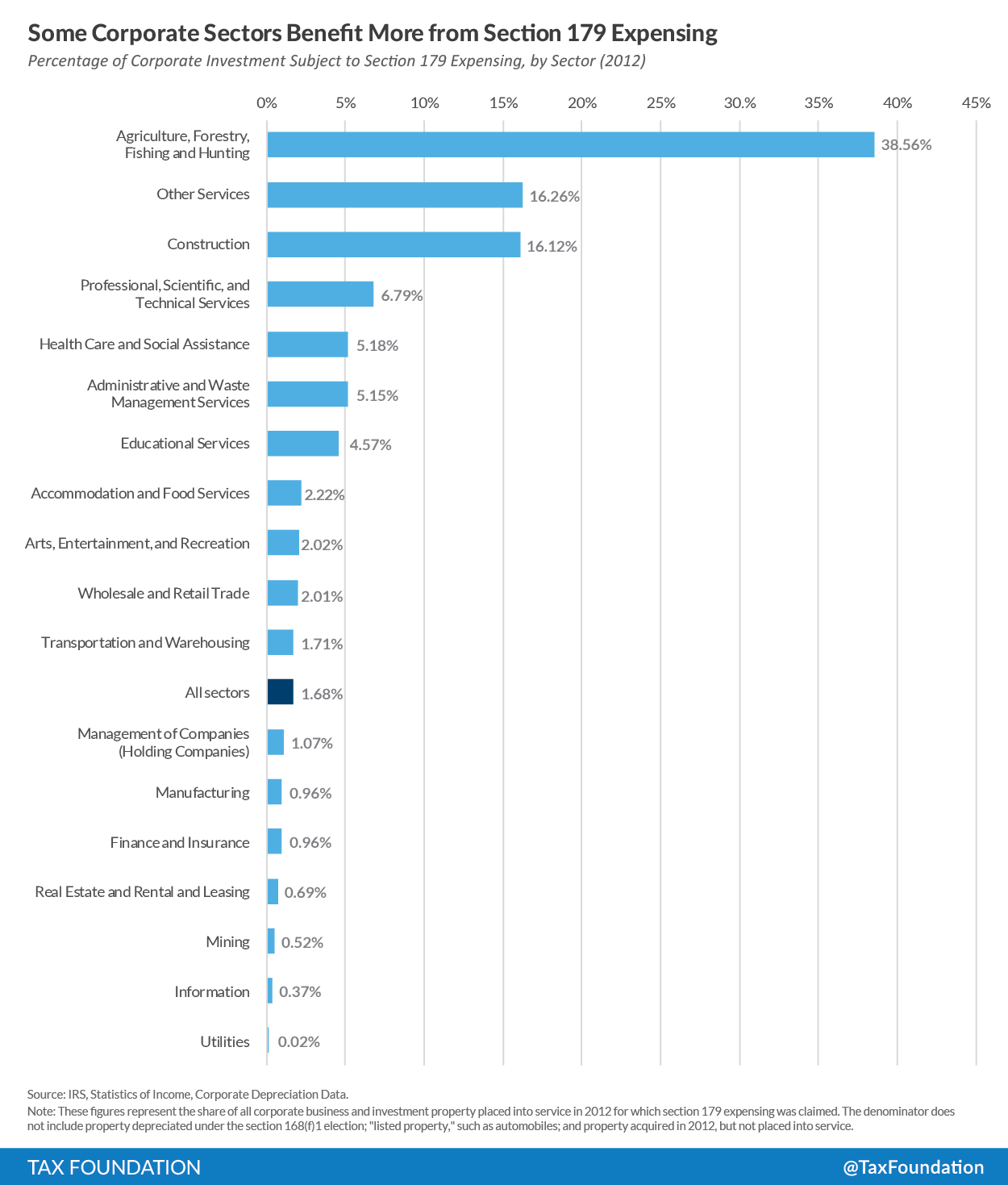

Overall, in 2012, about $11.9 billion of corporate investment was subject to Section 179. This represents 1.68 percent of the $705 billion of new corporate investment in 2012. Because of Section 179, corporations were able to deduct the full cost of this investment immediately.

As the graph above shows, the availability of Section 179 varies widely by industry. Corporations in the utilities sector only applied Section 179 to 0.02 percent of investments. Meanwhile, “Agriculture, Forestry, Fishing, and Hunting” corporations were able to apply Section 179 to 38.56 percent of their investments.[2]

Why is this the case? A quick glance at other corporate statistics reveals why: corporate investment in the “Agriculture, Forestry, Fishing, and Hunting” sector is heavily weighted towards small businesses, who are able to claim the Section 179 deduction. In other industries, corporate investment is more likely to come from large corporations that are ineligible for the Section 179 deduction.

|

Percentage of All Corporate Depreciation Claimed, by Size of Corporate Receipts, 2012 |

||

|

Agriculture, Forestry, Fishing, and Hunting |

Utilities |

|

|

Under $25,000 |

15.55% |

0.03% |

|

$25,000 to $100,000 |

2.34% |

0.01% |

|

$100,000 to $250,000 |

4.02% |

0.03% |

|

$250,000 to $500,000 |

7.16% |

0.04% |

|

$500,000 to $1,000,000 |

9.19% |

0.03% |

|

$1,000,000 to $2,500,000 |

19.27% |

0.09% |

|

$2,500,000 to $5,000,000 |

9.93% |

0.10% |

|

$5,000,000 to $10,000,000 |

8.08% |

0.24% |

|

$10,000,000 to $50,000,000 |

8.92% |

0.76% |

|

$50,000,000 to $100,000,000 |

3.44% |

0.49% |

|

$100,000,000 to $250,000,000 |

4.52% |

1.16% |

|

Over $250,000,000 |

7.59% |

97.02% |

|

Source: IRS Statistics of Income, Corporation Complete Report, Table 5 |

As the above table shows, corporate investment in the “Agriculture, Forestry, Fishing, and Hunting” sector is likely to come from small businesses. 15.55 percent of all investment deductions claimed in this sector from corporations with under $25,000 in revenue. Only 7.59 percent came from corporations with over $250 million in receipts. On the other hand, investment by utilities corporations is much more likely to come from large businesses. Only 0.03 percent of corporate investment deductions in the utilities sector came from businesses with under $25,000 in receipts, while 97.02 percent came from businesses with over $250 million.

To summarize, the latest statistics confirm that Section 179 does, in fact, offer larger benefits to small businesses; the corporate sectors that make the greatest use of it are the ones dominated by small companies. (In all likelihood, this conclusion would be even clearer if the data included all businesses, not just corporations.)

All of these statistics are important because, without Congressional action, the current parameters of Section 179 will expire. The tax extenders bill, a package of temporary provisions that have been renewed year after year, sets the maximum value of Section 179 at $500,000 and the investment limitation at $2,000,000. If Congress does not renew the tax extenders by the end of the year, the maximum value of the deduction will fall to $25,000 and the investment limitation will fall to $200,000; this would effectively kill the Section 179 deduction for many small businesses.

Ideally, all business investments would be given the same treatment as Section 179 and businesses would be able to deduct all investment costs in the year that they occur. But until the U.S. tax code adopts this ideal, Section 179 remains an important provision that allows some businesses to deduct investment costs as they occur. Lawmakers should carefully consider the consequences for small businesses and the U.S. economy before allowing the current parameters of Section 179 to expire.

[1] The Joint Committee on Taxation’s figure only includes the cost of extending the $500,000 expensing allowance and the $2,000,000 investment limitation, not the entire cost of Section 179. Without extension, these limits would drop to very low amounts: $25,000 and $200,000. Because of this, it is safe to assume that JCT’s estimate of $22 billion represents close to the full annual cost of Section 179.

[2] This data about Section 179 also helps clear up a few questions about the bonus depreciation statistics I wrote about on Friday. One reader asked me why “Agriculture, Forestry, Fishing, and Hunting” corporations only applied bonus depreciation to 24.8 percent of their investments – much lower than the national average of 67.2 percent. The Section 179 statistics tell the answer: these corporations are already expensing a significant portion of their investments under Section 179, making bonus depreciation a superfluous provision for them.