All Related Articles

New Research Shows Positive Long-Run Effects from Corporate Tax Cuts

Policymakers should continue to focus on longer term impacts rather than emphasizing the short-term stimulus effects of tax cuts.

3 min read

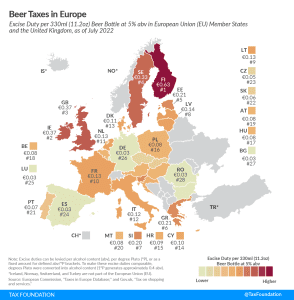

Beer Taxes in Europe, 2022

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read

How Tariffs and the Trade War Hurt U.S. Agriculture

With inflation continuing to skyrocket, especially for food, which reached 10.4 percent in June, it is worth examining how the ongoing U.S. trade war with China and U.S. tariff policy overall has impacted U.S. agriculture and food prices.

3 min read

Three Questions on Pillar One

While the global minimum tax gets much attention in the media, there is another significant piece to the deal.

6 min read

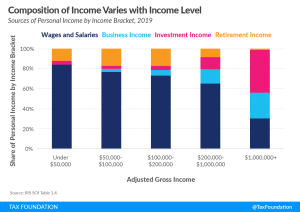

Sources of Personal Income, Tax Year 2019

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

Lithuanian Model Could Help French Workers’ Upward Mobility

Reshaping some of these policies to generate a smoother variation of marginal tax rates over different income levels would likely raise labor supply and encourage the upward mobility of workers and especially that of average-income workers.

5 min read

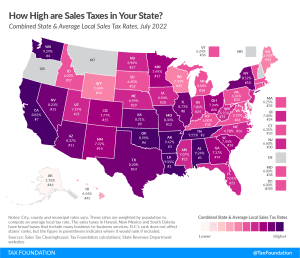

State and Local Sales Tax Rates, Midyear 2022

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

Biden and OECD Tax Proposals Would Hurt FDI

Academic research indicates foreign direct investment (FDI) is highly responsive to the corporate effective tax rate (ETRs); that is, the tax rate after accounting for all deduction and credits available to corporations.

3 min read

Pennsylvania Cuts Corporate Net Income Tax Rate

Policymakers from both parties in Harrisburg have proposed reducing Pennsylvania’s 9.99 percent corporate net income tax (CNIT) rate but could not agree on an approach—until now. With the enactment of HB 1342 lawmakers finally succeeded in cutting what had been the second highest state corporate tax rate in the nation.

7 min read