Trump Tariffs: Tracking the Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

36 min read

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

36 min read

Instead of doubling down on a shrinking tax base, Ohio lawmakers should instead look towards tax solutions that secure the state’s long-term fiscal health.

4 min read

From generous tax breaks to costly trade-offs, the House GOP’s One, Big, Beautiful Bill has a little of everything. It’s a sweeping attempt to extend key provisions of the 2017 Tax Cuts and Jobs Act before they expire in 2026—but what’s actually in it?

Between Russia’s war in Ukraine, President Trump’s uncertain policies towards Europe, and Poland’s attempt to increase domestic defense capabilities, raising revenue has become one of the most critical topics in the campaign.

7 min read

It’s been a whirlwind 24 hours in tariff news: first, a trade court blocked Trump’s sweeping new tariffs, calling them executive overreach. Then, a federal appeals court reinstated them—at least for now. We break down what happened, what’s next, and why it matters.

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

The House reconciliation bill includes numerous changes to the tax code: good, bad, and ugly. However, the new corporate alternative minimum tax, or CAMT, goes largely untouched.

4 min read

Florida’s latest property tax debate highlights the familiar challenge of prioritizing pro-growth tax policy while tackling rising property tax burdens.

6 min read

The EV fee in the reconciliation package would help the fiscal situation but would overcorrect the hole in the gas tax base EVs create. There are intermediate options, such as VMT taxes for EVs and commercial traffic or pairing flat EV fees with gas and diesel tax increases, that would be incrementally better than the reconciliation package’s approach.

7 min read

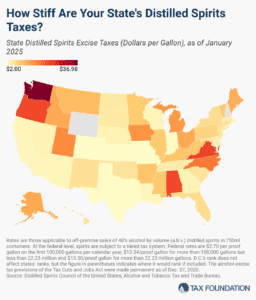

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits.

6 min read