A Big-Picture Look at Taxing the Wealthy

Taxing wealth has become a hot-button issue in today’s political discourse, promising to reshape economic equality. But what are the real-world implications of such policies?

Taxing wealth has become a hot-button issue in today’s political discourse, promising to reshape economic equality. But what are the real-world implications of such policies?

Many developed countries have repealed their wealth taxes in recent years for a variety of reasons. They raise little revenue, create high administrative costs, and induce an outflow of wealthy individuals and their money. Many policymakers have also recognized that high taxes on capital and wealth damage economic growth.

30 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

8 min read

Given the positive contribution of full expensing to economic growth and that the UK already incurred the peak-year costs due to the existing policy, it is imperative to maintain it permanently.

5 min read

Portland residents face some of the country’s highest taxes on just about every class of income. In an era of dramatically increased mobility for individuals and businesses alike, that’s not a recipe for success.

11 min read

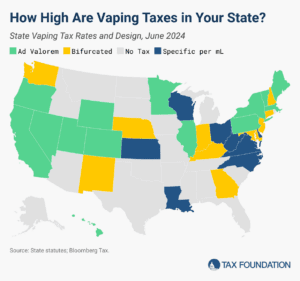

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

4 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

The government won in Moore. However, given the narrow opinion of the court and the reasoning in the Barrett concurrence and the Thomas dissent, it seems likely that future rulings under other facts and circumstances could favor taxpayers instead.

7 min read

Adopting tax policy based on sound principles like neutrality rather than political expediency is essential for the European Union’s fiscal future.

5 min read