All Related Articles

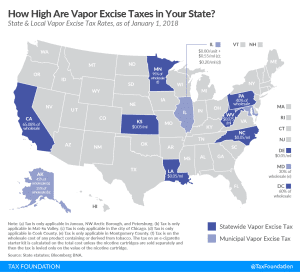

Vaping Taxes by State, 2018

A variety of taxing methods and a wide range of rates indicates that there is little consensus on the best way to levy vapor taxes in the U.S.

3 min read

Gross Receipts Taxes in the Marijuana Industry Found to Cause Distortionary Effects

States considering legalizing and taxing marijuana should pay attention to natural experiments occurring in states across the country.

4 min read

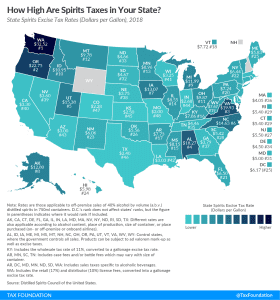

Distilled Spirits Taxes by State, 2018

2 min read

Governor Dayton’s Budget Proposal: Some Pro-Growth Provisions, but Misses the Mark on Others

The proposal includes some good reforms, including conforming to the federal full expensing provision, but also rolls back some recent positive changes.

2 min read

Facts and Figures 2018: How Does Your State Compare?

Facts and Figures is a one-stop data resource comparing the 50 states on over 40 measures of individual and corporate income taxes, sales taxes, excise taxes, property taxes, business tax climates, and more.

1 min read

Proposed Chinese Tariffs Will Raise Taxes Following a Large Tax Cut

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read