All Related Articles

9225 Results

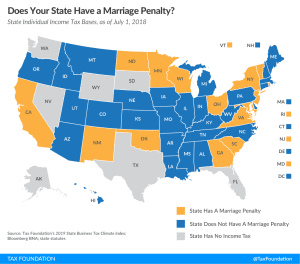

Does Your State Have a Marriage Penalty?

1 min read

A Wave of Digital Taxation

9 min read

Results of 2018 State and Local Tax Ballot Initiatives

Ballot initiatives are often an afterthought on Election Day, but in many states, voters went to the polls to weigh in on significant tax policy questions. Here are the most recent results we’ve compiled for tax-related ballot measures.

5 min read