Comparing Wealth Taxation and Income Taxes

A low wealth tax rate is equivalent to a high-rate income tax. The interaction between wealth taxes and the existing income taxes must be considered when analyzing a wealth tax plan.

6 min read

A low wealth tax rate is equivalent to a high-rate income tax. The interaction between wealth taxes and the existing income taxes must be considered when analyzing a wealth tax plan.

6 min read

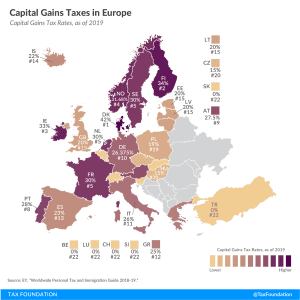

Biden, Sanders, and Warren have staked out similar plans to increase capital gains taxes on the wealthiest Americans. While all three candidates have called for taxing capital gains at ordinary income rates, the phase-in levels and top marginal tax rates vary.

5 min read

The tax base for the income-inclusion rule will be just as important as determining the rate, and both the base and the rate will likely impact business decisions. Additionally, policymakers need to determine how the choice for blending fits with the overarching goal of the policy. And as the example of GILTI shows, it is essential to assess how current international tax regulations would interact with a global minimum tax.