GILTI of Neglecting Losses

As lawmakers are reviewing international tax rules and determining what to change and update, they should pay attention to the way GILTI interacts with profitable and loss-making companies.

5 min read

As lawmakers are reviewing international tax rules and determining what to change and update, they should pay attention to the way GILTI interacts with profitable and loss-making companies.

5 min read

The six counties with the highest median property tax payments all have bills exceeding $10,000—Bergen, Essex, and Union Counties in New Jersey, and Nassau, Rockland, and Westchester counties in New York. All six are near New York City, as is the next highest, Passaic County, New Jersey ($9,881).

3 min read

How should policymakers view crypto? How big is the issue of tax evasion in the cryptocurrency market and what can realistically be done to curb it? Is it possible to design a rational tax system around what, at times, can appear to be a less-than-rational market and, if so, what should it look like?

While the excise tax penalty in H.R. 3 is referred to as a 95 percent tax rate, it actually amounts to a 1,900 percent tax rate because of how the proposal defines the tax base. In other words, under the H.R. 3 tax penalty, a drug that sells for $100 would incur a $1,900 tax.

3 min read

To tackle problems of homelessness and housing costs, Senator Ron Wyden (D-OR) has released a major tax proposal, the Decent Affordable Safe Housing (DASH) For All Act. Several of Wyden’s proposals are also components of the Biden administration’s infrastructure agenda, with a large focus on tax credits designed to either incentivize new housing or directly reduce rent burdens.

5 min read

Temporary policy creates uncertainty for taxpayers and scheduling more expirations will add to the already-expiring provisions under the Tax Cuts and Jobs Act (TCJA) of 2017.

3 min read

Increasing tax compliance is a major part of the Biden administration proposal to raise revenue for physical and social infrastructure. Reducing the tax gap—the difference between taxes owed and taxes paid—is a good way to raise revenue, but it doesn’t come without trade-offs, and it’s important to go about it in the right way.

3 min read

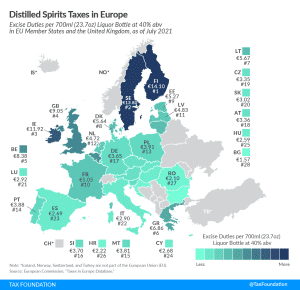

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min read

While arcane, expense allocation rules are relevant to current debates because they result in a heavier tax burden for U.S. companies under current law than the recently negotiated global minimum tax proposal.

10 min read