A Road Map to Recreational Marijuana Taxation

As more states consider legalization of recreational marijuana, lawmakers should take note of the experiences of the states already allowing legal sales and consumption.

66 min read

As more states consider legalization of recreational marijuana, lawmakers should take note of the experiences of the states already allowing legal sales and consumption.

66 min read

The digitalization of the economy has been a key focus of tax debates in recent years. Our new report reviews digital tax policies around the world with a focus on OECD countries, explores the various flaws and benefits associated with the wide set of proposals, and provides recommendations for lawmakers to consider.

12 min read

A digital services tax like the one implemented by France likely violates both the General Agreement on Trade in Services and a model U.S. free trade agreement. However, it is uncertain whether meaningful relief could be obtained under either regime.

26 min read

Improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures.

13 min read

The COVID-19 pandemic and accompanying economic downturn will wreak havoc on state and local tax revenues, with projections of a 15-20 percent decline in state revenues. Our new report provides a framework for how to design an effective state and local relief package.

35 min read

Policymakers will have to consider design options for accelerating NOL deductions to ensure the refunds are simple, provide targeted relief to struggling firms, and are consistent with long-run revenue needs.

17 min read

We examine whether excise taxes are a solution to budget deficits, and while the short answer to that question is no, there are of course nuances. Excise taxes can play a role in state revenues even as policymakers appreciate that excise taxes are not viable long-term revenue tools for general spending priorities.

21 min read

The Child Tax Credit (CTC) is a partially-refundable tax credit available to parents with qualifying dependents under the age of 17. Like other tax credits, the CTC reduces tax liability dollar-for-dollar of the value of the credit.

25 min readState revenue stabilization funds, often called rainy day funds, are better funded now than they were at the start of the Great Recession and can be a valuable tool as states face a sharp pandemic-linked economic contraction.

18 min read

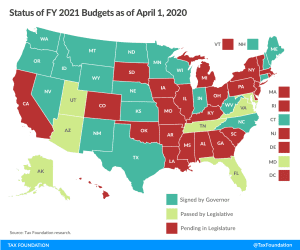

State options for closing FY 2020 shortfalls are limited and may ultimately include drawing on reserve funds and even accounting tricks

16 min read