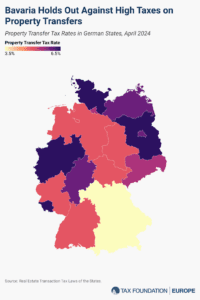

Real Estate Transaction Tax Rates in German States

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

3 min read