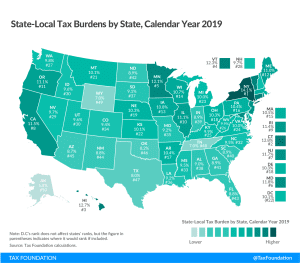

State and Local Tax Burdens, Calendar Year 2019

New Yorkers faced the highest burden, with 14.1 percent of income in the state going to state and local taxes. Connecticut (12.8 percent) and Hawaii (12.7 percent) followed.

19 min read

New Yorkers faced the highest burden, with 14.1 percent of income in the state going to state and local taxes. Connecticut (12.8 percent) and Hawaii (12.7 percent) followed.

19 min read

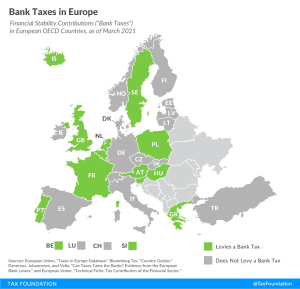

Today’s map shows which European OECD countries implemented financial stability contributions (FSCs), commonly referred to as “bank taxes.”

2 min read

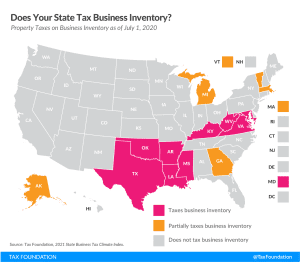

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

3 min read

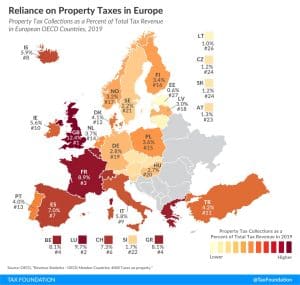

Property taxes are levied on the assets of an individual or business. There are different types of property taxes, with recurrent taxes on immovable property (such as property taxes on land and buildings) the only ones levied by all countries covered. Other types of property taxes include estate, inheritance, and gift taxes, net wealth taxes, and taxes on financial and capital transactions.

1 min read

Moving away from state gross receipts taxes would represent a pro-growth change to make the tax code friendlier to businesses and consumers alike, which is especially necessary in the wake of the coronavirus pandemic.

3 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

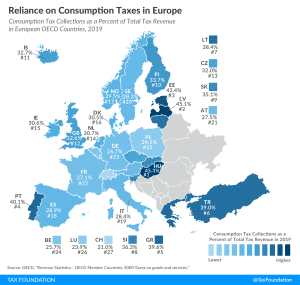

Hungary relies the most on consumption tax revenue, at 45.3 percent of total tax revenue, followed by Latvia and Estonia at 45.1 percent and 42.4 percent, respectively.

2 min read

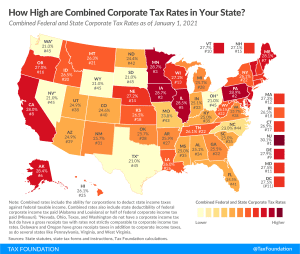

The state with the highest combined corporate income tax rate is New Jersey, with a combined rate of 30.1 percent. Corporations in Alaska, California, Illinois, Iowa, Maine, Minnesota, and Pennsylvania face combined corporate income tax rates at or above 28 percent.

3 min read

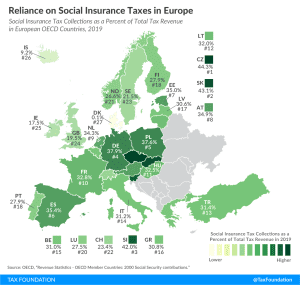

Social insurance taxes are the second largest tax revenue source in European OECD countries, at an average of 29.5 percent of total tax revenue.

2 min read

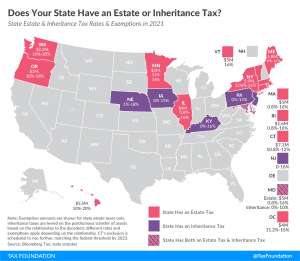

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Twelve states and Washington, D.C. impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness.

3 min read