A Better Way to Tax Stock Buybacks

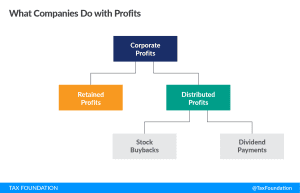

The distributed profits tax is a sounder approach to concerns about investment and stock buybacks than the existing policy approach.

6 min read

The distributed profits tax is a sounder approach to concerns about investment and stock buybacks than the existing policy approach.

6 min read

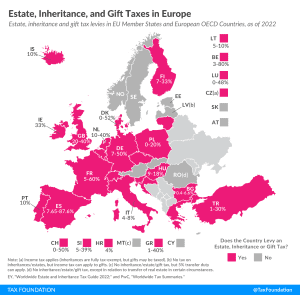

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

3 min read

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

9 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

Consistent principles ought to apply across the tax code. In the case of intangible drilling costs, companies should be able to claim full deductions for the costs they incur.

4 min read

Michiganders will pay a lower individual income tax rate next year thanks to high general fund revenues, but these savings may be short-lived following an opinion released by the state’s attorney general.

7 min read

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 21 states have implemented legislation to legalize and tax recreational marijuana sales.

6 min read

While the IRS hopes to increase revenue collection and minimize additional burdens on taxpayers, uncertainty remains regarding its ability to deliver, particularly on the latter. Furthermore, some concerns about the original funding package are already surfacing, specifically around insufficient funding for taxpayer services.

6 min read

The Portuguese government has introduced plans to exempt “essential” food items from its value-added tax (VAT) in response to the recent inflation spike. While this may sound like a reasonable measure on the surface, it comes with numerous unintended consequences that compromise its effectiveness.

4 min read