All Related Articles

Trump’s “No Tax on Social Security” Proposal Is Unsound and Fiscally Irresponsible

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read

How Are Olympians and Attendees Taxed?

The 2024 Summer Olympics are underway, drawing the attention of billions and continuing a tradition dating back thousands of years. But you know what else originated thousands of years ago and affects even more people? Taxes.

3 min read

Pillar Two: Electric Boogaloo

The global tax deal and Pillar Two are shaking up the tax landscape worldwide, introducing a web of complexity and confusion.

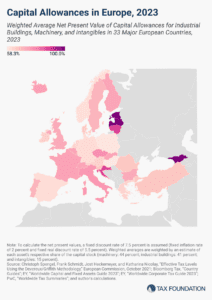

Capital Allowances in Europe, 2024

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

Good Policy Leads to More Tax Cuts for West Virginia

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

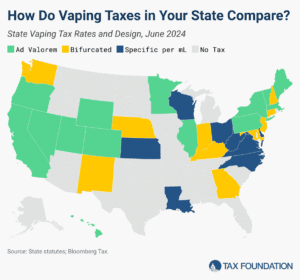

Current Challenges in Vaping Markets

As much as 98 percent of vaping products sold in the US are illicit. Most states levy an excise tax on vaping products, but these tax systems vary substantially. The result is a messy tax system covering largely illicit products, and no one knows whether taxes are being collected and remitted on most products sold nationwide.

7 min read

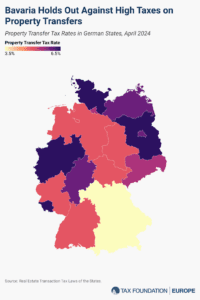

Real Estate Transaction Tax Rates in German States

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

3 min read

Where Does Kamala Harris Stand on Taxes?

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read