All Related Articles

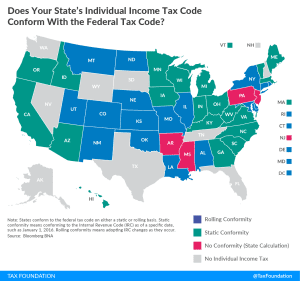

Does Your State’s Individual Income Tax Code Conform with the Federal Tax Code?

As the federal government continues to debate tax reform, states, and many taxpayers, are asking an important question: How is my state’s tax code impacted? The exact impacts won’t be known until the federal bill is finalized, but a good place to start is understanding the issue of conformity.

2 min read

Measuring Marginal Tax Rate on Capital Assets

This study demonstrates how Tax Foundation’s TAG model calculates the weighted average METRs for different capital assets in the corporate and noncorporate sectors. The high marginal rates of up to 53 percent in the corporate sector illustrate why there is an urgent need for business tax reform.

12 min read

High-Tax States are Inconsistent on the State and Local Tax Deduction

If the state and local tax deduction is necessary to prevent double taxation, why don’t states offer a deduction for federal and local taxes?

2 min read

Property Taxes in Arkansas

As Arkansas considers tax reform, expanding or increasing the state’s property tax, if used to finance other tax changes, would be worth exploring.

7 min read