All Related Articles

Legislation Introduced to Cancel R&D Amortization

Canceling the amortization of research and development costs would reduce federal revenue, but policymakers have a variety of options to offset the costs.

3 min read

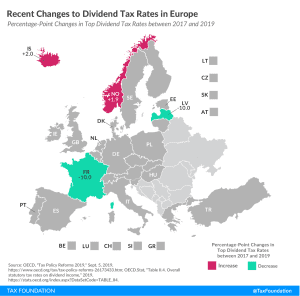

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read

Booker’s Plan to Eliminate Step-up in Basis and Expand the Estate Tax

Removing step-up in basis would encourage taxpayers to realize capital gains and it would plug a hole in the current income tax, while increasing federal revenue. Combined, however, with the estate tax, this would result in a significant tax burden on certain saving by requiring both the appreciation in and total value of transferred property to be taxed at death

2 min read

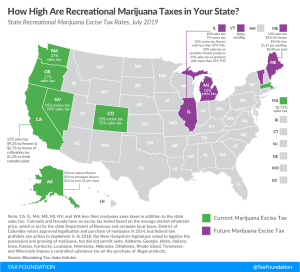

Marijuana Revenues Could Take a Hit

3 min read

Senator Sanders Proposes a Tax on “Extreme” Wealth

Bernie Sanders recently became the second major Democratic presidential candidate to propose a wealth tax.

2 min read

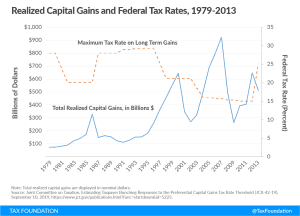

JCT Report Shows Capital Gains are Sensitive to Taxation

JCT’s report on capital gains elasticities reminds us that capital gains realizations, at least under a tax system that allows deferral, are sensitive to tax rates. Moving to mark-to-market taxation of all capital gains would remove this sensitivity by taxing capital gains annually.

4 min read