State Tax Changes Taking Effect January 1, 2024

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

An alcohol by volume (ABV) tax could replace the existing alcohol tax system. An ABV tax would make alcohol taxes simpler, more transparent, and substantially more neutral than the current system.

18 min read

Marijuana taxation is one of the hottest policy issues in the United States. Twenty-one states have implemented legislation to legalize and tax recreational marijuana sales.

16 min read

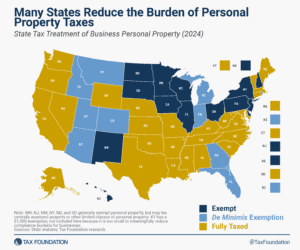

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

18 min read

While existing carbon taxes are a step towards the right direction in addressing climate change and incentivizing reductions in emissions, there is considerable room for improvement to reach the ideal theoretical carbon tax model.

59 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

The current patchwork of state laws taxing marketplace facilitators is complex, burdensome, and inefficient. States should work to resolve these issues and standardize the otherwise disparate requirements—with or without an inducement from Congress or the courts.

29 min read

The UK economy is experiencing an upsurge in business fixed investment following two pro-growth tax changes. In the second quarter of 2023, business investment was 9.4 percent higher than the same quarter last year.

10 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read