To What Extent Does Your State Rely on Individual Income Taxes?

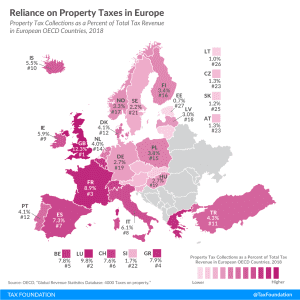

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read