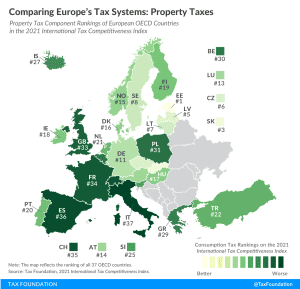

Comparing Europe’s Tax Systems: Property Taxes

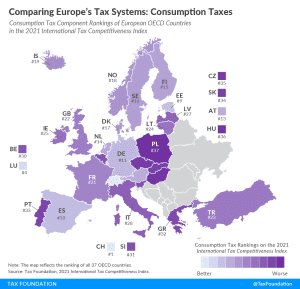

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read