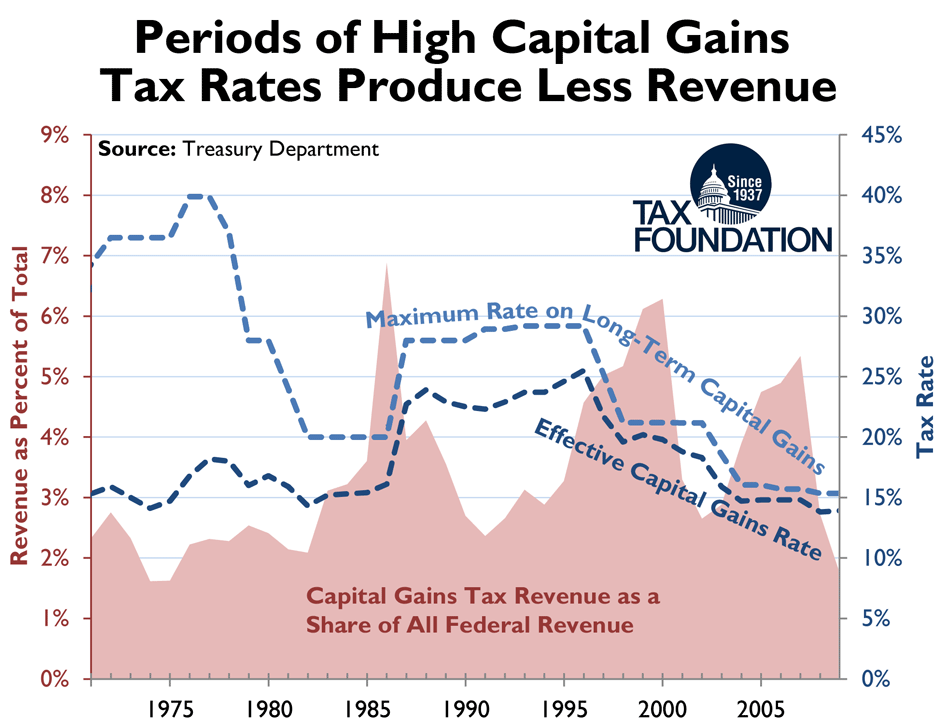

Bill Clinton’s speech last night reminded Americans of the many good things that happened while he was in office, including a booming economy, robust job growth, and budgetary surpluses beginning in 1997. Not so coincidentally, 1997 was the year that Bill Clinton, along with House and Senate Republicans, lowered the capital gains tax rate from 28 percent to 20 percent. The figure below tells what happened next. Capital gains revenues doubled, both in nominal terms and as a share of all federal revenues, between 1996 and 2000. To no small degree, this surge in capital gains revenue made possible Bill Clinton’s balanced budgets.

Certainly, the dot com bubble was a factor as well, but when looking at longer periods of time it remains the case that there is a Laffer Curve effect when it comes to capital gains, i.e. lower rates produce more revenue. When the capital gains rate was 28 or 29 percent between 1987 and 1996, capital gains tax revenue averaged 3.33 percent of total federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue. Since that time, while the rate came down to 20 percent in 1997 and then 15 percent in 2003, capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. revenue has increased to an average of 4.21 percent of federal revenue. This is partly because capital gains income is relatively easy to shield from taxes, either by holding on to the asset until tax rates come down or by passing it on to heirs.

I discuss this result more in depth in my latest report comparing the Obama and Romney tax plans. While Bill Clinton vigorously defended Obama’s policies, Obama’s proposed tax rates on capital gains would exceed Clinton’s. Obama is calling for a “Buffett Rule” minimum tax of 30 percent for millionaires, which effectively brings the top rate on capital gains up to 30 percent since millionaires get much of their income from capital gains. The last time the rate was that high was under Jimmy Carter.

Likewise, Obama is outdoing Clinton on dividend taxes, due to the Obamacare investment tax of 3.8 percent on top of the repeal of the Bush tax cuts. The last time the dividend tax was this high was prior to the Reagan Tax Reform of 1986.

|

Beyond Bill Clinton |

||

|

Clinton |

Obama |

|

|

Top Marginal Rate on Personal Income |

39.6% |

39.6% |

|

Top Marginal Rate on Long Term Capital Gains |

20.0% |

30%* |

|

Top Marginal Rate on Dividends |

39.6% |

43.4%** |

|

* Based on the “Buffett Rule” minimum tax of 30%. |

||

|

** Includes the 3.8% investment tax under the Affordable Care Act. |

Follow William McBride on Twitter @EconoWill

Share this article