Much has been made recently about the stock buybacks that companies have engaged in since the enactment of the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act (TCJA). To critics of the tax plan, stock buybacks are a sign that companies are not using the tax savings to either increase worker wages or to invest in new plants and equipment. My colleagues and others have written that stock repurchase is simply another way in which companies can return profits to shareholders, much like paying dividends.

While the TCJA seems to have made stock buybacks a political issue, little attention has been paid to whether companies are repurchasing more of their own stock today than in past years. That is why an article last week in The Wall Street Journal, “Record Buybacks Help Steady Wobbly Market” (under a paywall), caught my attention.

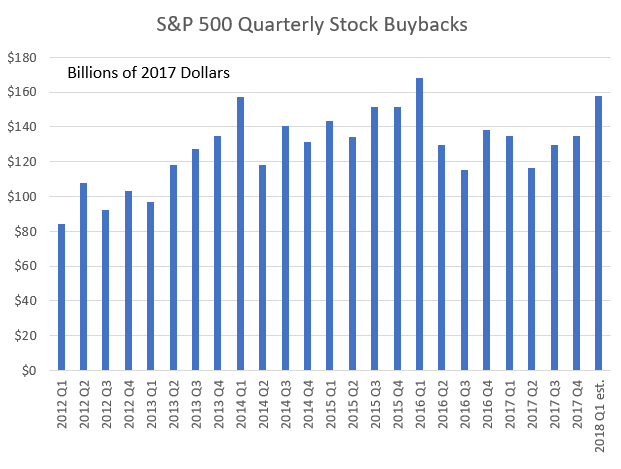

Despite the headline, the actual data contained in the chart accompanying the article shows that stock repurchases by S&P 500 firms in the first quarter of 2018 are on par with past peaks over the past six years.

We’ve re-created The Wall Street Journal chart in full, except that we adjusted the figures for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. . The Wall Street Journal, using S&P Dow Jones data, estimates that companies repurchased $158 billion worth of their own stock during the first quarter of 2018. However, this estimate includes only 85 percent of companies, so the final total could end up being much higher.

However, if we look at the quarterly data since 2012, we can see that there have been a number of quarters that are comparable to the first quarter of 2018. Indeed, during the first quarter of 2014, companies repurchased $157 billion in their own stock (in 2017 dollars), roughly the same amount as the first quarter of this year. During the full year 2014, companies repurchased $547 billion in their stock (in inflation-adjusted dollars).

The first quarter of 2016 saw an even bigger rush to stock buybacks. As the chart shows, companies repurchased $168 billion in their own stock that first quarter, and would go on to buy back $580 billion in stock that year.

If we look back over the past year – Q2 2017 to Q1 2018 – it does not appear that this period is at all abnormal compared to similar fourth-quarter periods. Over the past four quarters, companies purchased $538 billion in their own stock (although this figure could grow when all the companies report). By contrast, if we look at the four quarters ending in Q1 2014, companies had repurchased $538 billion in their own stock. During the same period ending in Q1 2015, companies had repurchased $533 billion worth of stock. And, for the same period ending in Q1 2016, companies had repurchased $605 billion worth of their own stock.

In other words, no matter how you look at the data it seems to show that the first quarter of 2018 is in no way an outlier when it comes to share repurchases by companies. What has changed is the political environment following the passage of the Tax Cuts and Jobs Act.

Source: Wall Street Journal, S&P Dow Jones Indices

Note: 2018 Q1 Includes only 85% of companies