Montana voters will decide on a Medicaid expansion ballot question, Initiative 185, on November 6 this year. The initiative would extend the expansion of Medicaid eligibility in the state and would pay for this expansion in part by increasing cigarette and other tobacco taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es. Medicaid was originally expanded just temporarily in Montana and is set to expire on July 1, 2019.

The tax increases in this initiative are projected to raise $74.3 million per year by 2023. They include:

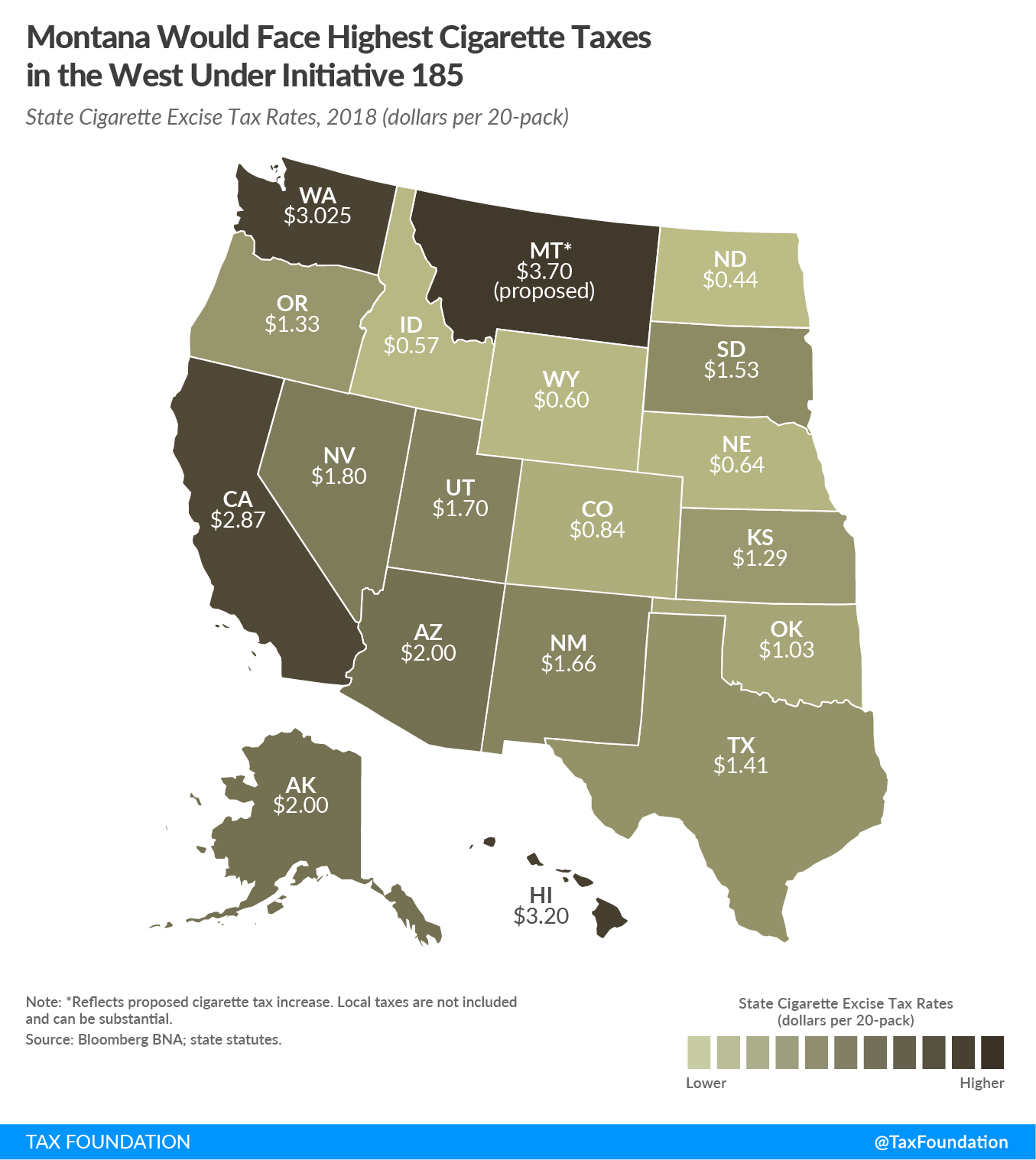

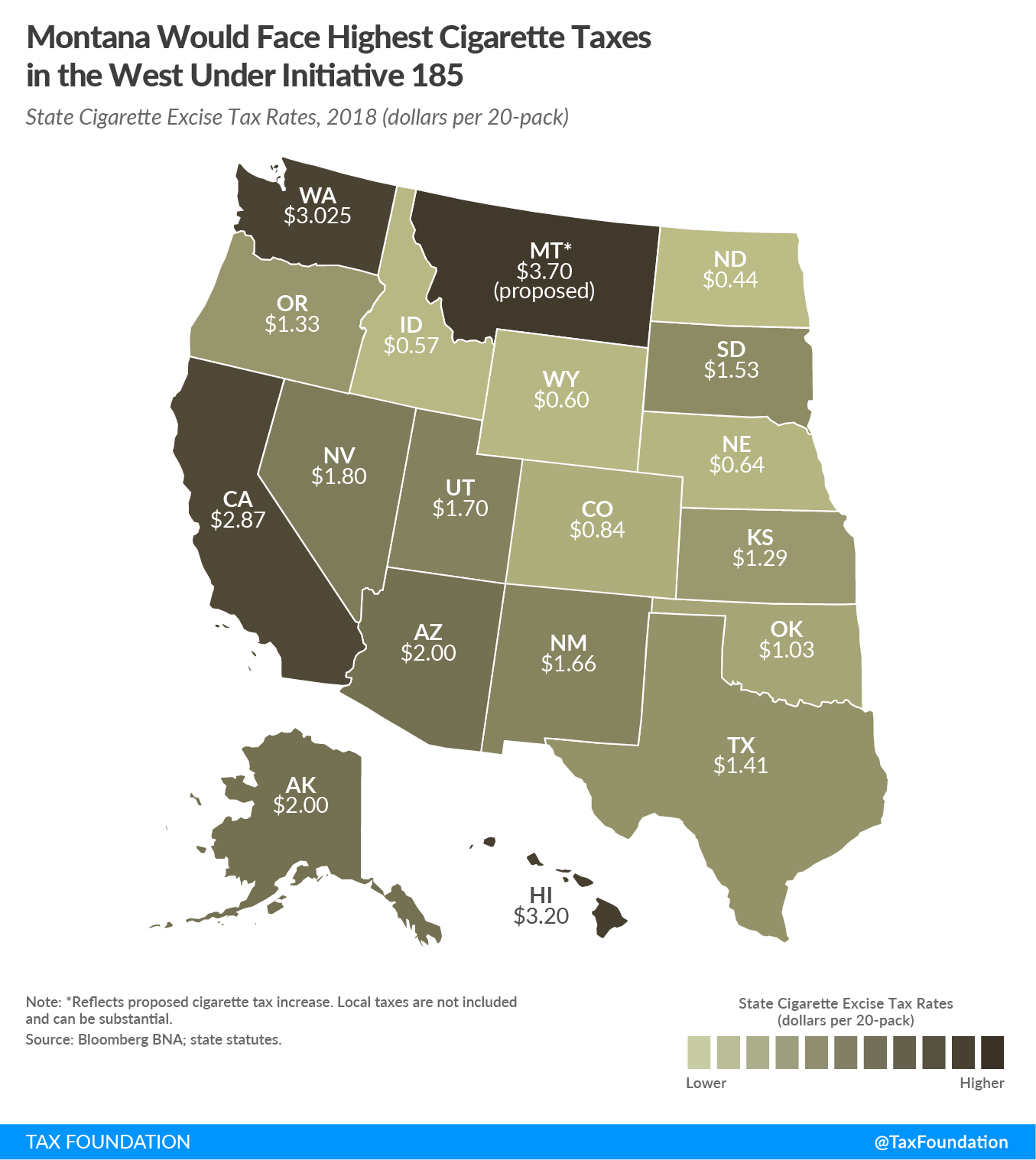

- A $2.00 per pack hike in the cigarette tax from $1.70 to $3.70 per pack.

- An increase in the tax on moist snuff to 83 percent of wholesale or $3.70 per 1.2 ounces, whichever is greater. (The current tax is $1.02 per 1.2 ounces.)

- An increase in the tax on all other tobacco products to 83 percent of wholesale price. (The current tax rate on these products is 50 percent of wholesale price.)

- A new tax on e-cigarettes and vapor products, taxable at the new 83 percent of wholesale price rate.

On the policy merits, this initiative will run into some serious problems if implemented. First, the stated purpose of the tax increase is to raise revenue to sustain important government programs, but research shows that cigarette taxes are a particularly unstable source of long-term revenue.

The interactive tool here shows cigarette tax collections since 1955. Montana has seen momentary revenue spikes after a cigarette tax rate increase, followed by a quick revenue fall-off in years soon after.

This undesirable revenue pattern is based on a few well-documented issues with cigarette taxes. The greatest of these is that cigarette consumption per capita has been falling since the 1960s. While this is a fantastic trend for public health, it makes taxes based on cigarettes unstable for supporting government programs that are designed to be continued year after year. In the case of Medicaid, the pairing with cigarette tax revenues is especially problematic, as health-care costs are expected to grow, not shrink, over the next decade.

Another important consideration of this initiative is that cigarette taxes are one of the most susceptible taxes to avoidance and evasion, as consumers of the products often procure cigarettes from lower tax states. Sometimes this is as simple as stocking up when they are in another state, but often networks emerge to buy the products from people who move cigarettes across state lines (sometimes illegally), buying low and selling high.

This cigarette smuggling issue is much larger than many people know. By our estimate, over 50 percent of all cigarettes purchased in New York in 2015 were from somewhere else; they were procured outside of proper taxing channels. In Montana in 2015, 23.3 percent of all cigarettes consumed were smuggled. This number is likely bolstered as a result of Montana’s location in the country close to some states with significantly lower cigarette tax rates: North Dakota at $0.44 per pack, Idaho at $0.57 per pack, and Wyoming at $0.60 per pack.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeFinally, another area where this ballot language is particularly ham-handed is its inclusion of vapor products and e-cigarettes–which are generally considered far less harmful than traditional combustible cigarettes–at the same tax rate as burned cigarettes. In other states, policymakers have avoided taxes on vapor products or set them at very low rates to make using these products to quit smoking less expensive.

While there is no doubt Initiative 185 was designed with the best of intentions, its design is quite flawed. Supporters of extending Medicaid expansion in Montana would do best to address its funding through the legislative process in the spring, instead of through this ballot measure, which will create significant long-term issues.

Share