Following the resounding defeat of Measure 97 in Oregon, the state faces a large budget deficit for its next biennium. A number of revenue increases are expected to be considered during the state’s legislative session, which begins in February. However, Our Oregon, the group that pushed for Measure 97, is getting an early start on the session. Yesterday, they released their tax reform plan, and while it makes a few important changes, the plan is Measure 97 redux.

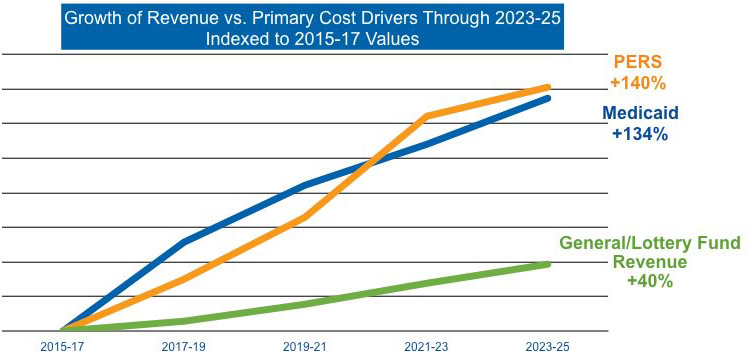

Oregon’s budget deficit is estimated to be $1.7 billion for the next session, or 8 percent of the state’s general fund budget. Much of the deficit comes from spending increases due to Medicaid and pensions for state employees. The chart below from the Oregon Business Plan shows the large disparity between general revenues and cost drivers.

To help close this gap, Our Oregon is proposing a $4 billion taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increase, which is remarkably similar to Measure 97. Measure 97 would have established a statewide gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. of 2.5 percent on C corporation sales greater than $25 million.

The new proposal would create a statewide gross receipts tax on all corporations, both C corporations and pass-through businesses. The rate would be slightly lower than the Measure 97 proposal at 2 percent instead of 2.5 percent, and the threshold would be higher at $100 million instead of $25 million. (The proposal says that it would exempt utilities.)

The other big difference between the new proposal and Measure 97 is that this proposal does not appear to be a minimum tax, as the previous version was. That means that Oregon’s high corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , at 6.6 or 7.6 percent, would also apply.

But overall, this proposal is remarkably similar to Measure 97, which was defeated by 19 points in November. Given the similarities, the economic effects will be similar as well. During yesterday’s news conference, Our Oregon representatives said that tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. wouldn’t occur under this new proposal, because it was limited to firms with $100 million in Oregon-based sales. That is a bold assumption. That would only be true if those firms only sold final goods directly to consumers. If their goods were inputs into other products, tax pyramiding could still occur, leading to higher costs for consumers.

According to the most recent data form the Oregon Department of Revenue, 273 C corporations had sales greater than $100 million in 2013. Given that the new proposal includes pass-through businesses, the number of affected businesses is likely higher than 273. It’s highly unlikely that all of these firms sell directly to consumers, meaning that tax pyramiding is still a real concern.

After losing by 19 points in November on Measure 97, Our Oregon is back at it, proposing another gross receipts tax. As the state looks to close its large budget deficit, this proposal would be the wrong approach to close the hole.

Share this article