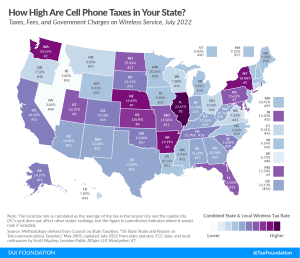

Excise Taxes and Fees on Wireless Services Increase Again in 2022

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read