As much as people want taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform in the abstract, they often fear it when the details are made public—especially if the reforms mark a radical departure from the current system. At the end of the day, many people would rather live with the devil they know than the devil they don’t know.

We are seeing that today with the debate over the border adjustment component of the House GOP “Blueprint” tax reform proposal. Indeed, the destination-based cash-flow tax (DBCFT) with its border adjustment would entail a dramatic departure from our current system by moving toward a consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible. base. Consequently, it has generated a considerable amount of hysteria and claims about its impact on consumers, retailers, and the overall economy.

In cases such as this, it is instructive to look at the experiences of other countries in implementing major tax reforms. In our case, an analogous example is when Australia introduced “The New Tax System” (TNTS) in July 2000. The plan made a number of structural changes, including: cutting personal income taxes; increasing assistance to families; increasing pensions and benefits; and, abolishing a number of harmful excise and sales taxes and replacing them with a 10 percent Goods and Services Tax (GST), another name for a value-added tax (VAT).

When the plan was announced in 1998, critics predicted that:

it would send the economy into recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. ; alternatively, it would pour fuel on an already over-heated economy; it would lift the rate of inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. on an ongoing basis; it would lead to widespread loss of employment; compensation would be inadequate; there would be increased incentive for businesses to operate in the cash economy; business compliance costs would be raised substantially and permanently; and business bankruptcies would be widespread.[1]

Three years after implementation, the Australian Treasury Office (ATO) conducted a comprehensive analysis of the economic impact of TNTS, with special attention to the impact of the GST. Treasury’s conclusion, “These predictions do not appear to have been realised.” (p. 3)

There are differences between Australia’s GST and the DBCFT’s border adjustment mechanism so not all of Australia’s experiences will be comparable. For example, Australia’s GST was largely an add-on tax (they retained their corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. ), whereas the DBCFT is intended to replace the current corporate income tax. Also, Australia’s GST is a full credit-invoice VAT that does not allow for the deduction of payroll from the business tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , whereas the DBCFT does allows for the deduction of payroll. This difference suggests that the impact the GST had on Australia’s price level is greater than what economists would expect the DBCFT to have on the U.S. price level.

Macroeconomic Effects

The Australian Treasury found that the GST “led to a once-off change in the price of many items in the economy. The price of many goods and services rose as a result of the indirect taxAn indirect tax is imposed on one person or group, like manufacturers, then shifted to a different payer, usually the consumer. Unlike direct taxes, indirect taxes are levied on goods and services, not individual payers, and collected by the retailer or manufacturer. Sales and Value-Added Taxes (VATs) are two examples of indirect taxes. reforms contained in the tax package, although some prices remained largely unchanged or even declined. The prices of most investment goods and services fell as the embedded cost of previous indirect taxA direct tax is levied on individuals and organizations and cannot be shifted to another payer. Often with a direct tax, such as the personal income tax, tax rates increase as the taxpayer’s ability to pay increases, resulting in what’s called a progressive tax. es on business inputs was removed.” (p. 4)

The Australian economy did slow for roughly one quarter, although much of that dip was attributed to other forces, such as increases in official interest rates, higher worldwide oil prices, and the decline of public spending for the Sydney Olympics.

Household Consumption Effects

Australian officials anticipated that consumers would change their behavior in the lead-up to the implementation of the GST. As expected, some consumers brought forward purchases they would have made in the future in order to avoid the new 10 percent GST. On the other hand, consumers who were planning to purchase a new automobile delayed their purchase because the GST replaced a higher-rate 22 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on cars, so they rightly expected the price of cars to decline.

The Treasury report found that, when taken as a whole, these effects basically offset each other. “The net effect on consumption growth in 2000-01 appears to have been relatively small and in line with expectations.” (p. 7)

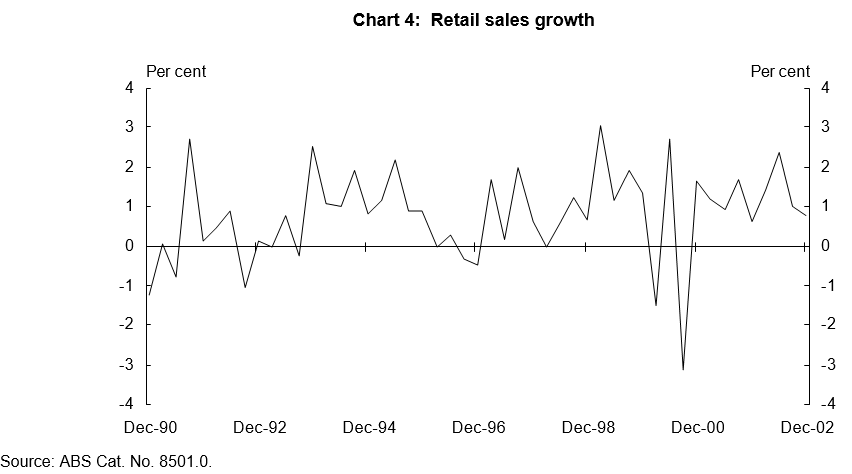

Retail Sales

“There appears to have been some transitional TNTS-related effects in retail sales (Chart 4). Large swings occurred in department store sales, household goods, and clothing sectors in particular—strong growth in the June quarter of 2000 was followed by a sharp decline in the September quarter and a rebound in the December quarter. The pattern of these transitional effects was broadly anticipated. Allowing for the usual data volatility, expenditure patterns appear to have returned quickly to what could be considered more “typical” levels. (p. 8)

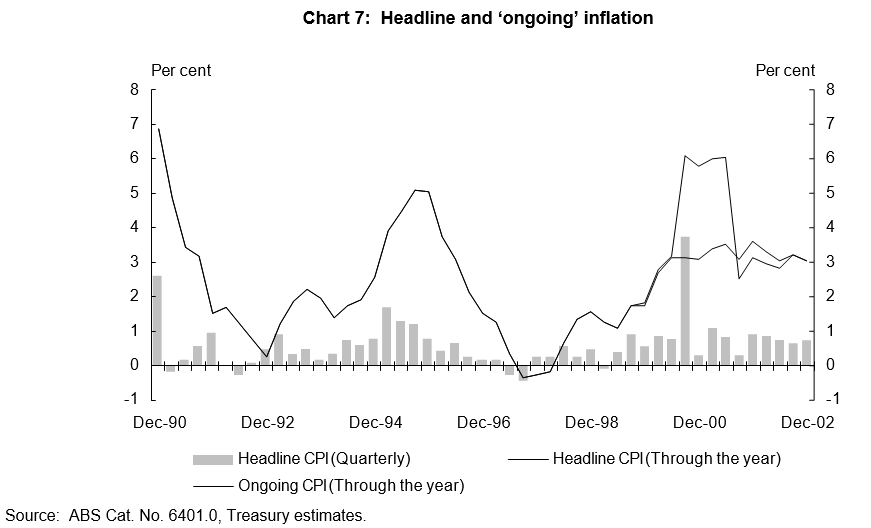

Prices and Wages

Of course, the implementation of any consumption-based tax raises concerns about the effect on prices. The Treasury report found that “the introduction of TNTS led to a once-off change in the price level of many items in the economy. An indication of the “overall” effect on consumer prices can be observed in movements of the Consumer Price Index (CPI) (Chart 7).

“The main price effect was recorded in the September quarter 2000, with the CPI rising by 3.7 per cent. TNTS is estimated to have contributed a little less than 3 percentage points to the overall CPI increase in the quarter, significantly lower than the 3¾ percentage points forecast in the 2000-01 Budget. Quarterly inflation outcomes, while exhibiting some volatility, generally returned to more typical levels from the December quarter 2000. This single ‘spike’ in the quarterly CPI data confirms that the inflationary impact of the TNTS reforms on prices was essentially once-off in nature and did not become entrenched in inflation outcomes or inflation expectations.” (emphasis added. p. 11)

“For the 2000-01 financial year in total, the headline CPI increased by 6.0 per cent in through-the-year terms. TNTS is estimated to have contributed around 2½ percentage points of this increase.” (p. 11)

Distributional Issues

While much of the focus of Australia’s tax reform was on the effects of the GST, the plan was comprehensive and included cuts in individual tax rates, the expansion of the zero-bracket, and tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. s for families with children. ATO compared the real disposable income for different family types one year following enactment of the plan to their disposable income before enactment.

The results were categorical. “All quintiles within each family type were found to have greater real disposable income about 12 months after the introduction of tax reform.” (p. 17) Indeed, couples with children in the lowest quintile saw an8 percent increase in disposable income while those in the top quintile saw a 2 percent increase. As Table 3 from the report shows, other family types enjoyed similar outcomes.

| Quintile | Couple without children | Retired pensioner couple | Couple with children | Self-funded retiree | Retired pensioner single | Single person in the labour force | Sole parent | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Source: STINMOD and Treasury calculations. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| % | % | % | % | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | 4 | 7 | 8 | 5 | 7 | 5 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | 2 | 7 | 8 | 6 | 7 | 0 | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | 1 | 6 | 4 | 5 | 6 | 1 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | 1 | 6 | 4 | 3 | 6 | 2 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | 2 | 10 | 2 | 2 | 7 | 3 | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bankruptcies

Australian retailers in particular were concerned that the GST would lead to a rise in bankruptcies. ATO found, however, that “from March 2000 to December 2000, which included the first 6 months of GST, the number of bankruptcies per quarter was the lowest it had been since the October to December 1996 quarter.” Interestingly, bankruptcies did increase in the first half of 2001, but “the GST was mentioned as the cause of bankruptcy in less than 0.3 per cent of total cases.” (p. 23) After that brief increase, the number of bankruptcies fell in each subsequent quarter in 2001.

ATO’s Conclusion

After looking at all of the effects of the GST on the broader economy, consumers, and businesses, the Australian Treasury concluded:

Overall, the data indicate that the implementation of the TNTS reforms did not bring about the adverse impacts on the Australian economy that some critics had predicted. As the discussion above demonstrates, there were a number of (broadly anticipated) transitional impacts on various economic aggregates around 1 July 2000. However, these effects appear to have largely ‘washed out’ over the two years since, leaving the Australian economy well-placed to maintain its position as one of the world’s top-performing developed economies. (p. 13)

Lessons for U.S. Lawmakers from the Australian Experience

The Australian experience with implementing a broad-based consumption tax should provide U.S. lawmakers a number of valuable lessons. The most notable takeaway is the brevity of its impact on prices, consumer spending, retail sales, and the overall economy.

Contrary to what some have suggested for the U.S. border adjustment, Australia did not phase in the GST. They implemented the entire tax plan at the beginning of the third quarter of 2000 and endured most, if not all, of the negative economic effects of the new policy during that quarter. With most of the negative effects behind them, the economy began the fourth quarter of that year on an upswing.

As we are now seeing in the U.S. with the criticisms of the border adjustment, critics of Australia’s tax plan focused solely on the GST and failed to see that policy within the overall context of tax reform. But the post-reform increases in family disposable incomes show that Australian lawmakers successfully balanced tax cuts with a GST policy that many assumed would be regressive.

The Australian government also put considerable effort into preparing the country for tax reform by launching a comprehensive educational program well in advance of the implementation of the new tax system. The program was aimed not only at businesses that would levy the GST, but consumers and communities who would be paying the tax. The government even provided funds to any small-to-medium businesses that needed transition assistance to the new system.

In the end, all of these factors combined to make for a successful implementation of tax reform in Australia:

The implementation of well designed reform at a time of relatively strong economic fundamentals, complemented by appropriate compensation and a comprehensive education and assistance programme before, during and after the tax changes, as well as the concerted efforts of business, appear to have combined to help smooth the transition. (p. 24)

[1] Australian Treasury, Economic Roundup Autumn 2003, “Preliminary Assessment of the Impact of The New Tax System,” p. 3. https://www.oecd.org/ctp/tax-policy/39494160.pdf All further citations are from the same document.

Share