Mississippi House Speaker Philip Gunn (R) recently proposed a “tax swap” plan to direct revenue toward the state’s infrastructure repair and maintenance needs by phasing out an individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. bracket while phasing in an increase to the state’s gasoline excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. . My colleague Nicole Kaeding and I highlighted the benefits of such a plan, which include a more stable revenue stream and a flatter income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. structure.

In response, some stakeholders have posed an alternative funding mechanism: increasing the excise tax on cigarettes from $0.68 to $1.50 per pack. While finding a pay-for is rarely an easy task, it is important to remember that not all revenue sources are created equal. Policymakers should consider the disadvantages of using a cigarette tax increase to fund infrastructure maintenance: namely, mismatched incentives and a declining revenue stream.

Cigarettes for Roads? A Mismatched Incentive

For many health advocates in Mississippi, raising the cigarette tax has been a longtime goal. During the 2018 legislative session, several bills were introduced in the House and Senate to increase the cigarette tax and direct revenue toward public health programs like Medicaid. Now, proponents suggest increasing the cigarette tax would cover roughly one-third of the state’s annual infrastructure maintenance needs.

With backers of this idea so quickly pivoting to infrastructure, rather than Medicaid, as the targeted revenue recipient, it is evident that the real goal here is to raise the cigarette tax—not for the revenue it can generate but for the way it may influence behavior.

In this scenario, the goal is improved public health, and the means is a cigarette tax increase. Infrastructure improvement is nothing more than a worthy byproduct, and cigarette users are the unlucky target.

While improving public health is a laudable mission, advocates who hope to deter smoking would do better turning to health education and awareness – rather than the tax code – to achieve their goal.

Cigarette Taxes are a Declining Revenue Stream

While state gasoline taxes may need supplementation as vehicles become more fuel-efficient, the gasoline tax and similar transportation taxes and user fees help ensure taxpayers directly benefit from the revenue they generate. When linked to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , transportation-related taxes and infrastructure user fees generally help ensure that as long as infrastructure networks have reliable users, they have reliable funding. On the other hand, not only are cigarette taxes unrelated to infrastructure, but they also represent a declining revenue stream.

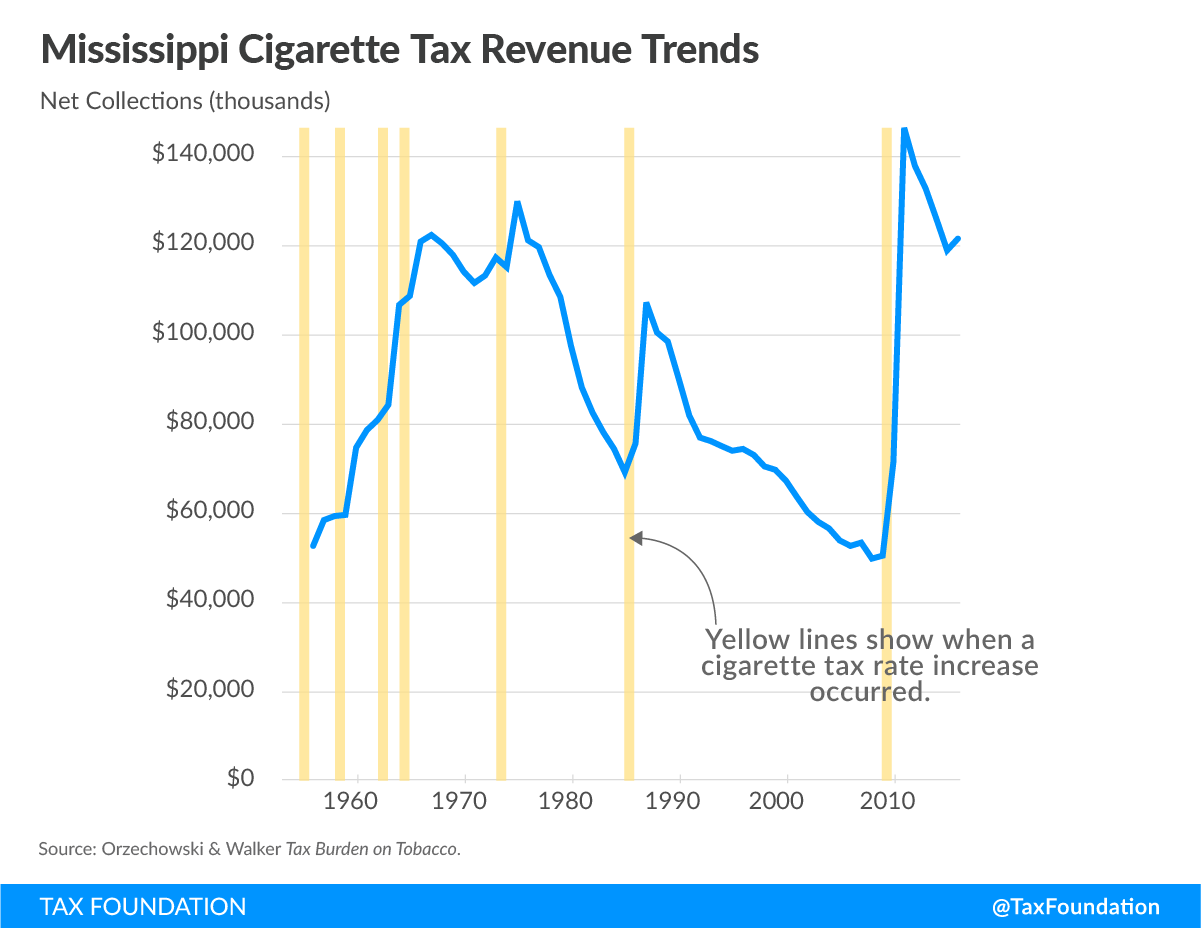

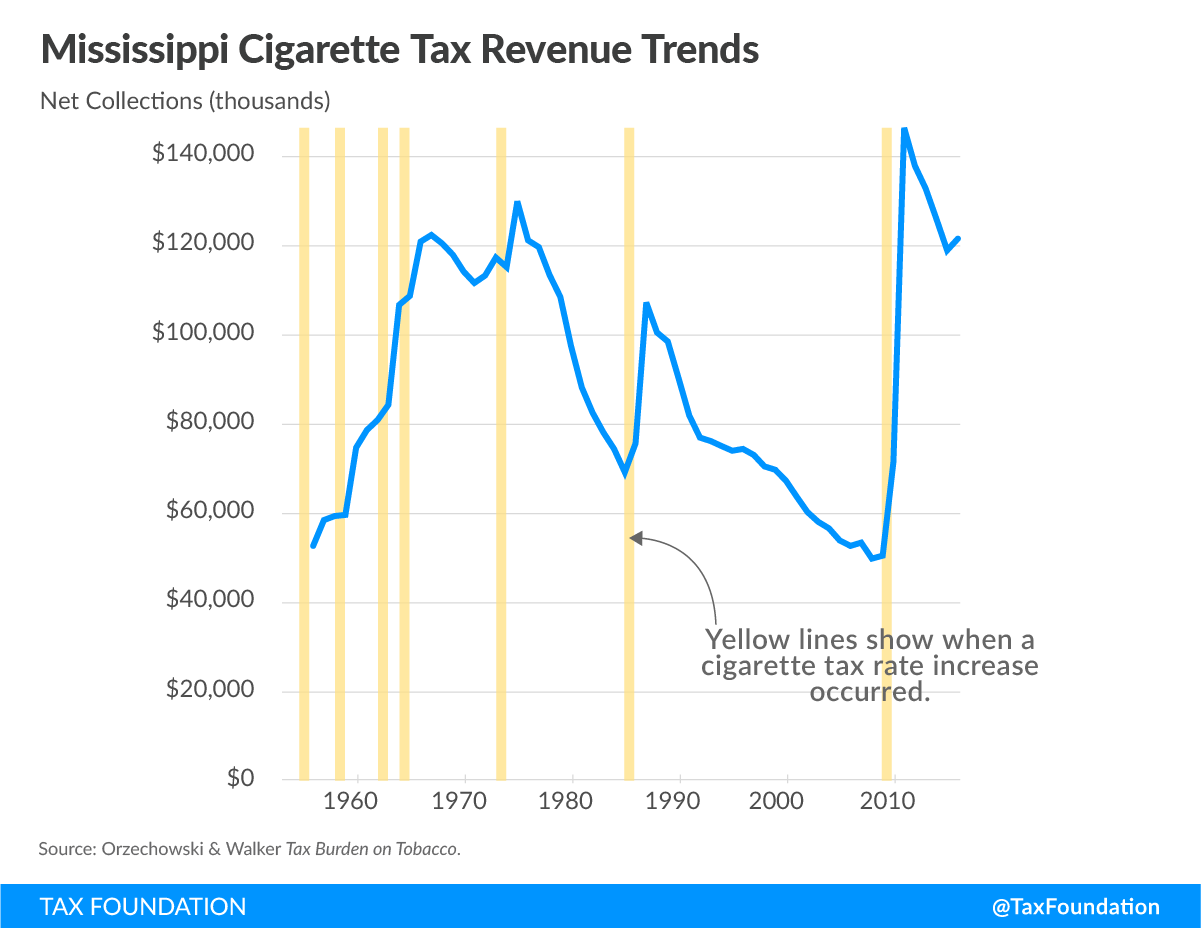

The graph below shows how cigarette tax revenues have changed in Mississippi between 1955 and 2015, adjusted for inflation. The blue line represents total tax revenue, while yellow lines indicate dates on which the cigarette tax rate increased in the state.

When Mississippi raised its cigarette excise tax by just $0.07 in 1985, the state saw a spike in revenue generated from cigarette sales for about two years, but that spike was followed by a decade-long revenue decline. By 2000, annual revenue generated from the tax was lower than in the year the tax increase took effect. When the state again raised its cigarette tax rate in 2009, this time by $.50 per pack, the same scenario occurred: cigarette-generated revenue spiked from approximately $60 million in 2010 to over $140 million a couple years later, but by 2015, annual revenue had already dropped to roughly $120 million. Our interactive web tool shows how this trend is evident in every state that has increased its cigarette tax over time.

Several factors contribute to these revenue declines. Since the U.S. Surgeon General released the first report on the health risks of smoking in 1965, cigarette consumption has declined. Interstate commerce is another factor contributing to state-specific decline: when one state increases its cigarette tax, consumers in communities along state borders eventually notice how prices vary across state lines.

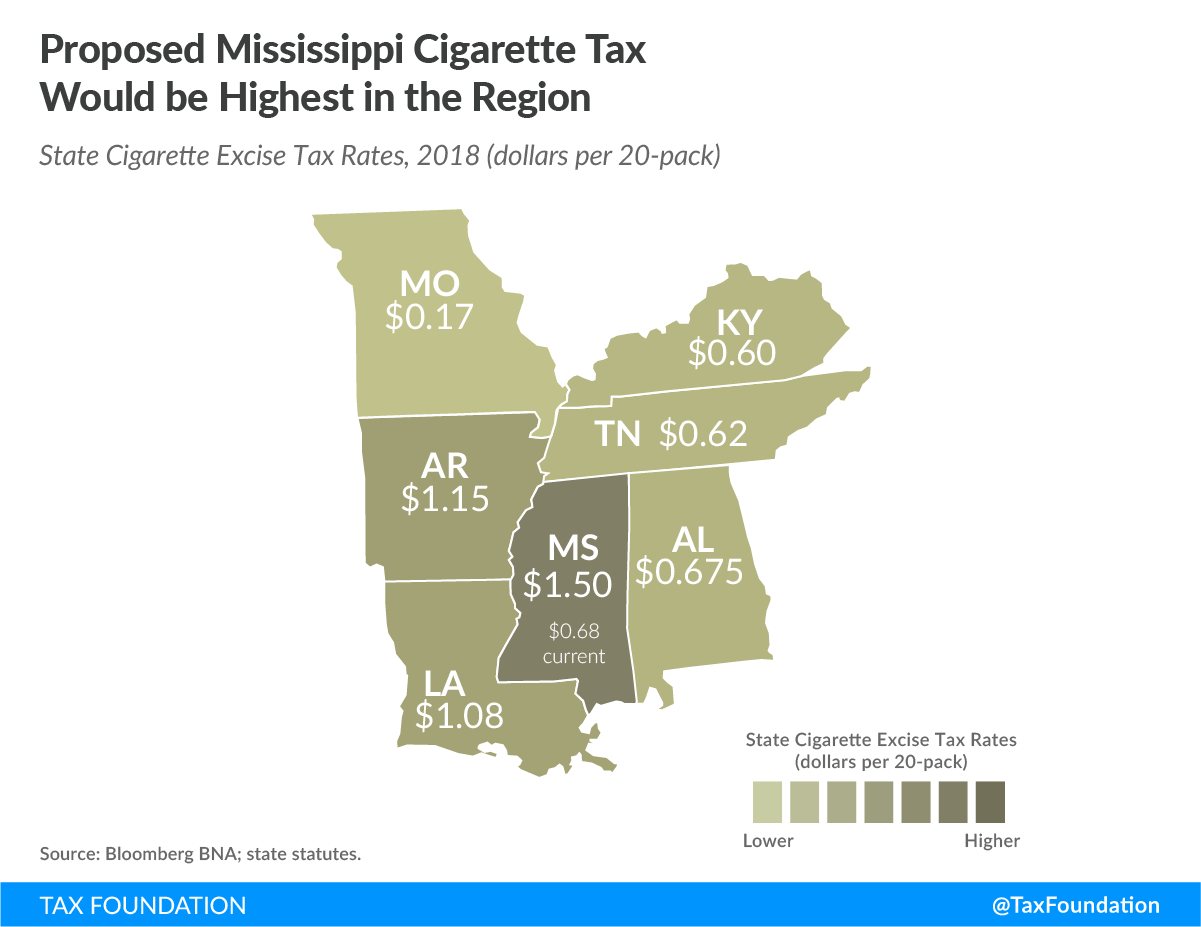

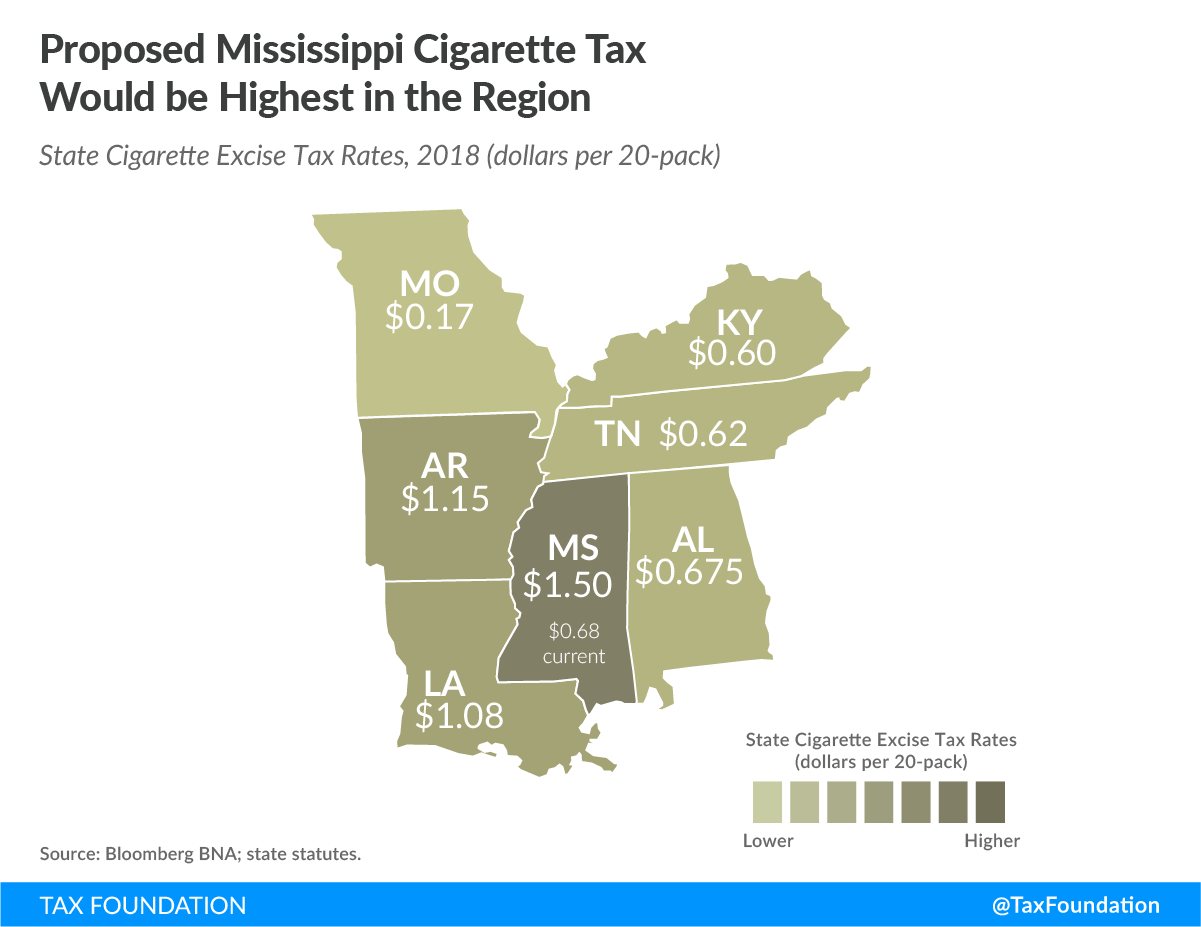

Should Mississippi increase its cigarette tax from $0.68 to $1.50 per pack (a 120 percent increase), some residents will soon find that they can purchase their cigarettes much cheaper in neighboring states like Tennessee, where the tax is $0.62 per pack, or Alabama, where the tax is currently consistent with Mississippi’s at $0.68 per pack. In the neighboring states of Louisiana and Arkansas, cigarette taxes are $1.08 and $1.15, respectively—also lower than the proposed new rate in Mississippi.

While a cigarette tax increase would bring a short-term revenue spike, if history is an indicator, this type of policy change would soon prove inadequate. Instead, in deciding how to fund its present and future infrastructure repair and maintenance needs, Mississippi should keep its focus a bit further down the road.

Share