Last week, the Organisation for Economic Co-operation and Development (OECD) released new revenue estimates for the global minimum tax and other significant changes to the international taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system. The headline number for Pillar Two’s global minimum tax: $220 billion. This is comparable to the total U.S. corporate tax receipts from 2019 and 2020 ($230 billion and $212 billion, respectively).

However, the new global minimum tax revenue estimate ignores some fundamental issues.

To begin with, an OECD economist has written that the $220 billion could be overinflated if profits shifted to low-tax jurisdictions have fallen in recent years or if revenues from other policies were double counted. There’s reason to believe both have occurred (more on this below).

Additionally, the project was rushed through without sufficient analysis of existing and recent policy changes, the layers of complexity for both taxpayers and tax collectors make reliable revenue estimates difficult, and the OECD has downplayed the potential negative effects on certain countries—all of which point to the fact that the OECD is only performing a partial analysis.

It Began with BEPS

With the minimum tax rules already moving through legislatures in South Korea, Japan, the UK, the 27 EU Member States, and several other jurisdictions, it’s important to understand how we got here.

In 2013, the OECD launched the Base Erosion and Profit Shifting (BEPS) project to stop multinational corporations from gaming the international tax system. At the time, corporations were using tax planning strategies that were technically legal to avoid taxation, so BEPS sought to change the rules of the game.

Dozens of countries introduced measures that tightened tax laws for multinationals. These included transfer pricing regulations, controlled foreign corporation rules, anti-hybrid rules, and rules preventing the use of cross-border debt structuring to minimize taxes owed. There was also a new review process for tax incentives offered by countries.

These changes adjusted the way multinational companies structured themselves and required more compliance work by taxpayers and administrative efforts by governments.

The U.S. government made the most aggressive move by adopting the first-of-its-kind pair of minimum taxes on multinational companies. This was the tax on Global Intangible Low Tax Income (GILTI) and the Base Erosion and Anti-abuse Tax (BEAT).

When other countries observed this approach, they became inspired (some might say “greedy”). It appears that subsequent action was driven more by the desire to raise government revenue than create a workable solution that accounted for previous government actions.

Even though one of the key action items of the original BEPS project was to consistently monitor the impacts on shifted profits, the OECD has not published a comprehensive review of the impact those changes have had on government revenues. (A summary of research from 2021 by Elke Asen shows the need for such a comprehensive review.)

The Limits of the OECD’s Impact Assessment

This brings us back to last week’s impact assessment. The analysis likely engages in double counting because it uses old data (as much as five years old). To be clear, this is not necessarily the OECD’s fault; up-to-date data can be hard to come by.

But the challenge with old data in this context is that many of the BEPS project priorities were not fully in place five years ago. The 2017 U.S. tax reforms were freshly implemented, and some complicated arrangements using Irish entities had not been phased out. Even last year, the U.S. adopted a new corporate alternative minimum tax on multinationals (which is different from the global minimum tax, but does impact taxes paid by multinationals).

Therefore, the OECD’s analysis did not—because it could not—account for these changes, calling into question the validity of its revenue estimate.

Other factors it seems the OECD did not account for are administration and compliance costs. Not every tax authority has the resources of the U.S., UK, Germany, France, Japan, or South Korea. Some tax authorities include just a handful of staff who administer streamlined tax systems (like Estonia) or they are in smaller or lower-income jurisdictions.

The global tax rules are complex, and countries are understandably struggling to translate them into their own languages and national laws. For smaller jurisdictions, the clock is ticking. Will they be able to move fast enough to reclaim their own tax base before another country swoops in without their permission?

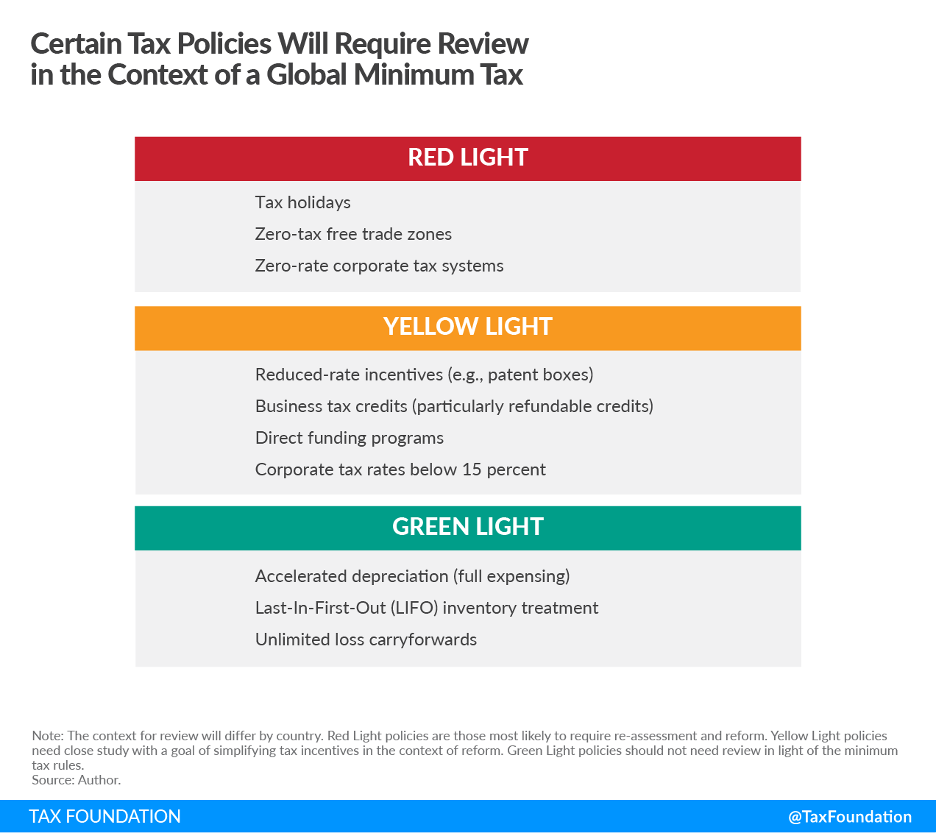

This leads to another point the OECD seems to have ignored. Part of the work of the original BEPS project was to review several dozens of tax incentives offered by countries around the world. The OECD’s goal was to eliminate or reform tax incentives that only served to reduce income taxes while being disconnected from employment, tangible investment, or real ongoing activities. Some countries that went through these reviews and adjusted their policies are now being told that the minimum tax will still reduce the value of the tax preferences they offer.

This feels like a bait and switch for many jurisdictions, especially those outside of the G20.

The erosion of tax preferences alongside the minimum tax will directly increase tax costs and reduce foreign direct investment (FDI)—a key priority for many small, open economies around the world. An estimated 2 percent reduction in foreign direct investment may not seem like much, but, in economies that are heavily dependent on FDI for employment and production, it will be meaningful.

Problems with the Global Tax Deal—and How Countries Should Proceed

Dr. Leopoldo Parada from the University of Leeds recently identified what he calls “three unconvincing premises” of the global tax deal. These premises include the following:

- All corporate tax incentives offered by developing countries are equally inefficient

- Countries can easily switch from corporate tax competition to other forms of competition (like competing with better-educated workforces or improved infrastructure)

- If countries do not act to implement the global minimum tax they will be missing out on meaningful revenues

Dr. Parada is not alone in his skepticism of the OECD approach. As things have recently progressed, some countries have lost confidence in the OECD. Recent calls for a more powerful UN role in international tax policy or regional alliances that might aim for alternative policies reveal a lack of trust that the policies produced through the OECD process have countries’ best interests in mind. Nigeria, the largest economy on the African continent, has flatly refused to join the deal.

For supporters of principled, pro-growth tax policies, the situation is bleak. Policymakers did not evaluate major policy changes before embarking on new approaches. Now governments are moving quickly to implement a massive new tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. while pitching its revenue-raising capacity, but ignoring its complexity and impact on smaller countries.

What are the alternatives? Countries are not obliged to adopt the minimum tax, and the current policy environment provides a good opportunity to reform their systems. Many tax preferences are distortionary. One company benefiting from a special industrial preference could see an effective tax rate very close to zero while another that is ineligible for preferences pays in the high teens or low 20s.

Countries should review their preferences and how they fit within the global minimum tax framework. Then they should aim for truly neutral, investment-friendly tax policies. There’s a reason Estonia has placed at the top of our International Tax Competitiveness Index nine years in a row. Smaller countries can take a page from their playbook and adopt simple structures like a tax on distributed profits to fundamentally reform their tax systems for the better.

The process leading to the global minimum tax has been messy, and the mess will likely continue for years to come. New revenues are hardly a salve for the setback they represent.

But that does not mean pro-growth reform opportunities are now fully off the table. There are much more efficient ways to raise revenue in which countries can invest. Tax bases for consumption should be broadened, high marginal rates baked into tax and benefit systems should be addressed, and simple solutions for business taxation like the Estonian approach should be tried.

Countries shouldn’t let the OECD’s faulty revenue estimate distract them from undertaking real, pro-growth reforms.

Related Research

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe