Among the many questions we’ve received regarding Rick Perry’s flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. plan is “can it work?” The simple answer is yes. There are some two dozen countries across the globe that have a flat taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . One of the first countries to implement a flat tax was Slovakia, whose flat tax went into effect in January 2004.

In November of 2004, Vladimir Tvaroska , an official from the Slovakian Ministry of Finance, spoke at a Tax Foundation-sponsored conference on global tax reform about their transition to the flat tax and the strategies they employed to overcome the political opposition to the plan.

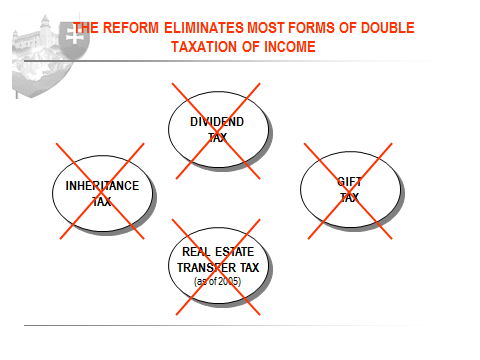

According to Tvaroska, (his Powerpoint is here) the basic philosophy of their plan was to create a tax system that was “light, nondistortive, simple and transparent.” The goal was to improve the business climate in Slovakia while improving “tax fairness by taxing all types and all amounts of income equally.”

They wanted the plan to be revenue neutral in 2004 (unlike Washington, they don’t have 10 year budget windows). But rather than rely one “official” government agency for an estimate, they solicited revenue estimates from five different sources, including the International Monetary Fund, the Slovak Ministry of Finance, and the Slovak Academy of Sciences. U.S. lawmakers would be wise to adopt such a policy.

Like the U.S., Slovakia had a progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. rate structure with many deductions and loopholes. As the slides below show, they got rid of all of that complexity with the flat tax.

In his conclusion, Tvaroska shared the lessons they learned in implementing the flat tax, lessons U.S. lawmakers would should keep in mind. First, he advises, you “must have a clear vision of where you want to go” and “implement the less popular steps first” because those will be the hardest.

As importantly, lawmakers must take a hard line against lobbies and special interests. “If you give in to one demand,” he said, “you will be less able to say no to others.”

Finally, he cautioned, “compensate the most vulnerable part of the population.” The flat tax does that with a generous personal allowance that exempts the poor from the tax.

The Slovakian flat tax has been a key ingredient in their ability to lure FDI and grow their economy.

If it can work in a former Communist country, surely it can work here.

Share this article