All Related Articles

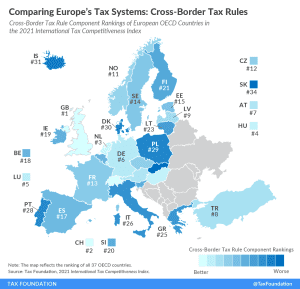

Comparing Europe’s Tax Systems: Cross-Border Tax Rules

Cross-border tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country’s tax code.

3 min read

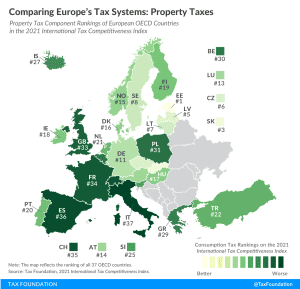

Comparing Europe’s Tax Systems: Property Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

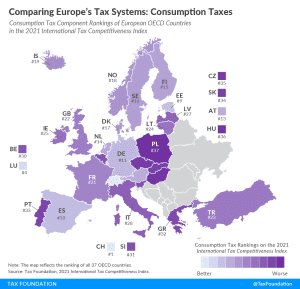

Comparing Europe’s Tax Systems: Consumption Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

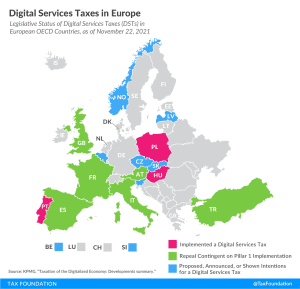

Digital Services Taxes in Europe, 2021

Despite ongoing multilateral negotiations in the OECD, about half of all European OECD countries have either announced, proposed, or implemented their own unilateral digital services tax.

7 min read

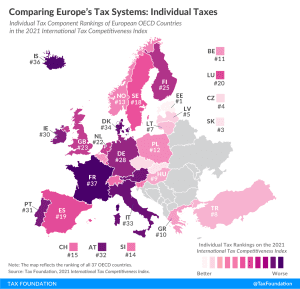

Comparing Europe’s Tax Systems: Individual Taxes

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

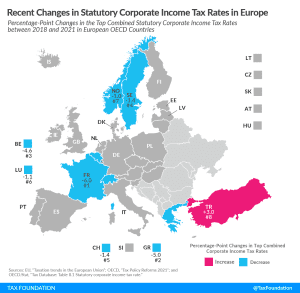

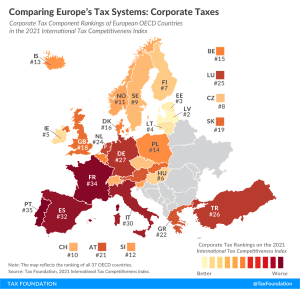

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2021 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

Testimony: EU Parliament Subcommittee on Tax Matters Hearing on the Impact of National Tax Reforms on the EU Economy

Tax Foundation testimony on the diversity of tax systems within the EU, three important ways to consider reforms by Member States, and several recommendations for the EU Parliament’s Subcommittee on Tax Matters to consider.

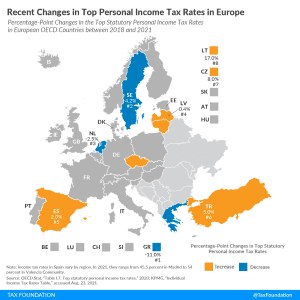

Recent Changes in Top Personal Income Tax Rates in Europe

In the past three years, eight European OECD countries changed their top personal income tax rate, of which four of them cut their top personal income tax rates.

3 min read

Regional Tax Competition Is Stopping Spain from Becoming Europe’s Tax Hell

Tax competition has proven to be key in keeping tax hikes under control in some regions of Spain as regional governments look to copy Madrid’s tax reforms.

6 min read