All Related Articles

The European Commission and the Taxation of the Digital Economy

The consultation on the EU’s digital levy provides an opportunity for policymakers and taxpayers to reflect on the underlying issues of digital taxation and potential consequences from a digital levy. Unless the EU digital levy is designed with an OECD agreement in mind, it is likely to cause more uncertainty in cross-border tax policy.

12 min read

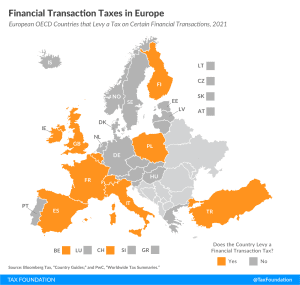

Financial Transaction Taxes in Europe

Belgium, Finland, France, Ireland, Italy, Poland, Spain, Switzerland, Turkey, and the United Kingdom currently levy a type of financial transaction tax

2 min read

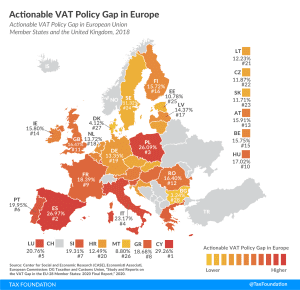

Actionable VAT Policy Gap in Europe, 2021

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

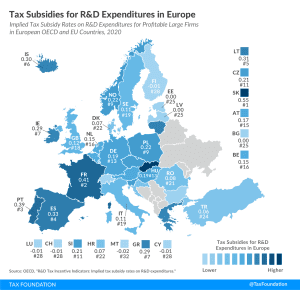

Tax Subsidies for R&D Expenditures in Europe, 2021

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read

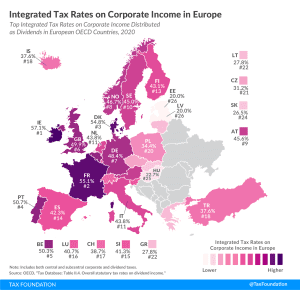

Integrated Tax Rates on Corporate Income in Europe, 2021

The integrated tax rate on corporate income reflects both the corporate income tax and the dividends or capital gains tax—the total tax levied on corporate income. For dividends, Ireland’s top integrated tax rate was highest among European OECD countries, followed by France and Denmark

4 min read

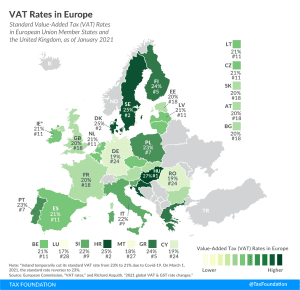

VAT Rates in Europe, 2021

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read

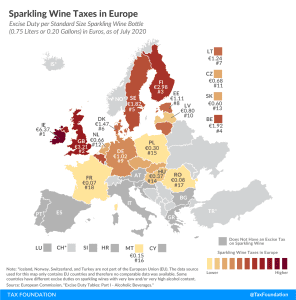

Sparkling Wine Taxes in Europe

This week, people around the world will celebrate New Year’s Eve, with many opening a bottle of sparkling wine to wish farewell to—a rather consequential—2020 and offer a warm welcome to the—by many of us, long-awaited—new year 2021.

1 min read

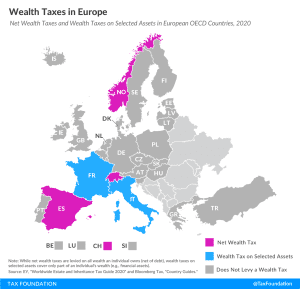

Wealth Taxes in Europe, 2020

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

3 min read

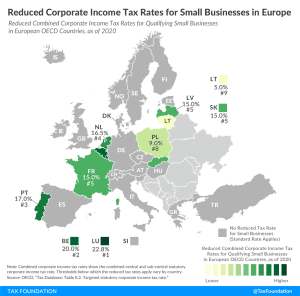

Reduced Corporate Income Tax Rates for Small Businesses in Europe

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses

2 min read

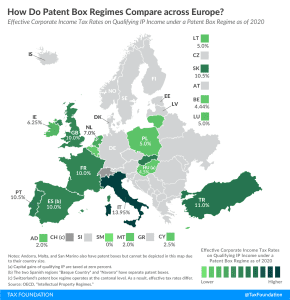

Patent Box Regimes in Europe, 2020

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read