All Related Articles

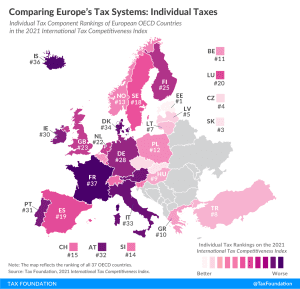

Comparing Europe’s Tax Systems: Individual Taxes

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

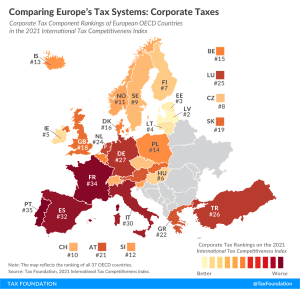

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2021 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

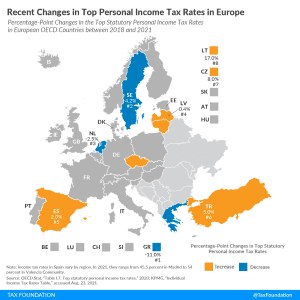

Recent Changes in Top Personal Income Tax Rates in Europe

In the past three years, eight European OECD countries changed their top personal income tax rate, of which four of them cut their top personal income tax rates.

3 min read

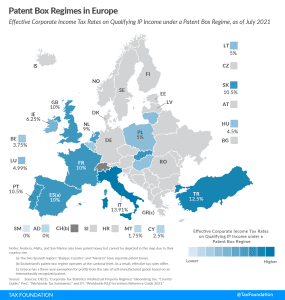

Patent Box Regimes in Europe, 2021

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 14 of the 27 EU member states have a patent box regime.

4 min read

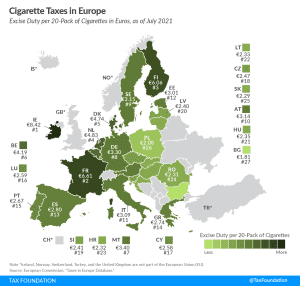

Cigarette Taxes in Europe, 2021

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.42 ($9.60) and €6.61 ($7.53) per 20-cigarette pack, respectively. This compares to an EU average of €3.34 ($3.80). Bulgaria (€1.81 or $2.06) and Poland (€2.08 or $2.37) levy the lowest excise duties.

3 min read

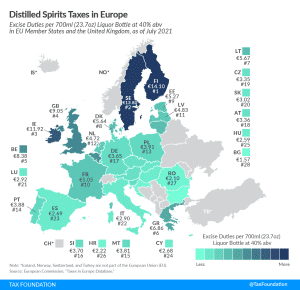

Distilled Spirits Taxes in Europe, 2021

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min read

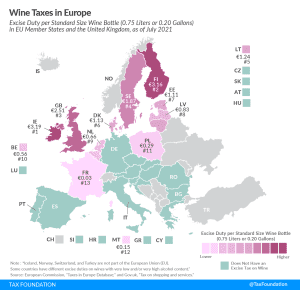

Wine Taxes in Europe, 2021

As one might expect, southern European countries that are well-known for their wines—such as France, Greece, Portugal, and Spain—either don’t tax it or do so at a very low rate. But travel north and you’ll see countries that tend to levy taxes on wine—and often hefty taxes.

3 min read

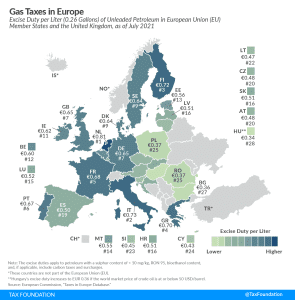

Gas Taxes in Europe, 2021

5 min read

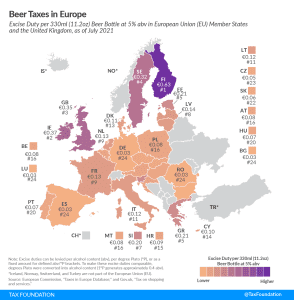

Beer Taxes in Europe, 2021

Finland has the highest excise tax on beer in Europe, followed by Ireland and the United Kingdom. Compare beer taxes in Europe this International Beer Day

3 min read

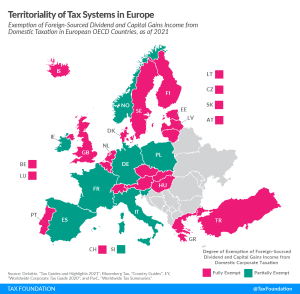

Territoriality of Tax Systems in Europe

19 European OECD countries employ a fully territorial tax system, exempting all foreign-sourced dividend and capital gains income from domestic taxation. No European OECD country operates a worldwide tax system.

3 min read

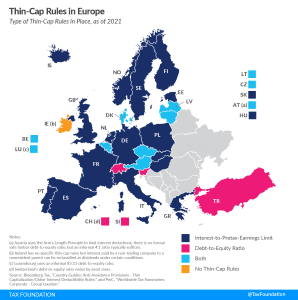

Thin-Cap Rules in Europe

To discourage this form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

5 min read

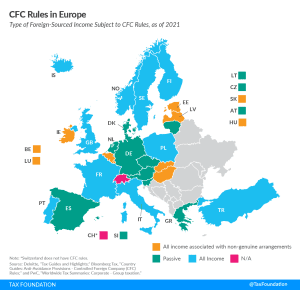

CFC Rules in Europe

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences, countries have implemented various anti-tax avoidance measures, such as the so-called Controlled Foreign Corporation (CFC) rules.

5 min read

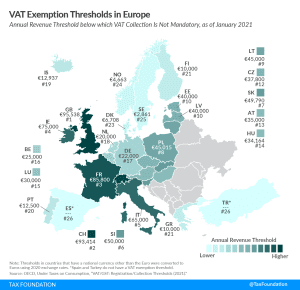

VAT Exemption Thresholds in Europe

To reduce tax compliance and administrative costs, most countries have VAT exemption thresholds: If a business is below a certain annual revenue threshold, it is not required to participate in the VAT system.

2 min read

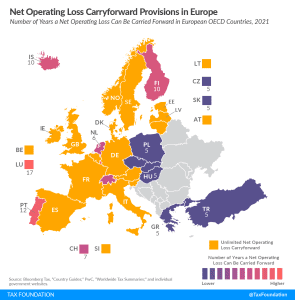

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2021

Many companies have investment projects with different risk profiles and operate in industries that fluctuate greatly with the business cycle. Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

7 min read

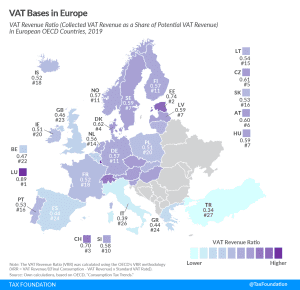

VAT Bases in Europe

As economic activity resumes and the task of accounting for the deficits incurred in navigating the crisis of the past year becomes the focus of fiscal policy deliberations, a greater reliance on VAT could be an important tool in ensuring fiscal stability going forward. Countries should use this as an opportunity to improve VAT systems by re-examining carveouts in the form of exemptions and reduced rates.

2 min read

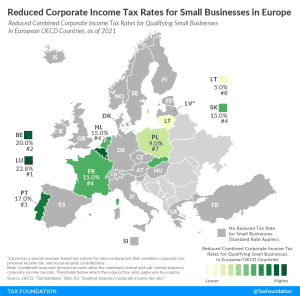

Reduced Corporate Income Tax Rates for Small Businesses in Europe

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses. Out of 27 European OECD countries covered in today’s map, eight levy a reduced corporate tax rate on businesses that have revenues or profits below a certain threshold.

3 min read

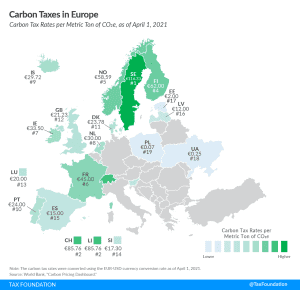

Carbon Taxes in Europe, 2021

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

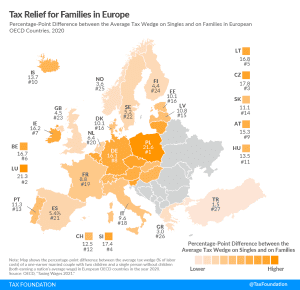

Tax Relief for Families in Europe

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read