During its Fiscal Year 2019 budget debate, the District of Columbia Council voted 10 to 2 late this afternoon to insert a cigarette taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increase, raising the tax from $2.50 per pack to $4.50 per pack. The new rate would be the highest in the United States, and Washington City Paper’s Andrew Giambrone reports that the proportional increase will apply to all tobacco products, including vaping products.

Councilmember and former Mayor Vince Gray pushed for the increase, saying higher cigarette taxes are the “most effective, time-tested” way to achieve smoking cessation. I testified to the Council on this topic in February, and I pointed out a few other things such an increase would be effective at doing:

- Increasing cigarette taxes exacerbates black markets. Many Americans are unaware how large the black market in cigarettes is. New York, which currently has the highest state cigarette tax at $4.35 per pack, sees over half (56.8%) of cigarettes consumed in the state smuggled from other jurisdictions. A few years ago, in preparation for testimony on the topic, the first DC store I walked into sold me a pack of cigarettes with a Virginia tax stamp. A $4.50 DC tax rate compares to Virginia’s 30 cent tax rate, offering smugglers a $42 per carton smuggling incentive.

- Cigarette taxes disproportionally harm low-income individuals. More than half of today’s smokers nationwide earn less than $36,000 per year, making cigarette taxes highly regressive. A pack-a-day smoker would pay $700 more in taxes under this proposal.

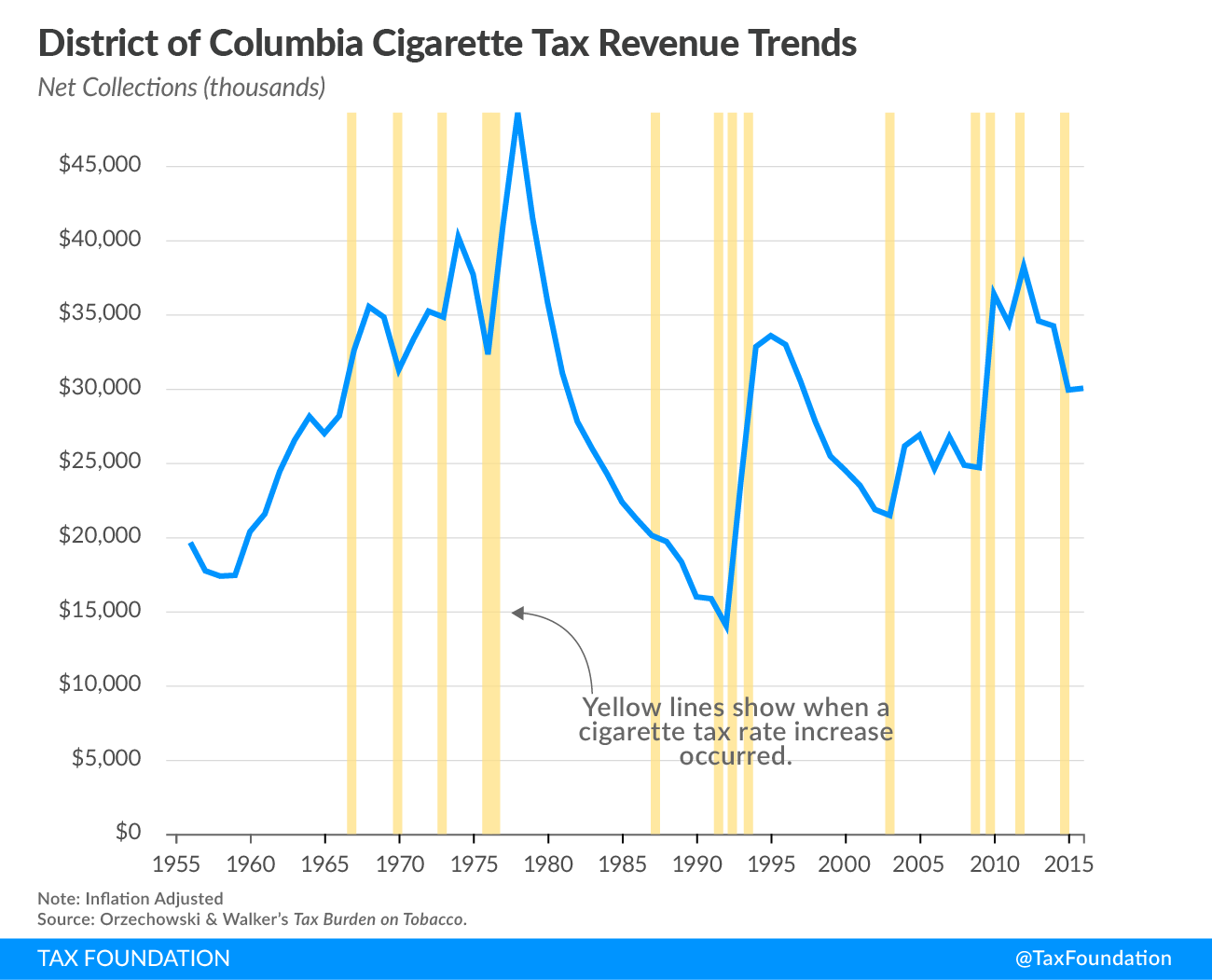

- Funding programs with cigarette taxes invites budget instability. Cigarette tax increases usually see immediate bumps in revenue but then fall off quickly because of increased smuggling or the general decline in the rate of smoking. DC actually collects less in cigarette tax revenue now than it did several years ago when the tax rate was lower (chart below, blue is revenue and yellow bars are cigarette tax rate increases). This increase may result in D.C. raising less revenue, rather than more, while counting on the money to fund expanded programs.

Additionally, if Councilmember Gray’s goal is smoking cessation, increasing the tax on vapor products runs counter to that goal. Studies have found that they are useful cessation tools.

While a cigarette tax increase can seem like a productive step for public health, the decision carries with it many undesirable outcomes.

Share