Net Operating Loss Carryforward and Carryback Provisions in Europe, 2025

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

4 min read

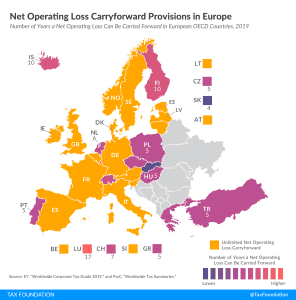

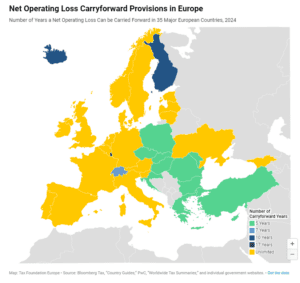

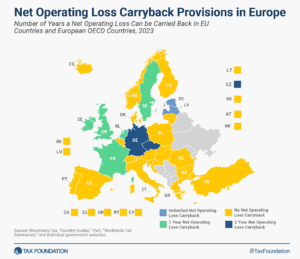

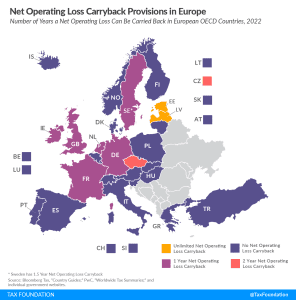

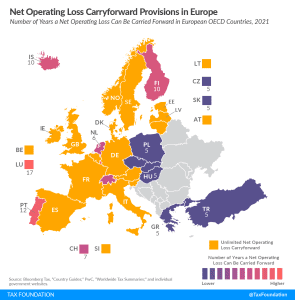

Many companies have investment projects with different risk profiles and operate in industries that fluctuate greatly with the business cycle. Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

7 min read