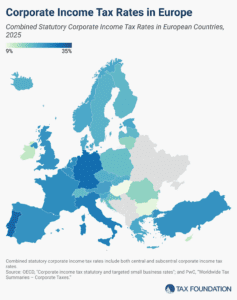

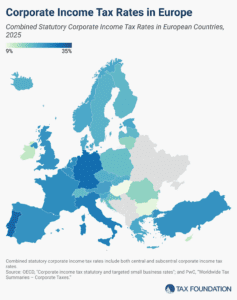

Corporate Income Tax Rates in Europe, 2025

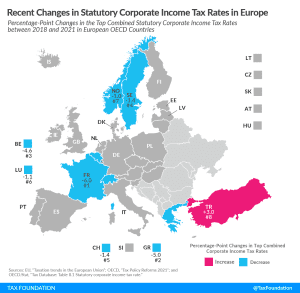

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

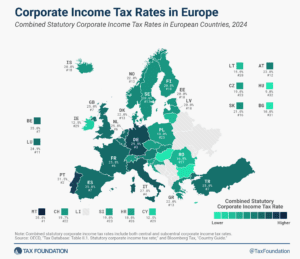

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

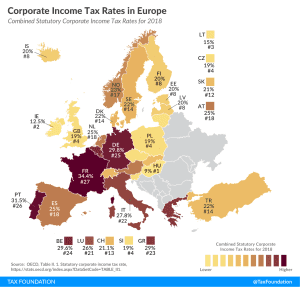

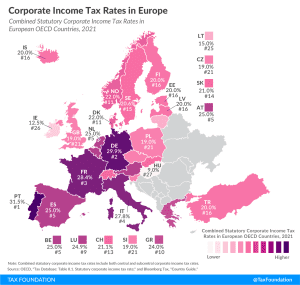

Taking into account central and subcentral taxes, Portugal has the highest corporate tax rate in Europe at 31.5 percent, followed by Germany and Italy at 29.8 percent and 27.8 percent, respectively

2 min read

Portugal, Germany and France have the highest corporate tax rates in Europe. How does your country compare?

2 min read

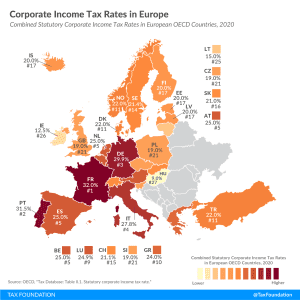

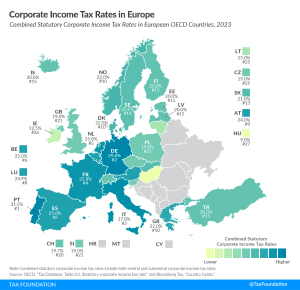

On average, European OECD countries currently levy a corporate income tax rate of 21.7 percent. This is below the worldwide average which, measured across 177 jurisdictions, was 23.9 percent in 2020.

2 min read

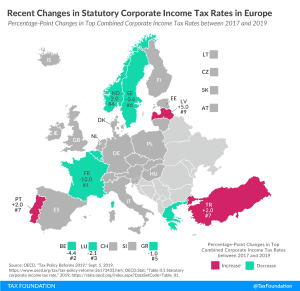

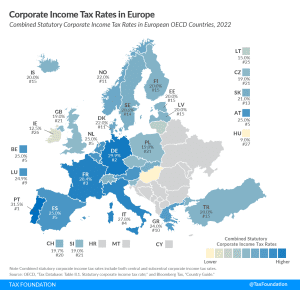

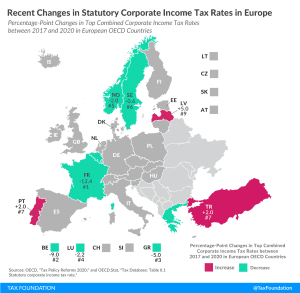

Over the last two decades, corporate income tax rates have declined around the world. Our new map shows the most recent changes in corporate tax rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2017 and 2020.

3 min read