Providing journalists, taxpayers, and policymakers with the latest data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission.

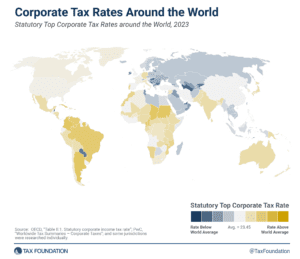

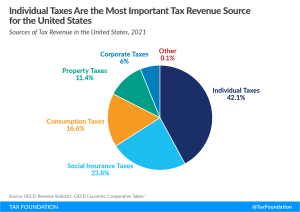

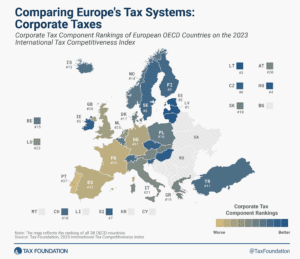

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility. Our global tax policy team regularly provides accessible, data-driven insights, including a survey of corporate tax rates around the world, from sources such as the Organisation for Economic Co-Operation and Development (OECD), the European Commission, and others.

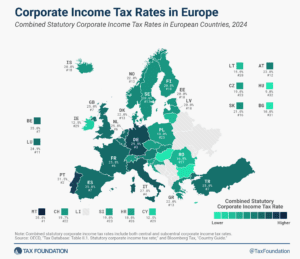

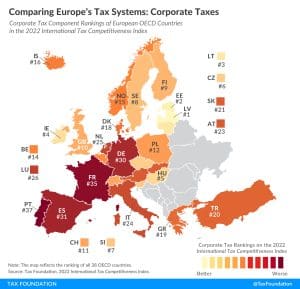

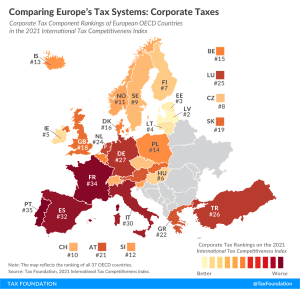

Browse European Tax Maps