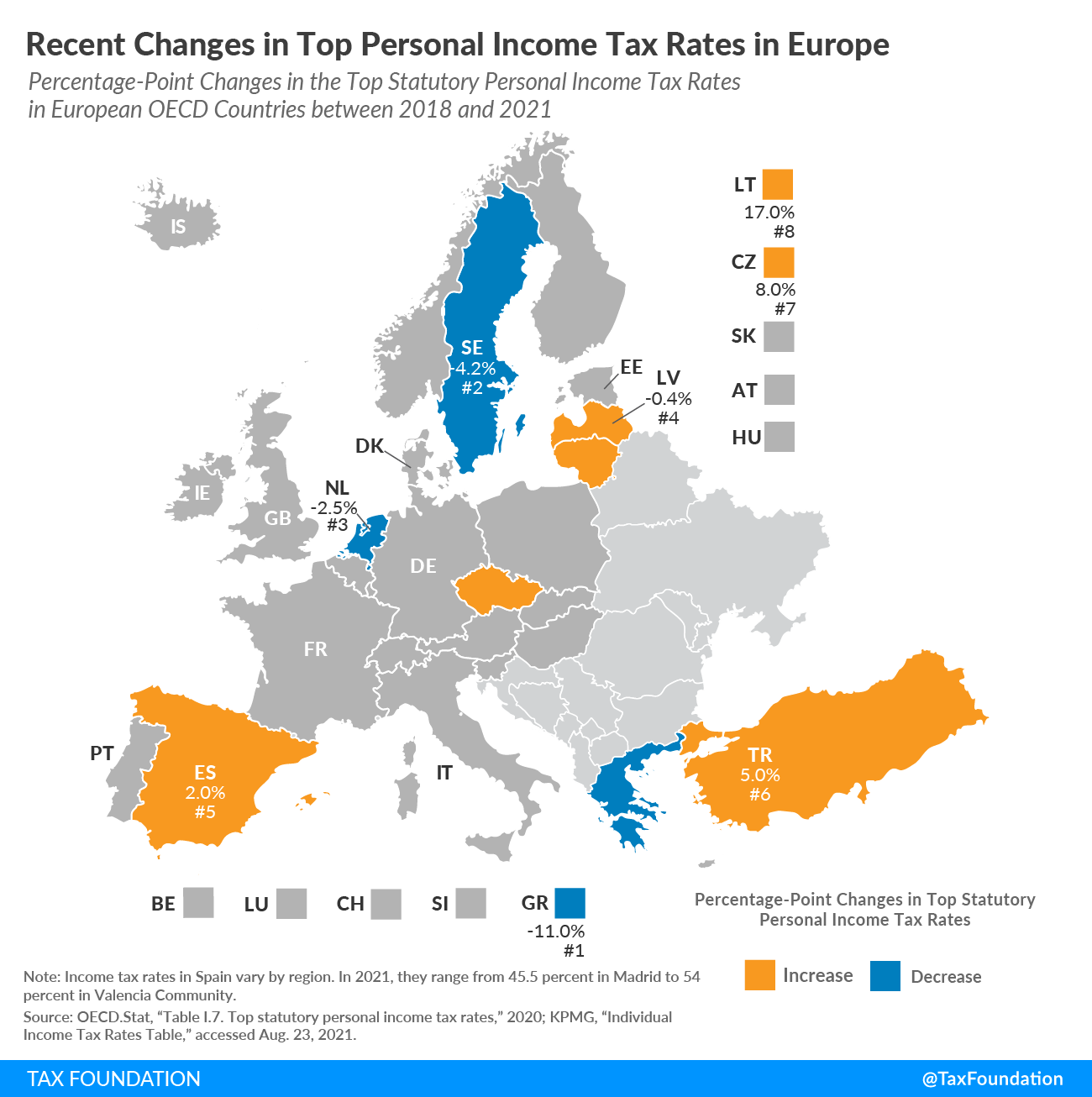

Recent Changes in Top Personal Income Tax Rates in Europe

3 min readBy:In 2019, revenue from personal income taxes made up 24 percent of total taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue across OECD countries. Countries tax labor income in various ways through payroll taxes, personal income taxes, and, in some cases, surtaxes.

Between 2018 and 2021, eight European countries in the OECD changed their top personal income tax rates. Of these eight countries, four cut their top personal income tax rates while the other four raised their top rates.

The Czech Republic, Latvia, and Lithuania moved from flat taxes on personal income to progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. structures. Spain increased its top personal income tax rate. Sweden eliminated a surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. . A surtax in Greece has been temporarily suspended. The Netherlands made a slight change to its personal income tax rates. Turkey added a new top personal income tax bracket.

Czech Republic

As of 2021, the Czech Republic has reintroduced progressive taxation with a top rate of 23 percent on income beyond CZK 1 million (US $78,000). Previously, a 15 percent flat tax applied.

Greece

Greece reduced the top personal income tax rate from 55 to 54 percent (44 percent income tax plus 10 percent solidarity surcharge) in 2020. In 2021, the solidarity surcharge was suspended for all types of income, other than income from public sector employment and pensions. The top rate applies to income exceeding €40,000 (US $45,610).

Latvia

In 2018, Latvia shifted its system from a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. on personal income to a progressive tax. Prior to this change, Latvia applied a 23 percent flat tax. The new system has three separate brackets, at 20 percent, 23 percent, and 31 percent (31.4 percent prior to 2021). The top rate applies to income above €62,800 (US $71,608) in 2021.

Lithuania

In 2019, Lithuania transitioned from a 15 percent flat personal income tax to a progressive income tax initially with two brackets with rates of 20 percent and 27 percent. The current top rate is now 32 percent. The top bracket applies to income above €81,162 (US $92,545).

Netherlands

The progressive tax system in the Netherlands moved from four brackets with a top personal income tax rate of 52 percent to three brackets with a top rate of 51.75 percent in 2019. The bracket structure was further amended in 2020, reducing the top personal income tax bracket to 49.5 percent.

Spain

Spain has a fiscally decentralized system with personal income tax rates that are a combination of national and regional policies. Madrid has the lowest combined personal income tax rate in the country—a 21 percent local tax rate plus the current 24.5 percent national income tax rate results in a 45.5 percent combined rate. The highest rate is 54 percent in Valencia Community. In 2020, the national rate was increased from 22.5 to 24.5, thus increasing rates throughout the country.

Sweden

Sweden removed its top personal income tax rate in 2020, which had added a 5 percent surtax to incomes exceeding SEK 703,000 (US $76,372). Sweden levies a tax rate of 20 percent on incomes above SEK 523,200 (US $56,839) as well as a varying municipal tax rate. The current average municipal rate is 32.85 percent.

Turkey

In 2020, Turkey introduced a new top personal income tax rate of 40 percent which applies to earnings beyond TRY 650,000 (US $92,527). The new rate has been added to Turkey’s tax brackets of 15, 20, 27, and 35 percent.

| Country | 2018 Tax Rates | 2019 Tax Rates | 2020 Tax Rates | 2021 Tax Rates |

|---|---|---|---|---|

| Czech Republic (CZ) | 15% | 15% | 15% | 23% |

| Greece (GR) | 55% | 55% | 54% | 44% |

| Latvia (LV) | 31.4% | 31.4% | 31.4% | 31% |

| Lithuania (LT) | 15% | 27% | 32% | 32% |

| Netherlands (NL) | 52% | 51.75% | 49.5% | 49.5% |

| Spain (ES) (Madrid) | 43.5% | 43.5% | 43.5% | 45.5% |

| Sweden (SE) | 57.1% | 57.2% | 52.3% | 52.9% |

| Turkey (TR) | 35.8% | 35.8% | 40.8% | 40.8% |

|

Note: Income tax rates in Spain vary by region. In 2021, they range from 45.5 percent in Madrid to 54 percent in Valencia Community. Source: OECD.Stat, “Table I.7. Top statutory personal income tax rates,” 2020, https://stats.oecd.org/index.aspx?DataSetCode=TABLE_I7; KPMG, “Individual Income Tax Rates Table,” accessed Aug. 23, 2021, https://home.kpmg/xx/en/home/services/tax/tax-tools-and-resources/tax-rates-online/individual-income-tax-rates-table.html. |

||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe